DOWNLOAD FULL REPORT

Introduction

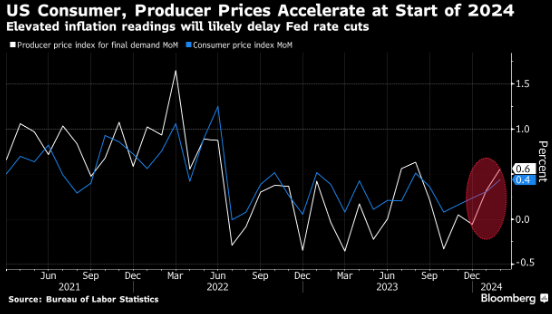

Financial markets have closely monitored consumers’ financial health following the COVID-19 pandemic to gauge when the exceptional economic tailwind provided by high levels of household savings would fade. Accounting for roughly two-thirds of GDP, consumer spending was juiced by pandemic era stimulus programs which ballooned household savings. These savings were later depleted as post-stimulus inflation took hold. To combat rising prices, many households turned towards borrowing to support spending while the Fed increased interest rates to slow inflation. Rising rates and higher levels of outstanding debt, coupled with falling savings, produced concerns about an impending collapse of household balance sheets, which has yet to occur.

These circumstances, alongside an ever-changing economic outlook, have sparked conversations about the safety of cyclical credits tied to consumer finances. Asset-backed securities (ABS) have been rightly placed in this conversation’s crosshairs. Following the Global Financial Crisis (GFC), many treasury professionals shunned ABS, as several instruments within this broad asset class were thought to have caused, or were closely tied to, the downturn. In the post-crisis years, ABS returned to be mainstream as investors realized their value as a diversifier with yield enhancing capabilities. Although Capital Advisors Group has been advocating for ABS inclusion in cash portfolios for over a decade, increasingly uncertain outlooks for rates, growth, and employment force us to ask if they continue to remain appropriate for cash portfolios. Is ABS safer now than before the GFC? Has the post-crisis acceptance of ABS by investors reduced its yield enhancing abilities? In this whitepaper, we hope to provide our perspective that not all ABS is alike, and with adequate due diligence, credit card ABS and occasionally auto ABS may prove beneficial to corporate treasury investors.

Safety First

Traditionally, treasury professionals have filled portfolios with the most vanilla securities available, creating some resistance to the idea of investing in structured products. After all, the complexities of many ABS products contributed to the chaos of the GFC, when many investors may have not fully understood certain ABS securities and their underlying exposures. However, ABS as a broad asset class may provide cash investors with several benefits.

Cashflow Diversification: ABS credit quality rests on the timely payments from often thousands of individual borrowers, granting a single ABS security significantly greater cashflow diversification than any corporate or financial issuer who may only have a handful of unique revenue streams.

Reduction of Headline Risk: Since the trusts ABS are issued from are distinct from the program’s sponsor, the market value of ABS tends to be more insulated from negative headline events, which can spark uncertainty about a corporate issuer’s credit profile.

The annualized volatility of total returns over the prior 10-years for fixed rate bullet credit card debt has been right on par with AAA and AA rated corporate debt, hovering around 1bp1.

ABS* Within ABS

*A Bunch of Selection

In the post GFC era, investors are rightfully more concerned with the fundamental risk characteristics of investments than a security’s credit ratings. The GFC, pandemic, and post-pandemic commercial real estate stresses have served as real-life test cases for how different asset classes react independently from each other based on their underlying exposures. In placing the upmost emphasis on safety, we think one should first establish which types of ABS may be appropriate for conservative corporate investors before relative value analysis can commence.

Similar to corporate securities from different industries with different credit characteristics, asset-backed securities are known by the financial assets that back up the bonds. We advocate investing only in AAA-rated asset-backed securities backed by prime credit card receivables, and under specific circumstances investing in ABS backed by prime auto loan receivables. These types of ABS represent a subset of the overall market.

Source: JPMorgan Research, ABS Weekly Volume Datasheet, as of 1Q 2024

As Figure 1 indicates, of the $708B of ABS outstanding (as of Q1 2024), credit card and auto ABS accounted for $81B and $271B, respectively. Combined, these two categories account for 49% of the total ABS market. Even within auto and credit card ABS, we would continue to suggest that only securities backed by prime receivables2, whose obligors have a FICO score greater than 660, should be included in cash portfolios. While most credit card ABS are backed by prime receivables, prime auto ABS represented just under 40% of the auto ABS market by the end of 20213. Despite being only a portion of the market, credit card and auto ABS supply has been consistent and plentiful since the GFC, averaging $27.4B and $110.2B a year respectively between 2013 and 20234.

