Credit Implications of The Digital Markets Act

Introduction

On March 7th, 2024, the European Commission (EC) began enforcing the Digital Markets Act (DMA), one of the most sweeping antitrust policies for Big Tech to date. Yet despite the broad scope covered under the legislation, the market reaction was relatively muted. This suggests a belief that the companies’ operational changes proposed to comply with the DMA will have limited financial impact, or that the impact will be isolated within the European Union.

However, there has been significant overlap in recent antitrust action between European watchdogs and their American counterparts. As a result, there may be reason to believe that the Digital Markets Act could offer a window into potential changes across many companies’ operating markets. Moreover, two weeks after DMA enforcement began, the European Commission announced several noncompliance investigations across companies, suggesting some investors and companies may have underestimated the operational change needed to come into compliance. We believe it’s worth understanding the Digital Markets Act’s effects on Big Tech and its potential credit impacts.

What is The Digital Markets Act?

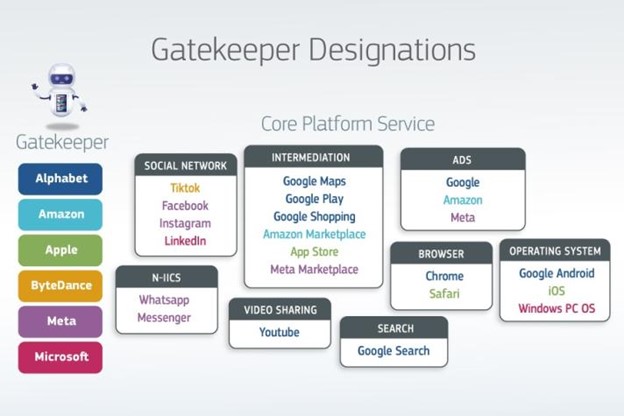

The Digital Markets Act was introduced in November 2022 by the European Commission to “ensur[e] fair and open digital markets.”11 The Act identifies and regulates companies deemed as “Gatekeepers.” To be designated as a Gatekeeper, a company must exceed thresholds relating to annual turnover, the number of active business, and end users in the EU and be considered to have an “entrenched and durable position” in the last three years. Unsurprisingly, these Gatekeepers target Big Tech—Alphabet, Amazon, Apple, Meta, and Microsoft—as well as ByteDance, TikTok’s parent company. These Gatekeepers are then guided by a series of “do’s” and “don’ts,” on what have been deemed core platform services. These rules mainly surround the following:

- App Stores & Payment

- Self-Preferencing

- User data

- Interoperability

The following analysis explores which business segments these regulations cover. It is important to note that although whole business segments are discussed, only revenues derived from the EU would be impacted by the DMA, if at all. The ultimate effect for each company will vary given their distinct business models and geographic exposures.

Source: European Commission

App Stores & Payment

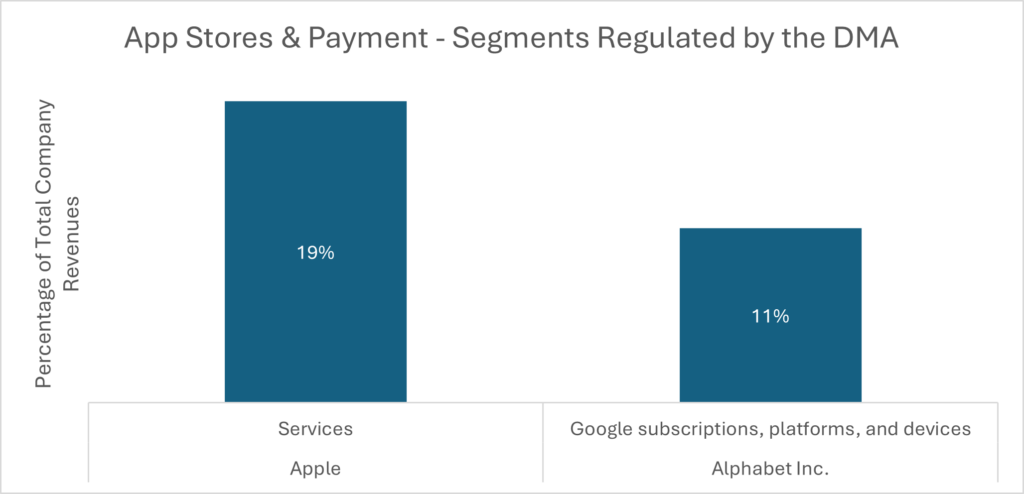

App stores & Payment: Under the Digital Markets Act, Gatekeepers must allow apps to be downloadable outside Gatekeeper app stores, including third-party app stores and web-based downloads. They must also allow third-party in-app payment systems. Preventing such offers is prohibited.

Figures are as of 2023. Source: SEC, Company Filings

Both Apple and Alphabet are the main companies subject to this component of the DMA, but Apple will face a greater impact because Alphabet already has third-party app stores. Introducing direct competition to the App Store may crack open Apple’s walled garden, targeting the estimated 30% of Services revenue derived from the store.2 To comply with the DMA, Apple announced a series of changes to their fee structure, reducing their standard App Store commission but introducing fees relating to payment processing and new installs.3 This may help shield Apple from lost commissions brought about by the breaking open of their walled garden. However, the European Commission has expressed concern with these measures,4 and further concessions may need to be made.

