January Month-End Portfolio Update

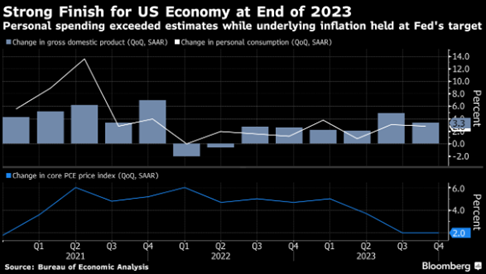

2023 GDP Up 2.5%

The advanced estimate for Q4 GDP came in at +3.3% vs. expectations for an increase of +2.0%, but down from the very solid Q3 reading of +4.9%. This was the 6th consecutive quarter with growth of 2% or better. Overall, GDP registered a gain of +2.5% in 2023, an improvement from the +1.9% in 2022. In the 4th quarter, consumer spending accounted for the bulk of the growth, rising +2.8%, while business investment and housing also helped fuel the larger-than-expected advance. Looking ahead, growth is expected to slow in 2024, with market consensus forecasting a Q1 2024 reading of 1% and 1.5% for the year, which is in-line with the Fed’s 2024 GDP projection of a +1.4% rate.

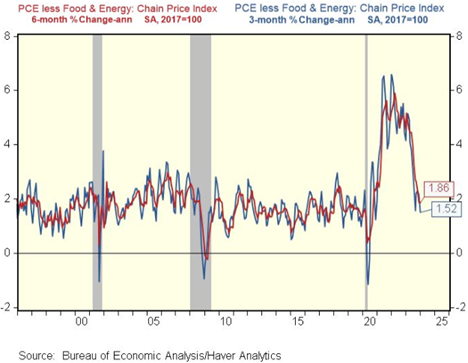

Core Inflation – Pace Running Below 2%

We see encouraging signs when reviewing short-term trends in the Fed’s preferred inflation gauge, Core PCE. Looking at both the 3-month and 6-month annualized rate, Core PCE has been running below 2% at 1.52% and 1.86%, respectively. If this progress continues, the yearly PCE reading (currently at 2.9%) could soon fall below 2%. The Fed will update their inflation expectations at the March FOMC meeting, which may cause them to lower their year-end inflation projections.

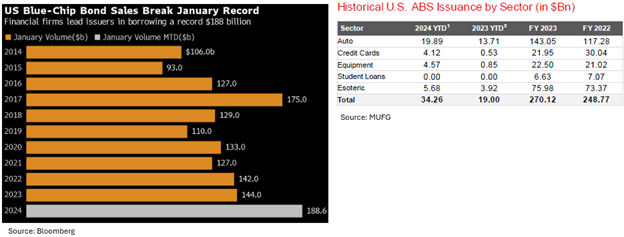

Record Corporate Bond and ABS Issuance

Both the corporate bond and asset-backed securities (ABS) markets had a January for the record books. New issuance of corporate bonds came in at over $188 billion, the largest January on record. Credit spreads tightened in January, which likely helped push companies to come to market along with lower Treasury yields compared to Q4. Both the Bloomberg Corporate Bond Index and ICE BAML Corporate Index rallied to a spread below +100 basis points for the first time since early 2022, and the Bloomberg index came within 11 basis points of the all-time close from 2005 of +83 basis points. The ABS market has priced over $34 billion in January, and like the corporate bond market, spreads have also tightened. There has been plenty of demand for the new credit and ABS issuance as investors look to lock in yields before the Fed starts cutting rates.

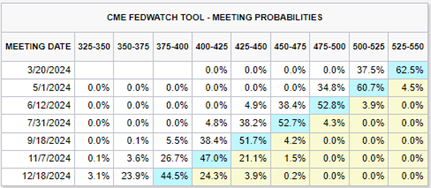

Game of Chicken Between the Fed and Market

For most of January there was a game of chicken between members of the Fed and the markets. While the FOMC found itself pushing back against expectations for a March cut, the market was pricing in close to a 70% probability of a 25 bp decline in the fed funds rate at that meeting. At the January FOMC meeting both the official statement and commentary from Fed Chair Powell supported the push-back narrative:

- Statement: “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

- Powell: “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to cut, but that’s to be seen.”

The Fed seems to have won this round: the market-implied probability of a March cut has dropped back below 40% after reaching nearly 70% ahead of the FOMC meeting this week.

As of 2/1/24:

Source: CME Group

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.