Source: SIFMA Research, U.S. Asset-Backed Securities Statistics. As of 4Q

The diversity of ABS emphasizes the need for cash investors to treat each category independently, and to scrutinize the structure of any ABS issuance, its underlying receivables, and their associated risk exposures.

Why Prime Credit Card ABS May be a Viable Choice

In our 2011 whitepaper, we cited the benefits of investing in asset-backed Securities, such as its yield advantage over treasury and agency securities, high credit quality, and low event risk. Relative to other non-mortgage ABS, we think securities backed by prime credit card receivables may be best for treasury investors for the following reasons:

Transparency: Consumer credit statistics are more readily available from major credit card trusts than many other asset collateral pools. By monitoring the delinquency, charge-off, and payment statistics, card investors may have better insight into the credit quality of the revolving credit balances than long-dated assets backing other ABS types.

Robust Sponsor Credit Profiles: Many of the major credit card trusts are serviced by well-known investment-grade bank sponsors such as JPMorgan Chase and American Express. Important credit characteristics not common in other ABS types include servicer quality, federal bank regulations, and potential parental support.

Soft Bullet Structure: ABS backed by revolving debt such as credit card receivables carry soft-bullet structures which by design, return a lump sum principal payment to investors on a pre-determined date. ABS backed by other forms of collateral return principal in what is known as a sequential payer structure, meaning a small portion of the principal is returned each month as borrowers pay their loans. The timing and amount of payments to security holders vary based on the level and timing of repayments on the underlying receivables. The heightened cash-flow predictability provided by credit card ABS is a practical consideration given that most treasury accounts need to closely control liquidity.

Post Crisis Enhancements

Certain types of ABS played a role in the GFC that led to a raft of official reforms and enhanced industry practices which have greatly benefited ABS credit quality. The introduction of Retention Rules, known as Regulation RR, aligned the interests of trust sponsors with security holders by forcing sponsors to maintain responsibility for at least 5% of principal receivable balances relative to the level of outstanding securities, commonly known as sellers’ interest5. This means that sponsors take on at least 5% of the receivable pool’s credit risk, encouraging conservative trust management practices. Most sponsors retain significantly more receivables than required. The ‘Big Six’ credit card trusts, (American Express Credit Account Master Trust, Chase Issuance Trust, Capital One Multi Asset Execution Trust, Citibank Credit Card Issuance Trust, Discover Card Execution Note Trust, BA (Bank of America) Master Credit Card Trust), averaged roughly 96% sellers’ interest as of April 20246.

Source: Trust Disclosures as of 4/30/24. Major Trusts: American Express Credit Account Master Trust, Chase Issuance Trust, Capital One Multi Asset Execution Trust, Citibank Credit Card Issuance Trust, Discover Card Execution Note Trust, BA Master Credit Card Trust. Red Highlight Indicates Recessionary Period.

Additionally, credit rating agencies significantly tightened standards in reaction to the crisis, forcing sponsors to elevate credit metrics to be awarded a coveted AAA rating. This has led to trusts being managed with consistently higher levels of excess spread, which represents the positive cash flow after the trust receives payments, pays security holders, charges-off delinquent accounts, and pays other expenses. This can be thought of as a trust’s emergency buffer.

Source: Trust Disclosures as of 4/30/24. Major Trusts: American Express Credit Account Master Trust, Chase Issuance Trust, Capital One Multi Asset Execution Trust, Citibank Credit Card Issuance Trust, Discover Card Execution Note Trust, BA Master Credit Card Trust. Red Highlights Indicates Recessionary Period.

Higher rating agency requirements also pushed sponsors to tighten underwriting standards and fill the trusts with higher quality receivables, leading to significantly lower delinquency and charge-off rates. These and other enhancements, such as monthly receivable pool disclosure requirements, have greatly enhanced the credit quality of AAA rated credit card ABS trusts relative to before the GFC.

Source: Trust Disclosures as of 4/30/24. Major Trusts: American Express Credit Account Master Trust, Chase Issuance Trust, Capital One Multi Asset Execution Trust, Citibank Credit Card Issuance Trust, Discover Card Execution Note Trust, BA Master Credit Card Trust. Red Highlights Indicates Recessionary Period.

Where We Stand Today

Traditionally, credit card ABS asset quality moves in tandem with unemployment. While we still believe this to be true, extreme levels of consumer support through the pandemic insulated consumer finances from what would likely have been a crippling 13.8% peak unemployment rate. Since then, high levels of accumulated savings coupled with a very strong post pandemic labor market has led to exceptionally high payment rates on outstanding credit card receivables. This has kept delinquencies and charge-offs low, while excess spreads remained high.

Source: Trust Disclosures as of 4/30/24. Major Trusts: American Express Credit Account Master Trust, Chase Issuance Trust, Capital One Multi Asset Execution Trust, Citibank Credit Card Issuance Trust, Discover Card Execution Note Trust, BA Master Credit Card Trust.

