April 2025 Mid-Month Market Update

Markets Stabilize Following Tariff Announcements

It has been a historic month for global markets due to the Trump administration’s on-again/off-again tariff announcements. Despite the recent volatility, we are seeing signs that markets may be stabilizing:

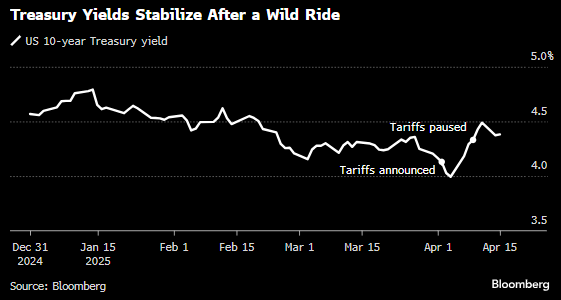

- Treasury yields have rallied lower over the past couple of days following last week’s selloff, which saw yields rise across the curve. Last week, the 2-year yield rose 30 basis points to 3.96% and the 10-year yield rose 50 basis points to 4.49%. This week through 4/15, the 2-year yield declined 11 basis points to 3.85% while the 10-year yield declined 16 basis points to 4.33%.

- The S&P 500 rose +5.7% last week and is up another +6.36% through 4/15.

- The investment grade corporate bond market priced over $35 billion of new issuance over the past two days. New issuances saw healthy demand with deals pricing much tighter than initial price talk.

Source: Bloomberg

Volatility Leads to Dip Buying

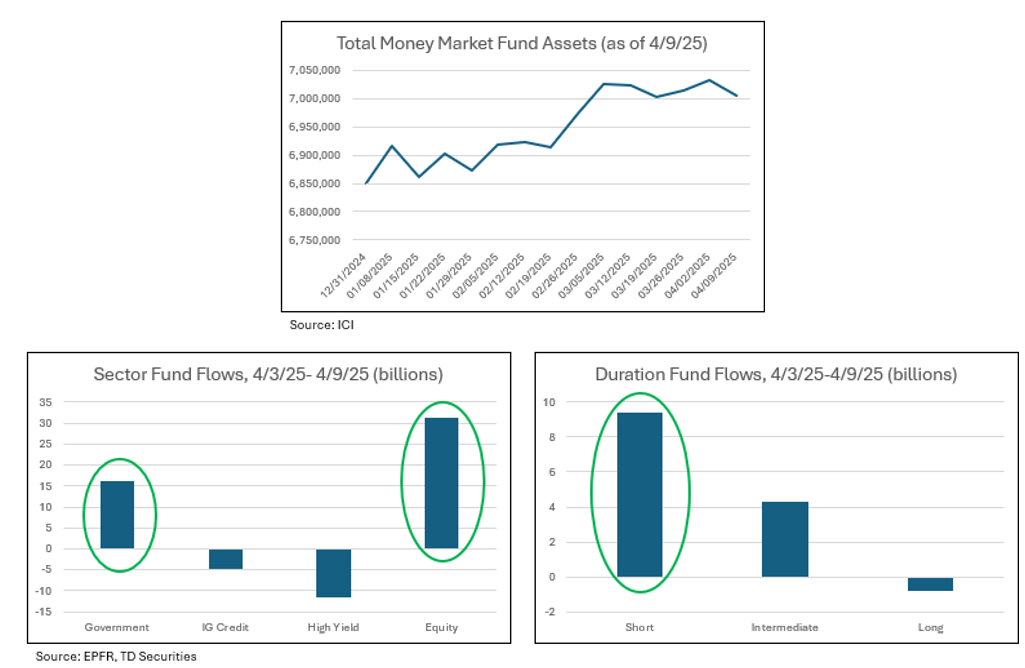

Although money market fund assets have increased to over $7 trillion, there was a notable decline from 4/2 to 4/9, while simultaneously, government and equity funds saw inflows: this could be the result of investors taking advantage of higher treasury yields and declining equity prices (see Sector Fund Flows chart). During the same time frame, there was also a notable shift in duration, with long duration funds seeing declines while short duration funds saw inflows of $9 billion (see Duration Fund Flows chart).

Source: ICI, EPFR, TD Securities

Diverging Views from Fed and Markets

Recent commentary from Fed members has conveyed a clear focus on inflation while discounting the idea of moving rates in the short-term due to potential tariff impacts. At the March 19th FOMC meeting, the Fed maintained its 2025 rate cut forecast of 50 basis points, but they do not appear inclined to cut in the near term. Instead, they will likely wait for economic data to guide monetary policy decisions instead of preempting the potential impacts of an uncertain tariff policy.

- Federal Reserve Chair Powell: “It feels like we don’t need to be in a hurry” to change rates. “It feels like we have time.”

- Minneapolis Fed President Kashkari: “Given the paramount importance of keeping long-run inflation expectations anchored and the likely boost to near-term inflation from tariffs, the bar for cutting rates even in the face of a weakening economy and potentially increased unemployment is higher.”

- New York Fed President Williams: “The current modestly restrictive stance of monetary policy is entirely appropriate given the solid labor market and inflation still above our 2% goal.”

Although the Fed does not seem to be in a rush to cut rates, the market is pricing in a more aggressive rate cutting path, averaging 75 to 100 basis points of rate cuts by the end of 2025 and a more than 70% probability of a cut by the June 18th FOMC meeting. However, a recent survey of over 60 different economists conducted by the Wall Street Journal showed average expectations of only 50 basis points of rate cuts by December.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.