Case Study: The Anatomy of a Deal

Challenge

Capital Advisors Group (“CAG”), was engaged by a late clinical stage biotech firm (the “company”) with a strong investor syndicate that was seeking debt financing to supplement a recent equity raise and bridge through a projected potential acquisition date. The option to acquire the biotech firm was part of an exclusive R&D collaboration with a large pharma that could be executed at the end of the period in 2018. With only the knowledge of a single near-term equity financing of $11 million, CAG set out to help determine the appropriate capital structure (including debt and necessary future equity financings) that would support the company out to, and slightly beyond, this important inflection point outlined in the collaboration agreement.

Process

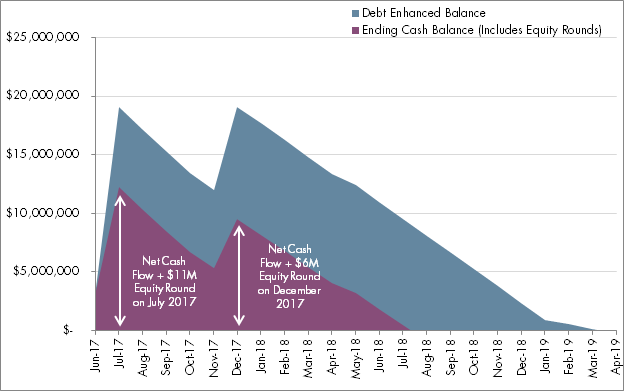

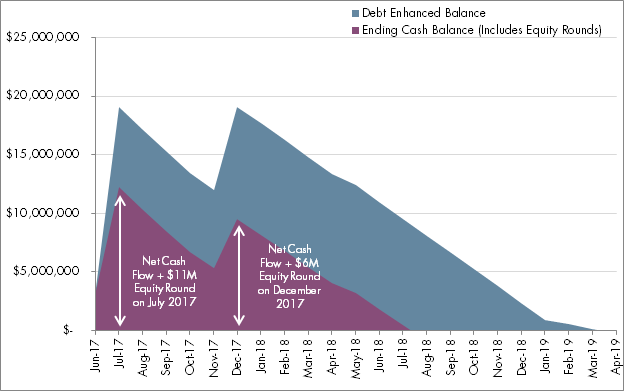

With the limited visibility into plans for future equity financing options for the company, but with the goal of limiting further dilution, CAG delivered various financing options via our “Cash Runway Analysis.” The benefit of the cash runway analysis process is that prior to initiating a formal debt financing investigation, CAG can pull debt financing terms from past transactions from its proprietary Debt Database to provide clients likely terms that might be available from lenders. CAG provided several runway models that included various loan amounts, single and multi-tranche loan structures and the future equity raise(s) that would be required to support the corresponding leverage via debt.

Scenario 1: Runway Analysis ($7M+$3M )*

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.