Should Bondholders Worry about the U.S. Government’s Recent Credit Rating Downgrade?

Introduction

Fitch Ratings’ downgrade of the United States coveted “AAA” credit rating to “AA+” on Tuesday, August 1st, 2023, drew an end to a minor mystery. The rating agency left U.S. sovereign debt on “Rating Watch Negative” after Congress agreed to suspend the debt limit just days before the x-date in June, citing “lower confidence in governance on fiscal and debt matters” from “repeated political standoffs” and “last-minute suspensions before the x-date.”1

On the next trading day, the market’s response was mixed with major stock indices selling off by less than 1%. The 10-year Treasury yield rose seven basis points to 4.15%. Other significant events, such as a strong private payroll report from ADP and a large Treasury issuance announcement, also contributed to market volatility.

The financial press and investment community also had mixed reactions. Legendary investor Warren Buffet bought $10 billion in Treasury debt and told CNBC’s Becky Quick that “there are some things people shouldn’t worry about. This is one.”2A large-font CNN headline read, “Fitch’s historic downgrade maybe a black eye for the U.S. but not much more.”3 Bill Ackman, the famed Pershing Square hedge fund manager, championed the bearish mood by announcing on X (formerly Twitter) that he is betting against the 30-year Treasuries.4

Is the Fitch downgrade nothing more than a black eye on U.S. government debt? Should bond investors be concerned with the recent downgrade? Are credit ratings even relevant to sovereign issuers like the U.S. government?

Fitch’s Rational for the Downgrade

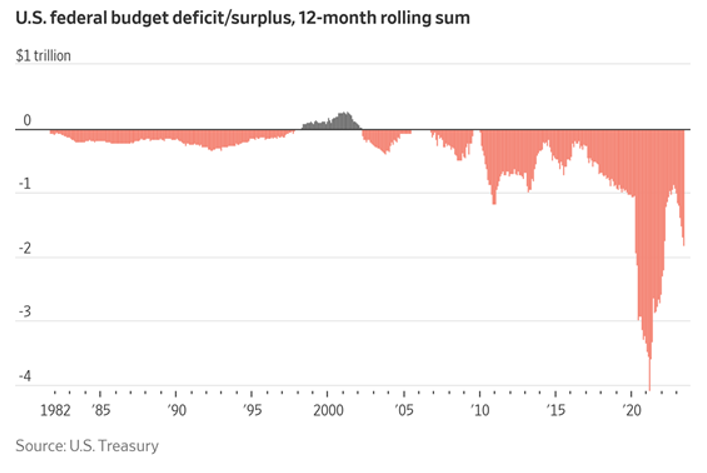

Fitch’s May 2023 press release listed the following factors for the negative watch: debt ceiling brinkmanship, breached debt limit that required extraordinary measures by the Treasury, and the approaching x-date.5Specifically, it pointed to widening federal deficit to GDP ratio of over 7% and a 119% (compared to 36.1% for “AAA” peers) in the coming decade as out of line with AAA sovereign ratings.

In the August 1st, 2023 press release that came with the downgrade, Fitch noted that although Washington politicians narrowly beat the x-date to suspend the debt limit, none of the structural and long-term concerns went away. It stated that “Steady deterioration in standards of governance” on fiscal and debt matters and “last-minute resolutions have eroded confidence.” The government lacks “a medium-term fiscal framework,” especially with respect to rising social security and Medicare costs for an aging population, it added. Interest expenses are expected to reach 10% of tax revenue by 2025 (compared to 2.8% for “AA” and 1% for “AAA” peers) just when the economy is expected to slow down next year. The 118.4% projected debt to GDP ratio in 2025 is over 2.5x higher than the “AAA” peers’ 39.3%. 6

Why did some experts say the downgrade was no big deal?

Despite stock and bond market volatility, the general mood among business and financial leaders was a collective yawn. The general logic goes something like this: “Surely, it doesn’t look good for the U.S. government to lose the AAA rating, but investors are not going to stop buying Treasury securities. After all, what’s the alternative?”

The dollar’s reserve currency status. Most market participants including Fitch agree that the U.S. dollar’s reserve currency status gives the U.S. government the flexibility to fund itself, a privilege not shared by other sovereign entities. Additionally, the U.S. government has many structural strengths such as an advanced and diversified economy with a vibrant private sector, the size, depth, and stability of its capital market, the strength of the banking system, a developed legal system and a comprehensive regulatory environment. These structural strengths are some of the safety nets that undergird the credit strength of U.S. government debt even without the gilded AAA ratings.

