AI Check-In

Before tariffs dominated the headlines, it was the rise of artificial intelligence (AI) that propelled movements in financial markets. The surging demand for AI models like ChatGPT and the advanced semiconductors needed to develop them primarily benefited the tech sector, while also driving increases in broader equities. Post-inauguration, attention to the nascent technology waned as focus shifted to tariffs, which came on more quickly and forcefully than most predicted. Nonetheless, the AI space continues to grow, and recent events have brought more clarity regarding investors’ questions over supply, demand, and profitability.

DeepSeek Update

The last major headline relating to AI pertained to DeepSeek, a Chinese AI company. In January, the NASDAQ fell over 3% on reports that DeepSeek had developed AI models that rivaled American counterparts with less powerful technology at a lower cost. This raised concerns over whether the hundreds of billions of dollars earmarked for servers, data centers, and other AI infrastructure would bear fruit or lead to oversupply.

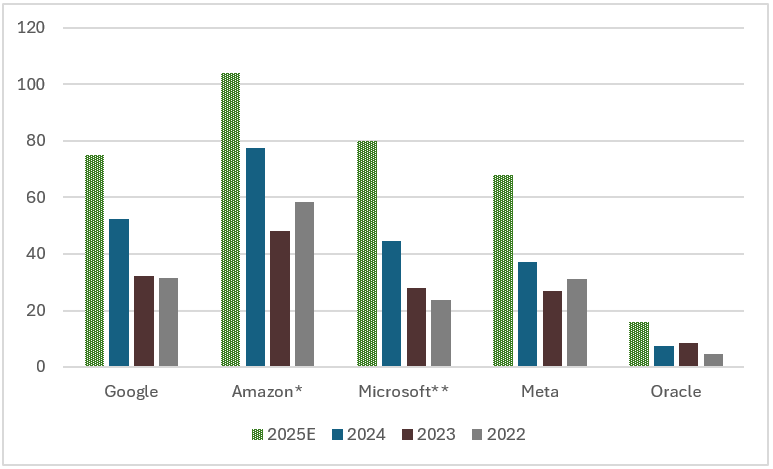

Earnings for the largest hyperscalers suggest that DeepSeek has not had a material impact on AI investment. The five largest cloud companies in their most recent earnings have broadly maintained their investment guidance, with Meta even raising their guidance by $7 billion. Microsoft guided higher CapEx but with a greater mix of short-lived assets, which may give them more flexibility regarding investment. While this could indicate some desire to pull back spending in the future, all five companies reported capacity constraints, with current demand outpacing supply. Investment and management commentary suggest that overinvestment concerns have not yet materialized.

Exhibit 1: Capital expenditures for five largest hyperscalers

Source: Company filings. Projected capex provided by management earnings call

*Amazon capex guidance reflects 4Q25 net capex, annualized

**Microsoft capex guidance provided in The Golden Opportunity for American AI

There are other reasons to suggest that the disruption of DeepSeek may have been overblown. DeepSeek reported training costs of $5.6 million for their R1 model, significantly below the $100 million to $1 billion range cited by Anthropic for their model costs. However, this only accounts for the final training run and excludes R&D, additional preparation, and hardware needed for the final run. SemiAnalysis believes that the price tag is closer to $1.4 billion[1], which would be above Anthropic’s range for comparable performance. Moreover, Microsoft CEO Satya Nadella and other industry participants have referenced Jevon’s Paradox, which argues that efficiency gains can lead to increased demand and boost consumption. Should this be held, efficiency gains would be a tailwind for software companies and a buoy for hardware companies offering AI products and services, rather than a threat to profitability.

Tariff Update

The announcement of reciprocal tariffs on April 2nd put tech companies in a precarious position, given the complexity of their supply chains and significant offshore concentration, primarily in Asia. For instance, over 90% of advanced semiconductors, which are critical to developing advanced AI models, come from Taiwan.[2] Efforts to shift this sourcing to domestic production to avoid tariffs would require extensive and expensive efforts which will likely take years to bear fruit, potentially magnifying tariff risk.

As with DeepSeek, the initial threat posed by tariffs may have been watered down to some degree. The 90-day pause on reciprocal tariffs announced on April 9th gave companies the near-term flexibility to adjust their supply chains, allowing them to shift their output from China to other established locations, providing some breathing room. On May 12th, the U.S. and China reduced their respective reciprocal tariff rates from 145% to 10% for 90 days following trade negotiations. This brought the tariff rate on China down to 30%, with the previous 20% fentanyl-related tariff still in effect. While tariffs on China remain higher than the baseline, the sizable decrease in magnitude may help ease pressures on input costs as well as demand.

