Interest Rate Outlook: Coronavirus

Coronavirus

While domestic economic growth began the year on solid footing, the worldwide spread of the coronavirus along with its effects on global supply chains and potential effects on aggregate demand are likely to dominate financial market movements through springtime. U.S. equity markets sank 15% last week in the fastest ever return to correction territory from a record high, before rebounding sharply Monday with the DOW’s largest ever one-day point gain. Bond yields remain dramatically lower than before the outbreak. The 2-year Treasury note began the year at 1.58% and currently yields 0.51% (as of 3/6/2020). Declines in short-term yields relate almost entirely to expectations of Fed monetary policy action, but changes in long bonds reflect adjustments in long-term growth and inflation projections. The 10-year note yield began the year at 1.88% and today yields .76% (as of 3/6/2020). The sharp decline in long bond yields and the implications for longer-term growth expectations contrasts sharply with year-to-date S&P 500 declines of about 9.5% (as of 3/6/2020).

Surprise FOMC Rate Cut

The Federal Reserve’s unscheduled statement last Friday, while not substantively different than any previous Fed communications, signaled to markets that the rapid 15% downturn in US equity markets last week was enough to prompt Fed intervention. As of last week, futures markets fully assumed at least a 25 basis point cut on March 18th and fully assumed a total of 50 basis points of cuts by April 20th. On Tuesday morning though, the Fed surprised markets with an inter-meeting cut of 50 basis points to a target range of 1.00% to 1.25%. The size of the cut matched market expectations but the rare inter-meeting action appears designed to reassure markets of the Fed’s willingness to intervene. Lower short-term borrowing costs do nothing to slow the spread of the virus or to ease supply chain disruptions, but may help promote recovery from potential demand interruptions after the virus runs its course.

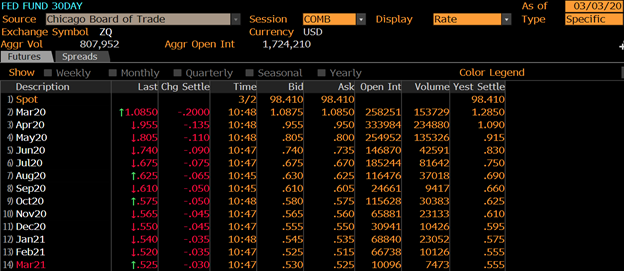

Fed Funds Futures

Futures contracts expect further activity from the Fed this year in response to supply chain interruptions and the potential for demand disruptions should U.S. consumer activity decline. Futures are pricing in another 25 basis point cut by July and 25 basis points more by early 2021.

Source: Bloomberg