CNN’s headline article provided a few other reasons why the Fitch action does not really matter much for the U.S. debt market in the long run.7

It was a small drop in ratings. AA+ is not as good as AAA, but it is still pretty darn good. A credit rating is an expression of the probability of default. Debt rated AA+ and AAA have about the same statistical default probability. An issuer rated AA+ is still a cut above most other sovereign issuer. “What matters is that global investors will still prefer U.S. Treasury debt over other sovereign debt”, Mark Zandi, chief economist at Moody’ analytics, was quoted in the article as saying.

The reasons cited by Fitch are nothing new. In essence, the rationale for Fitch’s decision was widely known. Fiscal deterioration, growing debt burden, government gridlock and political theatre around the debt limit are not good for government finances and the economy, but none of these factors are new. The action brought no incremental informational value to bond trading.

It wasn’t the first time. Standard & Poor’s (S&P) cut the U.S. government’s rating to AA+ from AAA in 2011 after Congress suspended the debt limit following a highly contested fight. The agency pointed to political risk as a factor and was treated with a serving of politics when the White House, the Treasury and Congress attacked S&P’s “credibility and integrity.”8 The government’s reaction to Fitch’s action was more muted, only saying it “defies reality” as the economy is doing better.9

The economy is doing well, so leave the bad news for another day. Economists and policymakers are generally less concerned with higher debt burdens than individual taxpayers, as long as the economy is growing faster than public debt. Some even advocate more debt to stimulate economic growth. With significantly lower inflation and moderately slower payroll gains, economic prospects look pretty good right now. The timing of Fitch’s action explained why market participants are not overly concerned with its ramifications.

Focusing on the rating action itself misses the mark

To say that the downgrade is nothing more than a black eye misses the mark. Despite the nonchalance, most experts agree with Fitch that growing federal deficits, the debt burden, and high-risk brinksmanship over the debt limit are bad for Treasury finances, bad for dollar bonds, and bad for the economy in the long run.

Cleanest shirt-in-dirty laundry analogy has a shelf life. The dim outlook on the United States’ unsustainable debt path in the backdrop of a slower economy has long term ramifications. Most at stake is the United States’ reputation for reliably making good on its promise to pay. Along with the US as the largest economy in the world, this calling card undergirds the reserve currency status of the dollar. Naysayers to the Fitch action like to point to economic woes in other developed economies and China as proof that no other currencies can replace the mighty dollar as the world’s reserve currency. However, the cleanest-shirt-in-a pile-of-dirty-laundry analogy has a limited shelf life. Although we may not know the exact expiration date, it will expire if events like the Fitch downgrade are not taken seriously by politicians and investors.

Complacency is no excuse for no action. As this titled Wall Street Journal column noted, former Federal Reserve Chairman Ben Bernanke acknowledged the U.S. debt issues 12 years ago when S&P knocked the U.S. off the AAA pedestal, “everybody who reads the newspaper knows that the United States has a very serious long-term problem.”10 The statement was neither original nor shocking back then. In the intervening years, the fiscal situation grew worse with higher spending and more tax cuts. The two parties’ animosity towards each other grew public and entrenched. The fatalism that nothing can be done about it became an excuse for ignorance and no action. Some, including the investment guru Buffet, view downgrades and selloffs as buying opportunities. When the market’s collective sentiment will turn from complacency to alarm is anyone’s guess, but no action on the government’s part will almost surely lead to actions by investors at some point.

Higher interest rates mean more difficult fiscal decisions and higher costs for everyone. The risk, of course, is higher today than in 2011, as rising interest rates force the government to pay even higher interest expenses. The administration and Congress could agree to some form of entitlements reform, but this is extremely unlikely in today’s political climate. The status quo would mean reduced appetite from overseas investors and higher “risk-free-rates” to entice more buyers. The process can crowd out private debt funding in a competitive market for debt capital. The outcome may be rising funding costs for all dollar debt issuers. China, one of the largest holders of U.S. debt that already started diversifying its foreign reserves into other hard currencies, may push the cost higher as it faces off with the U.S. on territorial claims, technological arms races, control over energy and mining resources, cybersecurity, support for the war in Ukraine and other confrontations.”11

Not a near-term concern, but expect more volatility, less liquidity and higher risk premium in fixed income markets.

Just as no one can pinpoint the exact moment when melting glaciers offered concrete proof that global warming was endangering human flourishment and economic prosperity, no one can say for certain when investors will abandon dollar debt for other currencies. Assuming the current problems are left unaddressed, debt investors—including institutional cash investors–should expect incrementally more volatility, less liquidity and higher risk premiums in fixed income markets in the years and decades to come.

