State of the Market: Debt Financing for Clinical Stage, Publicly Traded Life Sciences Companies

DOWNLOAD FULL REPORT

Capital Advisors Group is a Boston-area based institutional investment advisor that has been helping venture-backed companies invest their cash assets for more than 22 years. Its debt finance consulting division helps venture-backed companies determine their optimum capital structures, identifies appropriate lenders, sources term sheets and negotiates deals.

Executive Summary

Capital Advisors Group’s debt finance consulting division (formerly Debt Advisors Group) was founded in 2003 to closely monitor debt financing markets and help early stage companies secure the most competitive deal terms and conditions available. This paper will focus exclusively on the active financing market for early stage public life sciences companies and the debt financing opportunities currently available.

Biotech on the Rise

Amidst the pandemic of 2020 and the resulting terrible economic fallout, which will continue to persist, no one can dispute the biotech sector’s very successful run during the first half of the year. According to Pitchbook, US biotechs have raised more than $6 billion via IPO’s since the beginning of the year, with an even more rapid acceleration of such deals since the beginning of June. As many in the venture space know, “when equity leads, debt may follow,” and that has certainly been the case in 2020. Opportunities to raise less dilutive debt financing abound for publicly traded biotechs, but conditions must be favorable for borrowing.

General guidelines for public biotechs seeking optimal debt terms include a market cap greater than $100 million, a deep pipeline of assets advancing into or through the clinic, and enough cash to carry the company forward for at least 12 months. And, while there is a great deal of activity in the life sciences market, not all debt financing structures are available (or appropriate) for all companies. Before seeking debt financing, it is critical to understand where, along the spectrum of available debt structures, a company might qualify. We believe that any company exploring such financing must answer some basic questions regarding its own profile to determine what type of financing may be available and most appropriate to fulfill its goals. The answers to these and other such questions will dictate the lenders and the types of deals that might be available to the borrowing company.

We recommend asking and answering the following questions:

- How will debt financing benefit the company?

- How much financing will be necessary to achieve the company’s goals/milestones?

- Is the debt to be used for near-term operating expenses, pipeline acceleration or longer-term runway extension?

- Is the company preclinical, nearing more capital-intensive later clinical phases, or close to a new drug application (NDA) filing or a Prescription Drug User Fee Act (PDUFA) date?

- How much cash is the company burning? Is there at least 12 months of cash remaining?

- What is the current market cap of the company?

- How deep is the pipeline? Is there more than one asset in development?

- Is the company facing any regulatory risks, IP issues or legal challenges?

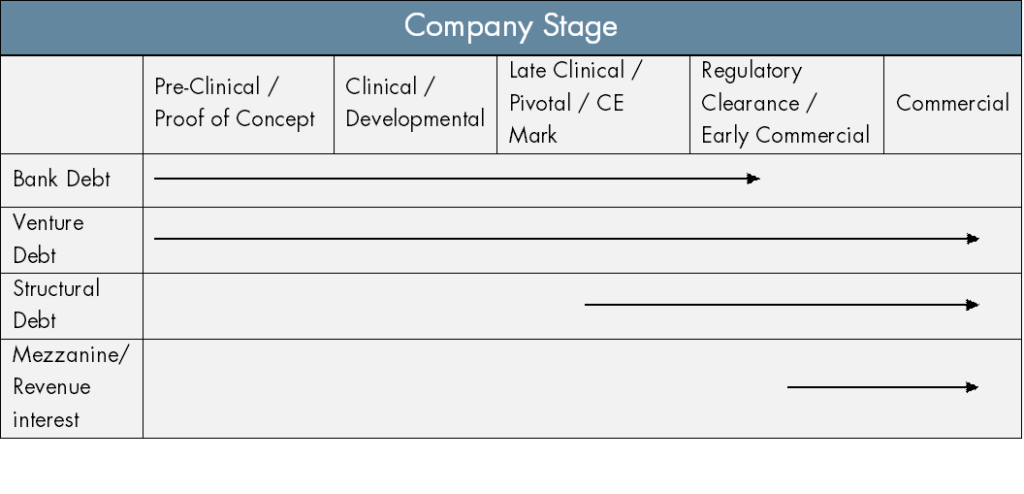

Once a company has determined that a term debt facility is the right option, then it must decide which structure may be most appropriate, identify the appropriate lenders, and solicit proposals. Consider the following general stage/timing guidelines:

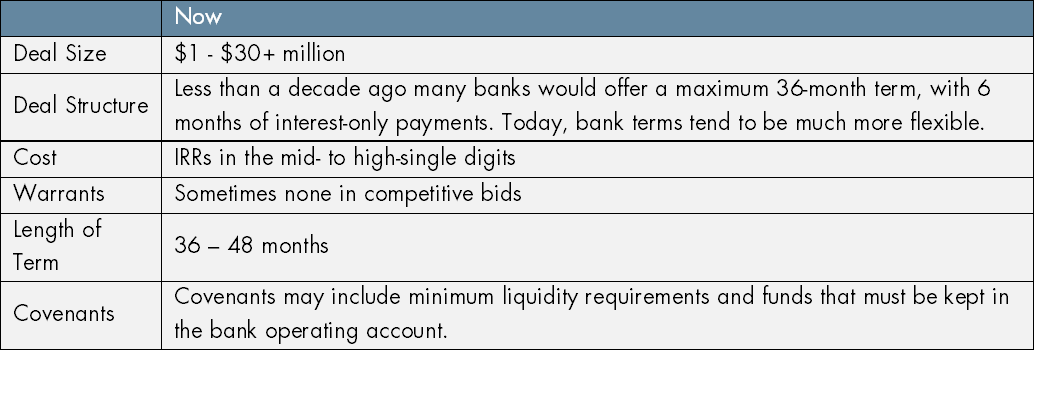

Bank Debt

Bank debt is available at the earliest stage that it may make sense for companies to consider debt financing. Banks, specifically venture banks, historically have been well suited to provide smaller term loans to cash-burning companies, because they have had relationships from day one when these companies first needed a checking account. In addition, they are positioned to quickly assess a client’s debt financing needs. In return for the risk the banks assume on these loans, they may require the borrower to use their other banking services. In the best cases, this can be a win/win scenario: the early-stage company with simple needs has a one-stop-shop for loans and banking services, while the bank collects deposits and fees on all services. However, today’s shifting landscape of mega IPOs has forced banks to take on more risk than they may have historically preferred in order to remain competitive. See the example below:

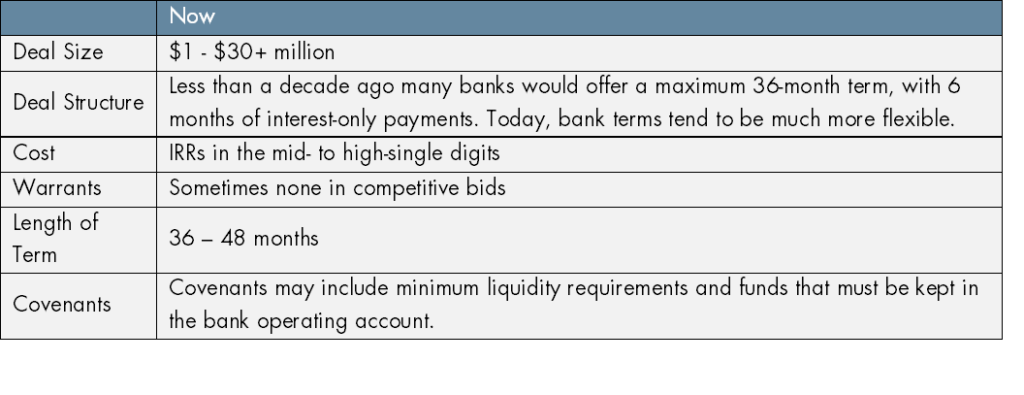

Venture Debt

As opposed to bank debt, venture-debt lenders typically can provide larger deal sizes for longer terms at a slightly higher cost of capital. Historically, venture-debt providers would offer maximum loans from $30 to $50 million. However, as equity rounds and IPOs have increased, so has venture debt. Several life sciences lenders now will provide loans up to $100 million, or even more in some cases. Non-bank publicly traded funds, venture arms of business development companies (BDCs), and specialty finance companies are active in this space. As with most venture debt deals in the life sciences sector, venture debt lenders will assume the risk of financing cash-burning companies that may have unproven drugs and insufficient collateral. Despite such factors these lenders will engage in such deals because they have a long track record of identifying publicly traded companies that present solid credit profiles made up of:

- The presence of top-tier institutional investors holding large positions in the company.

- A healthy market cap supporting a continued ability to raise funds. Market cap matters.

- A deep pipeline that gives the company multiple options to succeed.

- A strong management team with a track record of success.

- A request for reasonably sized financing within appropriate leverage parameters.

