Interest Rate Update

CPI Surprised to the Upside… Again

The Consumer Price Index rose 0.4% in September, double the expected increase, despite a decline in energy prices for the month. Services and shelter costs were the biggest contributors, but large increases were broad-based across categories. Core CPI accelerated unexpectedly to a 0.6% monthly gain, pushing the year-over-year comparison to another multi-decade high of 6.6%. With no improvement in core inflation, expectations for continued monetary policy tightening this year and into 2023 intensified. Last week the 1-year Treasury yield rose 0.26% to 4.50% and the 2-year Treasury yield rose 0.15% to 4.45%.

Wage Growth

Wages continue to grow but some measures suggest that gains may be slowing. The Atlanta Fed’s Wage Growth Tracker, while still very high, appears to have peaked in August with a decline in September from 6.7% to 6.3%. The September NFIB Small Business Optimism Index reported that a net 23% of respondents planned to increase employee compensation in the next three months, down from 26% in the previous month. A moderation in wage gains, along with falling levels of excess consumer savings could contribute to decelerations in consumer spending in the months ahead.

Recession Risk

The yield curve inversion, or the downward trajectory in Treasury yields from 2 years to 10 years, is roughly the same size as a month ago but some market participants believe the odds of recession are growing. An October Wall Street Journal survey of economists put the odds of a recession in the next 12 months at 63%, up from 49% three months earlier. When asked whether the Fed will raise rates too much, just enough or too little, 59% responded that the Fed will raise rates too much, up from 46% in July. The “just right” predictions on monetary policy shrank to 36% from 42%.

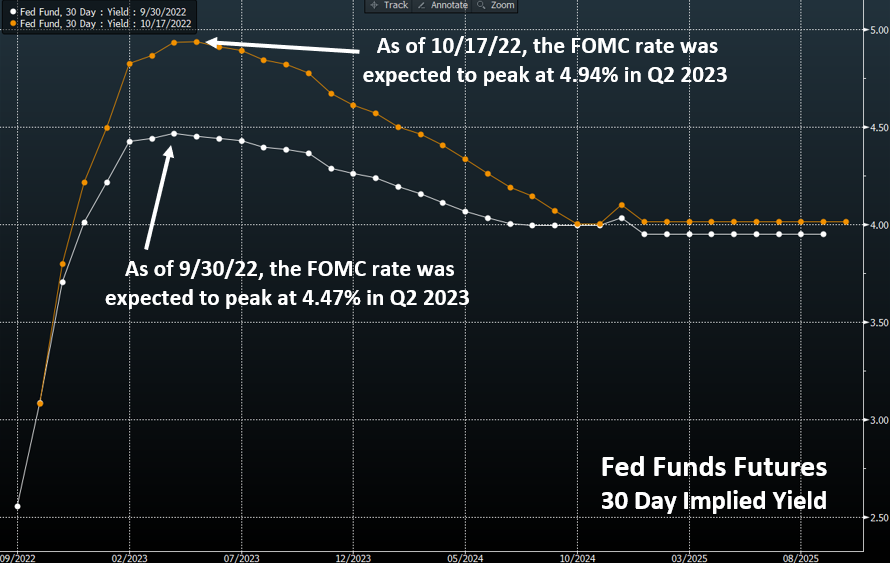

Fed Funds Futures

Another 0.75% hike is fully priced in for the November 2nd FOMC meeting (with very small odds of a larger 1.00% hike). Futures contracts imply a 65% chance of a fifth-consecutive 0.75% hike at the December 14th meeting, which would bring the bottom of the Fed funds target range to 4.50% for year end. Markets are pricing in a 2023 Fed funds peak near 5.00%, up from about 4.50% before the September CPI release. Futures contracts continue to suggest that the Fed could begin cutting rates in the second half of next year despite no such indications from the Fed itself.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.