More volatility and less liquidity. Debt investors often use credit ratings to assess a borrower’s creditworthiness. Credit risk refers to both the ability and willingness to pay, with full and on-time payment. Few will dispute the U.S. government’s ability to eventually honor its obligations, but its willingness to pay on time is what agonizes investors when the debt limit is reached. The Fitch action should serve as the latest in a line of warnings to investors, to expect more market volatility and less liquidity linked to Treasury finances, especially during future debt limit fights, through budget debates, and at Treasury issuance announcements. As the Treasury’s dependence on the bond market increases, calendar effects and geopolitics may also have a large impact.

Less impact on agency debt. Acceptance of debt from government agencies, including GSEs such as Fannie Mae, Freddie Mac and Federal Home Banks may be less affected. Despite their ratings linkage to the federal government, investors tend to be focused more on how these entities perform on their own because government support is often implicit, and on an as-needed basis.

No impact on government money market funds. Government money market funds that invest in Treasury, agency and government repurchase agreements are not likely to see their AAA fund ratings at risk nor their intrinsic credit strength reduced from the Fitch action. Fund ratings are not based on the average credit rating of the investments it holds, but rather on the combined strength of their quality and liquidity characteristics. If investments meet the Tier 1 minimum short-term credit ratings and liquidity requirements by the SEC, fund ratings generally are not materially impacted by sovereign ratings downgrades.

Higher risk premium. The crowding out effect may lead to higher costs and even funding stresses for less creditworthy issuers, especially during periods of higher market volatility and economic downturns. Highly rated companies and financial firms may also see negative impact on their debt and deposit ratings, as sovereign rating sometimes acts as a “ceiling” due to the impact of macro factors on individual companies. Rating agency methodologies also include a “notching differential” for deposits at systemically important banks (SIB) to the sovereign rating. Fitch said that its action will not trigger negative rating actions on non-financial corporate issuers but noted that “a sustained higher cost of debt capital and the severity of the economic slowdown remain the greatest sources of risk for issuer credit profiles in the near term,” in its press release.12

1 Fitch Ratings, “Despite debt limit agreement, U.S. “AAA” rating remains on Negative Watch,” June 2, 2023, www.fitchratings.com/research/sovereigns/despite-debt-limit-agreement-us-aaa-rating-remains-on-negative-watch-02-06-2023.

2 Fred Imbert, “Warren Buffett says he’s not worried about Fitch’s U.S. downgrade,” CNBC: Markets, August 3, 2023, www.cnbc.com/2023/08/03/warren-buffett-says-hes-not-worried-about-fitchs-us-downgrade.html.

3 Bryan Mena and Jeanne Sahadi, “Fitch’s historic downgrade may be a black eye for the U.S. but not much more,” CNN Business, August 2, 2023, www.cnn.com/2023/08/02/economy/what-fitch-downgrade-means-us/index.html.

4 See Ackman’s tweet, twitter.com/BillAckman/status/1686906272937869312?s=20.

5 Fitch Ratings, “Fitch Places United States’ “AAA on Rating Watch Negative,” May 24, 2023, www.fitchratings.com/research/sovereigns/fitch-places-united-states-aaa-on-rating-watch-negative-24-05-2023.

6Fitch Ratings, “Fitch Downgrades the United States’ long-term ratings to ‘AA+’ from ‘AAA; outlook stable”, August 1, 2023https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023.

7 See note no. 3.

8 Richard Adams, “U.S. attacks S&P’s ‘credibility and integrity’ over debt downgrade,” The Guardian, August 6, 2011, www.theguardian.com/world/richard-adams-blog/2011/aug/07/standard-poors-treasury-white-house.

9 The White House, “Statement from Press Secretary Karin Jean-Pierre on the recent decision by Fitch ratings”, August 1st, 2023, www.whitehouse.gov/briefing-room/statements-releases/2023/08/01/statement-from-press-secretary-karine-jean-pierre-on-the-recent-decision-by-fitch-ratings/.

10 Spencer Jakab, “American’s fiscal time bomb ticks even louder,” The Wall Street Journal: Markes | Heard on the Street, August 2, 2023, www.wsj.com/articles/americas-fiscal-time-bomb-ticks-even-louder-e2934f65.

11 See Jakab’s column above.

12Fitch Ratings, “U.S. corporate ratings unaffected by government downgrade, but risks linger”, Aug 2, 2023, fitchratings.com/research/corporate-finance/us-corporate-ratings-unaffected-by-government-downgrade-but-risks-linger-02-08-2023.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.