Reopening the economy led to a huge increase in demand for revolving credit. A high volume of credit origination leads to a very large chunk of new accounts, which typically need to go through a seasoning period. During seasoning, delinquency rates begin low as account holders start buying the first items with their new cards. 60-days later at the earliest, some accounts will begin contributing to rising delinquencies, possibly working their way into charge-offs sometime after that. This causes initially low, but then rising delinquencies, which eventually level out before falling into a sustainable long-term level as severely delinquent borrowers’ accounts are closed. This “seasoning effect” largely explains the rise in delinquency and charge-offs through 2023 and 2024. Once seasoning takes its course, credit card ABS asset quality will likely resume its historical high correlation with the unemployment rate, but from a much stronger starting position than prior to the GFC.

Source: Trust Disclosures as of 4/30/24. Major Trusts: American Express Credit Account Master Trust, Chase Issuance Trust, Capital One Multi Asset Execution Trust, Citibank Credit Card Issuance Trust, Discover Card Execution Note Trust, BA Master Credit Card Trust, FRED

Performance Is Favorable to AAA Corporates

So far, we hope to have established that credit card backed ABS may be a sound credit investment for treasury investors; but a discussion of ABS is not complete without a comparison of their total return performance relative to other eligible credit investments. We selected the ICE BofA US Fixed Rate Bullet Credit Card ABS Index (Code R0CB) as the ABS proxy. We used the ICE BofA 1-3 year AAA U.S. Corporate Index (Code C1A1) as the corporate AAA proxy and the ICE BofA 1-3 Year AA U.S. Corporate Index (Code C1A2) as the corporate AA proxy. A note of comparison, the effective duration for the Credit Card ABS, AAA Corporate Index, and AA Corporate Index are 1.68, 1.95, and 1.80-years, respectively7.

Source: Bloomberg. Compares return volatility of the ICE BofA U.S. Fixed Rate Bullet Credit Card Asset Backed Securities Index, ICE BofA 1-3 Year AAA U.S. Corporate Index, and ICE BofA 1-3 Year AA U.S. Corporate Index.

Over the previous five years, the credit card ABS index returned 1.38% annually, to a 1.30% annual return for the AAA corporate index, and a 1.53% annual return for the AA corporate index. Additionally, from 2014-2019 credit card ABS outperformed the AA corporate index on an annualized basis, and its annual spread over the AAA corporate index was a much larger 37bps8. This spread compression over time could be due to greater acceptance of ABS among investors, including cash investors, as we grow farther removed from the GFC. In short, AAA rated fixed rate credit card backed ABS could have provided attractive return potentials while diversifying risk in a corporate treasury account during these periods.

The Potential for Prime Auto ABS

Prime auto ABS will provide similar benefits to those offered by other types of ABS, including the aforementioned diverse cashflows and reduced headline risk. Additionally, prime auto ABS trusts provide the high level of collateral transparency enjoyed by credit card ABS investors. Furthermore, auto ABS receivables are collateralized by the vehicles being financed, allowing the trust to at least partially recoup losses from defaulted receivables. However, the sequential payer structure of auto ABS securities greatly limits their appropriateness for cash portfolios. In such a structure, the uncertainty of the repayment speed on the underlying receivables feeds through to the outstanding securities which can expose auto ABS investors to prepayment risk.

Prepayment risk consists of contraction and extension risks, stemming from borrowers making payments on receivables at a faster or slower rate, respectively, than the speed estimated at the time of purchase. Since payment speeds on the underlying receivables feed through to the outstanding securities, principal and interest payments may be made at different speeds from the initial estimate. This can materially affect the security’s yield and credit risk profile.

Contraction Risk: Receivable cashflows typically accelerate in falling rate environments as borrowers refinance outstanding debt at lower rates, increasing contraction risk. In auto ABS, this can also be driven by trade-ins, insurance claims, or obligors getting ahead on payments. When this occurs, principal payments to security holders come in larger amounts over a shorter period, improving portfolio liquidity but leaving lower principal balances in the trust, which means lower interest income over the term of the security. Lower interest payments can also lead to less cash being funneled into the trust, leaving lower funds to repay security holders, marginally increasing credit risk.

If an asset-backed security is purchased in the secondary market at a price above par, contraction risk will cause an investor to incur credit losses as the principal is returned at par value. Additionally, since falling rates are typically the largest driver of contraction risk, the security holder also faces re-investment risk, meaning these larger cash flows can only be invested at the lower prevailing rate. These risk and return factors should influence a cash investor’s decision to invest in prime auto ABS.