Additionally, on April 13th, Customs and Border Patrol announced several exemptions related to electronics, including laptops, semiconductor equipment, and smartphones. However, Commerce Secretary Howard Lutnick commented days later that the exemptions would be short-lived, and that these goods would be subject to a separate tariff rate following investigation. The revision to tariffs on certain electronics may be an indication that the administration recognizes the difficulties in increasing domestic production of technology products like advanced semiconductors and integrated circuits. It may also indicate support from the Trump administration for AI development. This tracks with the Commerce Department’s announcement that they planned to modify export controls on semiconductors, which they believed would “stymie American innovation.”[3]

Credit Metrics Remain Robust

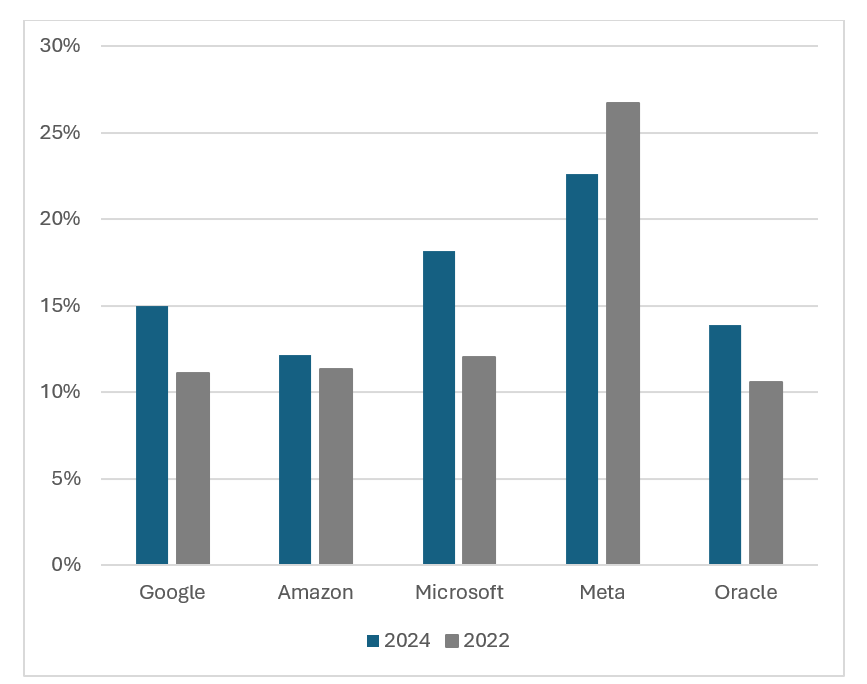

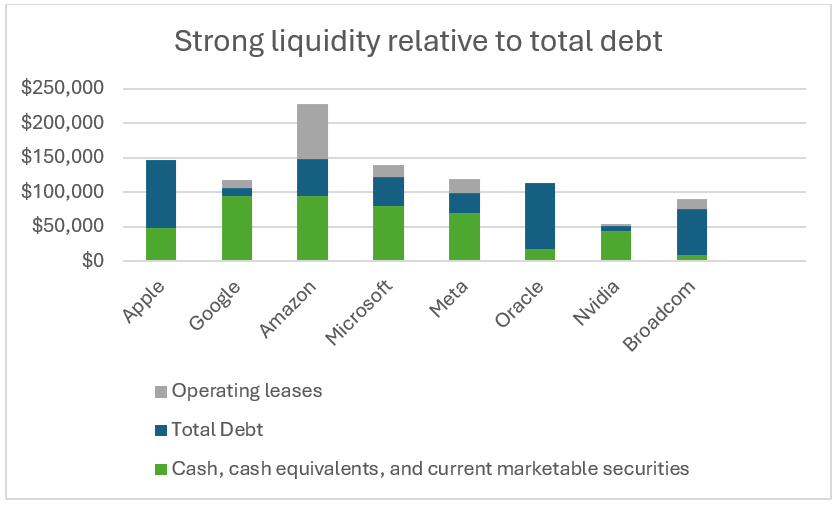

While credit and geopolitical risks hang over companies that develop AI products and services, the largest players in the AI space continue to experience strong growth and stable credit metrics. The demand for AI has generated significant revenues for the largest players in the AI space, which has helped to offset cash flow pressure driven by substantial investment. Collectively, CapEx increased 66% to $211 billion in 2024, primarily reflecting AI infrastructure investment.[4] While investment has increased substantially, the increase in CapEx to revenues has been relatively modest, which has helped to keep free cash flows trending upwards. Conversely, Nvidia and Broadcom, the two largest AI-semiconductor providers, do not face the same cash flow pressure as they outsource their manufacturing. Finally, the higher-rated entities in the AI space generally have ample liquidity and low leverage to withstand potential slowing of their related businesses, helping to provide an additional cushion.

Exhibit 2: Capital expenditure as a % of revenue for largest five hyperscalers

Source: Company Filings

Exhibit 3: Cash and cash equivalents relative to total debt and operating leases

Source: Company Filings

In short, while AI may not be the center of media attention as it has been in the last two years, the underlying fundamentals of the business appear to remain solid despite headwinds seen in early 2025. Although the cyclicality of the sector has come into focus given macroeconomic turbulence, recent revenue growth, spending plans, and management commentary suggest that AI demand has withstood these headwinds. While tariffs faced by the industry appear to be lower than initially advertised, they remain highly uncertain and are unlikely to be fully lifted in the near future. However, the solid financial position of many players helps to provide additional downside protection if conditions worsen. Although challenges to the business are far from over, there is evidence that the AI boom is far from a bust.

[1] Barclays – Powering AI: Post-DeepSeek Bull/Bear Debate

[2] US International Trade Commission – U.S. Exposure to the Taiwanese semiconductor Industry

[3] WSJ – U.S. to Overhaul Curbs on AI Chip Exports After Industry Backlash

[4] Moody’s – AI innovations point to strong spending on IT infrastructure despite macro turmoil

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.