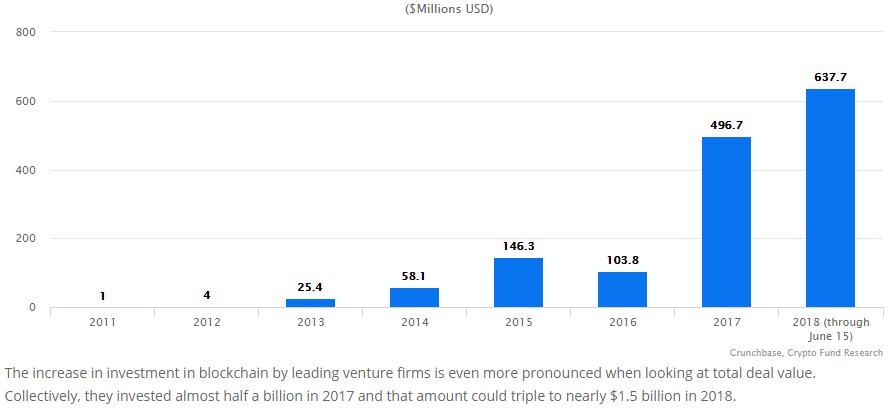

Regardless of what you might think about cryptocurrencies, blockchain technology represents an undeniable breakthrough in how we manage information. In the last couple of years, interest in the sector has increased materially, with investments by the top 50 VC firms in the field exceeding $600 million in the first half of 2018 alone. It won’t be long before institutional cash investors need to have a working understanding of a coming wave of blockchain applications for financial and investment management.

Top 50 VC’s Total Blockchain Investments by Year

Source: Crypto Fund Research, Top 50 Venture Capital Firms Investing in Blockchain Companies

While most potential impacts will be indirect, stemming mainly from improvements in back office functions, the blockchain is capable of changing many aspects of how capital markets function today. In this 3-part blog series, we will take a brief look at the impact that fully adopting a blockchain model could have on financial markets, focusing on issues affecting the short-term end of the yield curve. Specifically, we will look at the potential impact of the technology on liquidity, risk management, and investment returns while also painting a picture of the challenges that stand in the way of full adoption.

How it Works

In this first installment, we provide a quick overview of how it works. Blockchain technology came to prominence by enabling the creation of Bitcoin and other cryptocurrencies, but it is also the foundation for many other business information applications currently under development in finance, accounting and other realms.

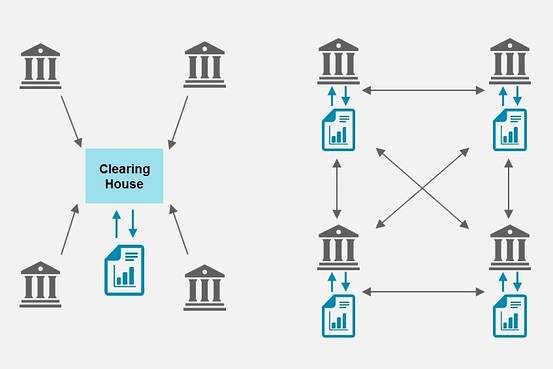

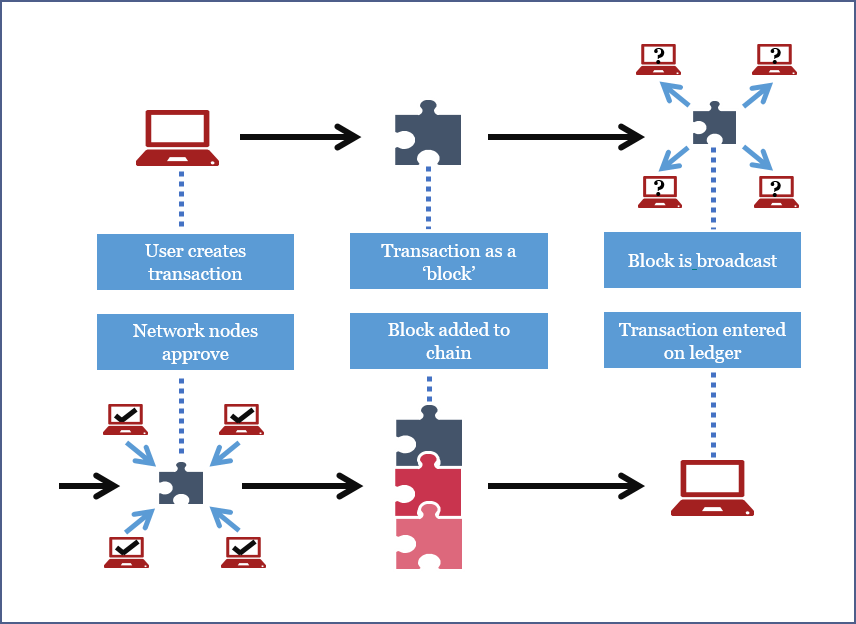

The blockchain can be characterized as a network of connected computers that collectively maintain a single, secure, and up-to-date ledger. This framework removes the need for a central clearing authority as it eliminates information asymmetries within the network. Each node within the network is aware of the balance sheet of all others through the shared ledger, thereby enabling an automatic Delivery-Versus-Payment (DVP) system for transactions in a manner similar to a clearinghouse. Once a transaction is verified, it is broadcast to the network, and the shared ledger is updated. Each entry into the ledger is individually encrypted as well as permanent. Any changes or corrections to a past transaction need to be logged as a new entry, reversing the effects of the past transaction. This practice generates an uninterrupted audit trail which acts as a safeguard against fraud.

Figure 1: How Blockchain Works

Source: Steven Norton, CIO Explainer: What Is Blockchain?, The Wall Street Journal

Figure 2: How Blockchain Works

Source: Jacob Kleinman, How does it work?, BLOCKCHAINPEDIA – Carnegie Mellon University

Advantages and Disadvantages

The blockchain framework carries several advantages, some of which are briefly listed below:

- An increase in the number of trusted counterparties available to participate in transactions,

- Greater market transparency supporting better risk management,

- Greater efficiency and lower costs for compliance and regulatory oversight,

- Improved accuracy and real-time monitoring capacity for the build-up of systemic risks,

- Lower transactions costs and faster settlement,

- Elimination of duplicated or redundant processes through ledger consolidation,

- Intraday transactions capability,

- Elimination of certain back office bookkeeping processes,

- Greater network resilience and stronger data protections for participants,

- Greater comparability of entities and securities through universal data standards.

At the same time, some concerns that will need to be addressed on the way to full adoption include:

- Privacy of participants and access privileges to the shared ledger,

- Determination and establishment of a reliable digital medium of exchange in the blockchain that is convertible to real world currency,

- Conversion of all assets into electronic form,

- A consensus on legal and operational frameworks,

- Energy consumption and computational power limitations,

- Operational risks of transitioning,

- Need for universal participation in the network.

In the next part of the series, we will delve a bit deeper into the areas of the capital markets that will be affected and explore the potential impacts on cash investors. We will then close the series with a discussion of where we are now, current challenges and concerns regarding adoption, and simple steps that individual firms may take to begin taking advantage of this framework internally.