Interest Rate Outlook: The Fed’s Inflation Target

Fed officials are committed to the current level of rates until inflation exceeds 2%

Several Fed officials spoke in late September on the timing of future interest rate hikes in relation to the inflation target of 2%. Chicago Fed President Evans reversed his earlier position that the Fed could start raising rates before inflation reaches 2%. His latest remarks indicate that such action is not expected until the US economy reaches full employment and inflation surpasses 2%. He further noted that it may be better to wait on altering the Fed’s asset purchase program until employment gets closer to 6%. Fed Governor Clarida also said that the Fed won’t consider raising rates until full employment is achieved, and inflation tracks at 2% for at least a few months. Boston Fed President Rosengren said “we’ll be lucky” to get to 2% inflation within four years, and that he is less optimistic on the outlook than his colleagues on the FOMC. Vice Chair Quarles said that “there is an unusually large amount of uncertainty now about any outlook” and risks are “weighted to the downside.” In his testimony to Congress, Chair Powell commented that the economic recovery has a long way to go and will require more fiscal support.

Spending Bill/Fiscal Stimulus

On September 30th, President Trump signed a short-term spending bill passed by both chambers of Congress to avert a government shutdown. House Speaker Nancy Pelosi and Treasury Secretary Mnuchin delivered the bi-partisan bill with a 359-57 vote. It passed in the Senate on Wednesday in an 84-10 vote and will fund the government until December 11th. The House passed a $2.2 trillion coronavirus relief bill yesterday, but it is unlikely to pass in the GOP-controlled Senate.

Economic Data

September’s Labor Report was released this morning showing a sharp decline in hiring. Nonfarm payrolls expanded by 661,000 compared to a 1.489 million increase in August. The unemployment rate continued to fall, declining to 7.9% from 8.4% in the prior month. Several large corporations have announced layoffs in recent weeks including Disney, American Airlines and United Airlines as lawmakers still have not come to agreement on a second COVID relief package.

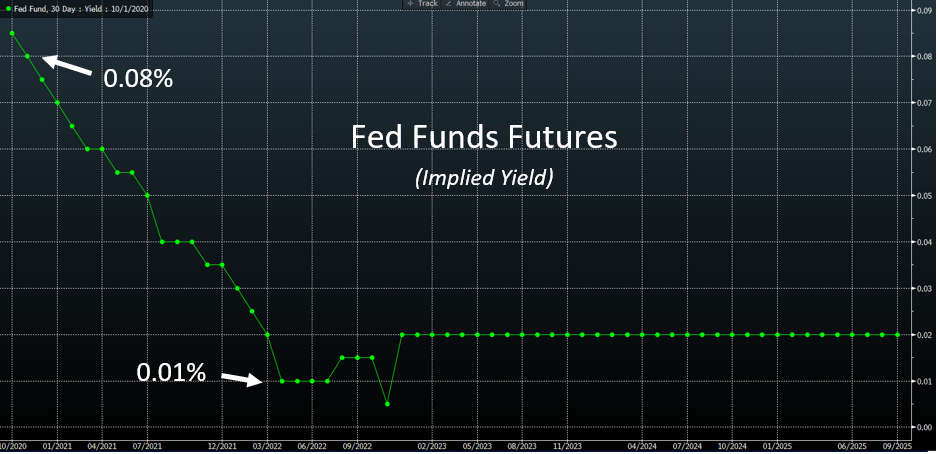

Fed Funds Futures Contracts

Futures contracts continue to indicate that the effective Fed funds rate is likely to decline toward the bottom of the Fed’s target range from its current level near 0.08%.

Source: Bloomberg