Extension Risk: Receivable cashflows typically slow down in rising rate environments due to fewer people refinancing their loans, or some obligors falling behind on regular payments. This causes the trust’s receivable balance to decrease at a slower pace than initially expected, leading an investor to receive smaller principal payments over a longer period. Although higher principal balances will result in more interest payments over the term of the security, this benefit is offset by delayed access to one’s principal investment, lowering portfolio liquidity. Additionally, rising rates will cause mark-to-market losses on all fixed income assets, including ABS. Again, these risk and return factors should influence a cash investor’s decision to invest in prime auto ABS.

Source: JPMorgan ABS Performance Statistics, as of 5/31/2024

Since contraction and extension risks from auto ABS may cause undesirable effects on cash portfolios’ principal preservation and liquidity objectives, Capital Advisors Group does not recommend them in cash burning portfolios, or for investors with low tolerance for principal loss or cashflow uncertainty.

On the other hand, the expected return potential on securities with prepayment risks may be higher than soft bullet ABS to compensate for their complexity and interest rate sensitivity. Since the Fed began raising rates in March 2022, the average 2-Year prime auto ABS spread over a comparable 2-year Treasury note was 66bps, compared to an average spread premium of 48bps for comparable maturity soft bullet credit card ABS9.

Source: JPMorgan ABS Weely Spread Datasheet, as of 5/31/2024

Despite their high credit ratings, sequential payer prime auto ABS may only be appropriate for investors with no near-term cash needs and who can stomach prepayment risk and principal volatility.

One Last Word

Treasury investors may be rightfully skeptical of the appropriateness of asset-backed securities in their cash portfolios today due to a wide range of ABS in existence, the cyclical nature of consumer finance, and structured products’ natural complexity. However, we continue to view AAA-rated fixed rate credit card ABS as viable investment for corporate treasurers. Their transparent asset collateral, strong servicer quality, prudent post GFC management, and soft-bullet structure are some of the advantages over other forms of ABS. They have emerged from prior crises significantly stronger than they entered and remain on solid footing. Recently rising delinquency and charge-off metrics have been driven by account seasoning dynamics rather than a widespread deterioration of consumer finances. We think it is appropriate for treasury investors to consider using this asset class as a viable investment choice. Additionally, prime auto ABS can provide similar benefits as prime credit card ABS but should only be included in cash portfolios under specific circumstances. In comparing the return history over the last decade, we have found AAA-rated fixed rate credit card bonds performed in lockstep with or better than comparably rated corporate securities while providing diversification benefits.

We think treasury investors should carefully evaluate the fundamental credit characteristics of ABS, rather than relying on general market sentiment in deciding whether ABS may be appropriate for their cash portfolios. Since the investment performance of consumer ABS may follow the overall consumer credit cycle, proper credit surveillance procedures need to be in place to evaluate security performance in a timely fashion.

1Source: Bloomberg. Compares return volatility of the ICE BofA U.S. Fixed Rate Bullet Credit Card Asset Backed Securities Index, ICE BofA 1-3 Year AAA U.S. Corporate Index, and ICE BofA 1-3 Year AA U.S. Corporate Index from 4/30/2014 – 4/30/2024.

2Morningstar, U.S. Credit Card Receivables Ratings Methodology, June 2018: https://ratingagency.morningstar.com/PublicDocDisplay.aspx?i=MOY9zUcsx7E%3d&m=i0Pyc%2bx7qZZ4%2bsXnymazBA%3d%3d&s=LviRtUKXqs8kml5dHt7FTeE2SZmY0Fvqd4iX49Mk%2f9UapyiFTEO6TA%3d%3d#:~:text=Some%20credit%20card%20ABS%20sponsors,subprime%20and%20near%2Dprime%20consumers.

3SIFMA Research, U.S. Asset-Backed Securities Statistics, as of 4Q 2021

4SIFMA Research, U.S. Asset-Backed Securities Statistics, As of 4Q 2023

5Code of Federal Regulations (annual edition). Title 12: Banks and Banking. Subpart B: Credit Risk Retention. Monday, January 1, 2024.

6Trust Disclosures as of 4/30/24. Major Trusts: American Express Credit Account Master Trust, Chase Issuance Trust, Capital One Multi Asset Execution Trust, Citibank Credit Card Issuance Trust, Discover Card Execution Note Trust, BA Master Credit Card Trust.

7Bloomberg, ICE BofA U.S. Fixed Rate Bullet Credit Card Asset Backed Securities Index, ICE BofA 1-3 Year AAA U.S. Corporate Index, and ICE BofA 1-3 Year AA U.S. Corporate Index.

8Bloomberg, ICE BofA U.S. Fixed Rate Bullet Credit Card Asset Backed Securities Index, ICE BofA 1-3 Year AAA U.S. Corporate Index, and ICE BofA 1-3 Year AA U.S. Corporate Index.

9JPMorgan ABS Weely Spread Datasheet, as of 5/31/2024