Case Study: When Speed Matters

Capital Advisors Group has written extensively in the past about the when and how a company can maximize the utility of venture debt financing, focusing on variables such as the company’s financial profile, its growth and development strategy, and management’s priorities. With this information in hand, Capital Advisors Group can help identify and engage the appropriate lenders, negotiate terms, and arrive at an optimized term sheet within 8 weeks of initiating a process. We also advise clients to consider an additional 4-8 weeks for final lender due diligence and documentation prior to the loan funding date. Typically, a well-prepared and financially sound company can plan, and reasonably expect to execute, its fundraising process within this timeframe. However, as this year has proven in many ways, circumstances can quickly change.

In this case study, we will review a transaction with a slightly different order of priorities where expediency of execution was key. We will identify the factors that enabled CAG to compress the debt financing timeline down to just a few weeks and discuss additional conditions that can help shorten the time to funding. Whether due to a constrained timeframe or the need to ensure a funding deadline is met, rapid execution is sometimes a key component when looking to maximize the value of a debt financing round.

The Challenge

Capital Advisors Group (CAG) was engaged by a clinical stage biotechnology company (the Company) seeking debt financing in order to optimize its pipeline of assets in the clinic. While financial flexibility and capital availability conditions ranked highly in the Company’s list of priorities, their primary concern was time to execution. The proceeds of the loan were to be used to acquire a critical asset that would help bolster the company’s pipeline and time was of the essence. Therefore, the Company was seeking to complete the fundraising process within four weeks, a fraction of the usual time.

The Process

Given the time sensitive nature of the transaction, CAG’s first order of business was working with the Company to establish a process schedule. We began by holding a series of management discussions aimed at ensuring all Company stakeholders were aligned. With a process schedule in place, CAG leveraged its lender database to identify a universe of suitable capital providers based on their investment criteria and the Company’s profile. We proceeded to engage with our contacts within that universe in order to home in on those lenders that could commit to meeting our pre-established process schedule.

With all stakeholders aligned, CAG initiated an accelerated version of our standard process, preparing lenders for the condensed timeline and coordinating a rapid flow of information between the Company and prospective lenders. Paramount to achieving that goal, was the establishment of direct points of contact within the Company that would specialize in fulfilling financial, legal, and scientific information requests, as well as a central point of contact for scheduling. In addition, a list of due diligence materials, requested of the client prior to kick-off, provided a universal starting point for participating lenders, the distribution of which was further streamlined through the use of the CAG’s cloud-based data room. This served to minimize the amount of ad hoc information requests from lenders that would need to be fulfilled individually, while the use of the technology enabled immediate access to pertinent data for lender deal execution teams, with minimal effort. As an added measure, weekly update calls, typically held with the client and a small team, were expanded to include all Company decision makers including the CEO, general counsel and sometimes board members and outside counsel to assure a coordinated message to lenders and avoid surprises late in the process.

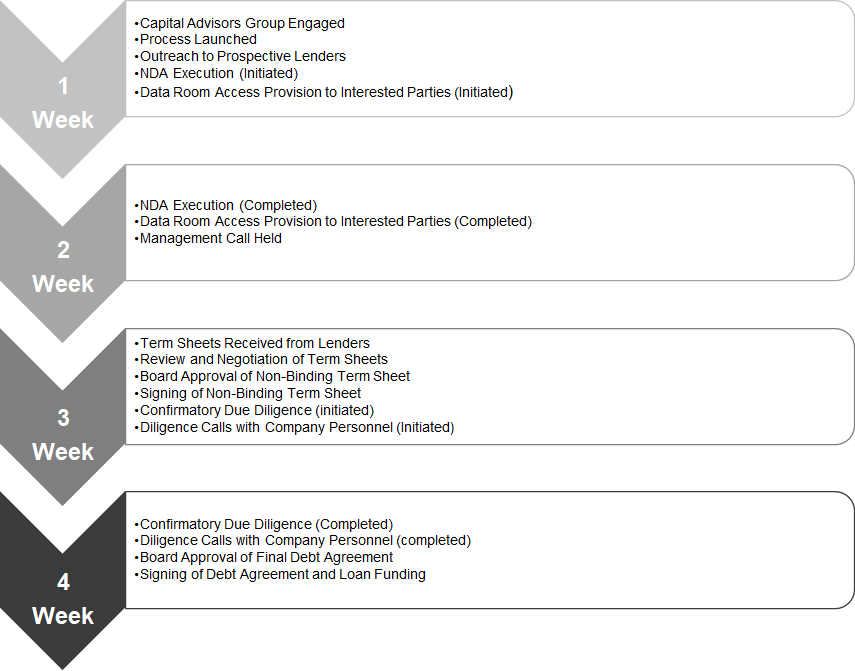

Finally, the commitment of both the Company’s and the lenders’ teams to meeting the transaction’s deadline cannot be overstated. Having aligned priorities, agreed to a common process timeline, and facilitated the flow of information between parties, the Company’s and lenders’ deal execution teams provided the personnel and resources required to meet the challenging timeline. Combined with CAG’s large database of historical term sheets and experienced execution team, this increased level of attention by all parties helped expedite the term sheet negotiation phase by focusing discussions on realistic and material terms, as well as primed the transaction closing process by lining up necessary board approval of the negotiated terms and the final due diligence process (weekends included). Below is a timeline of the transaction.

Conclusion

While not all debt financing transactions must meet such rigorous timelines, there are some lessons to be learned in such instances that can be useful to any borrower. We would stress the importance of a standardized process to accurately project the transaction timeline, the value of all internal stakeholder alignment in increasing predictability, and the benefit of continuous and timely communication between all parties in adapting to unforeseen circumstances. Additionally, it can be useful to streamline process administration through specialized client points of contact to support the quick resolution of lender requests, while also including an expanded team of stakeholders when necessary and embracing technology to speed up the and organize the dissemination of necessary materials. Finally, CAG’s database of historical transactions and lender deal criteria helped to shorten negotiation times and establish a better lender fit with the client. As we have previously written, the timing of a transaction can spell the difference between enabling or hindering critical components of a company’s growth. Therefore, careful preparation and an efficient process can help maximize the utility of a venture debt fundraising round.