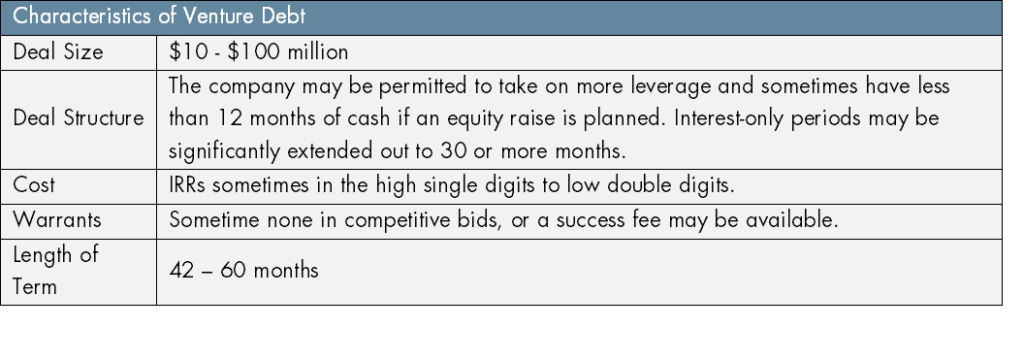

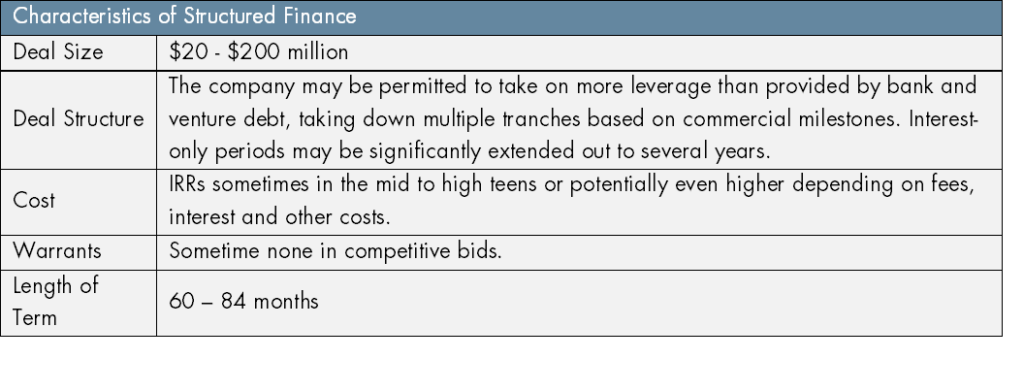

Structured and Royalty Based Finance

As companies move toward late-stage Phase III trials, near-term FDA approval, CE Mark/European commercial stage, or post-FDA approval, new opportunities for debt financing begin to emerge. While venture debt is still a viable option in some instances, there is a group of lenders that will begin to consider lending to such companies with an eye on future revenue streams. Historically, royalty finance was simply a method of taking a sum of cash up front and paying down the loan with existing revenue streams generated from the commercial assets. In the last 5-to-10 years, a group of lenders emerged that is willing to make a similar upfront payment based on future revenue streams. Known as Revenue Interest Financing or “Synthetic Royalty” financing, such lenders have filled a financing gap that used to be open only to large additional equity raises, partnerships, acquisitions or IPO’s. These instruments can be implemented at a crucial stage when a company is moving from clinical to commercial phase, or the funds can be deployed on an approved asset in order to further assets still in the pipeline. However, when clinical-stage biotechs are still years from approval, these lenders may not be appropriate.

In addition, some of these same lenders may also be able to offer a structured term debt facility to newly commercial companies. Companies that may be looking to develop and expand new products, push into new markets, or pursue an acquisition may be good candidates for this type of structured debt financing. They may be in a position to leverage their newly commercial products via tranched structures based on commercial milestones to access the capital they need to meet their goals. The lenders in this space can be much more flexible in terms of repayment with longer terms (up to seven years), extended interest-only periods, or even bullet structures. Because structured-debt financing terms are so varied, it is difficult to pin down the terms that may be available to a specific company without a thorough due diligence of its financials.

The Benefit to Borrowers

Continued competition has certainly provided benefits to borrowers. Terms and conditions have improved over the years as more lenders move into the space, creating more competition for deals. However, the greater number of lenders, different deal structures, and constantly shifting market have made the debt financing landscape that much more difficult to navigate. CFOs and other financial professionals at companies interested in exploring their financing options must conduct that much more research into the debt market and all of its players in order to identify the deal structures that might provide the greatest advantage to the organization–certainly not an easy or enviable task in light of these recent changes within the market. And to be sure, the debt financing landscape will continue to evolve.

Conclusion

Capital Advisors Group’s debt consulting team has always recommended that those seeking debt financing not limit their lender search to their banker or to referrals from peers and colleagues. With all of the new lenders and creative deal structures now available to those seeking debt financing in the healthcare space today, that message could not be truer. For those interested in seeking and securing debt financing, we recommend identifying no less than six lenders that might be suitable for your deal and understanding the typical structures of the deals that they may be able to offer. Interview them, get to know them, and research their reputations in the market. This is going to be a multi-year relationship, after all, and you want to enter into it with a good partner. Then, solicit term sheets and negotiate the deals on a comparative basis. Each lender may have slightly different evaluation criteria for deals they will pursue, which is why the more you can bring to the table, the better.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.