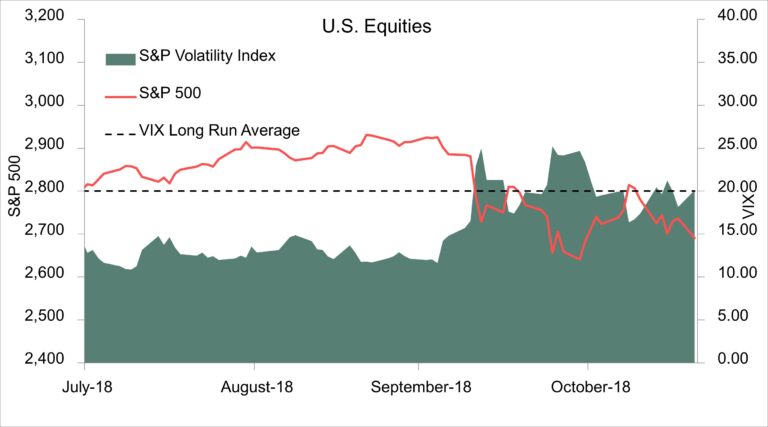

Shifting Dynamics of a Maturing Expansion

12 min readCo-authored by: Spyros Qendro, CFA Abstract The past few years have been predictable for investors, with an expanding economy accompanied by steadily rising interest rates and asset prices. In this two-part series, we look at some recent developments and their implications for the current environment. In part one, we look at recent equity market volatility,…