Self-Preferencing

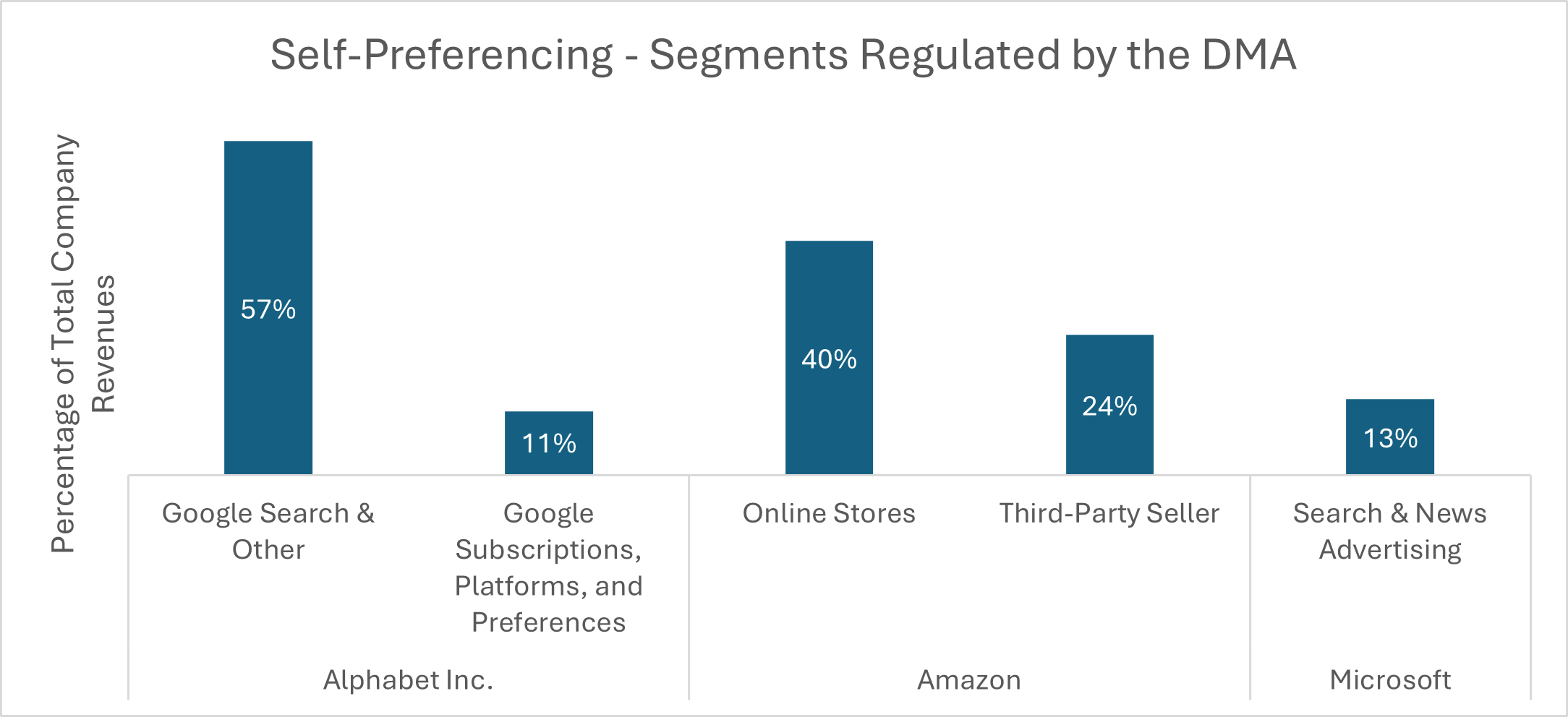

Self-preferencing: Gatekeepers are also prohibited from unfairly ranking their own products and services above competitors. Similarly, Gatekeepers must allow their pre-installed applications to be removed. Moreover, end users should, at first use, choose their default applications, as opposed to having preset defaults. Changing default apps should also be made easier.

Figures are as of 2023. Source: SEC, Company Filings

Rules about self-preferencing primarily impact Alphabet and Amazon. On Google Search or their proprietary apps in the app store, Alphabet must avoid unfairly ranking its own products. Most notably, Google can no longer be the preset search engine on AndroidOS or its pre-installed browsers, a solution currently being explored by the DOJ. The retention of Google’s users may provide a forecast into Alphabet’s future growth trends in the US if similar regulation is implemented, although most users will likely continue to use Google given both its familiarity and leading functionality.

Although Amazon Marketplace falls under the same restrictions, Amazon was already largely in compliance with the DMA as a result of a previous lawsuit with the European Commission.5 As such, the DMA’s self-preferencing rule will have little effect on Amazon, and their previous concessions have not had a material impact. Although the European Commission is investigating if Amazon preferences its own products on the Amazon Store, Amazon previously said their private brand products account for less than 1% of retail revenues.6

Data Portability

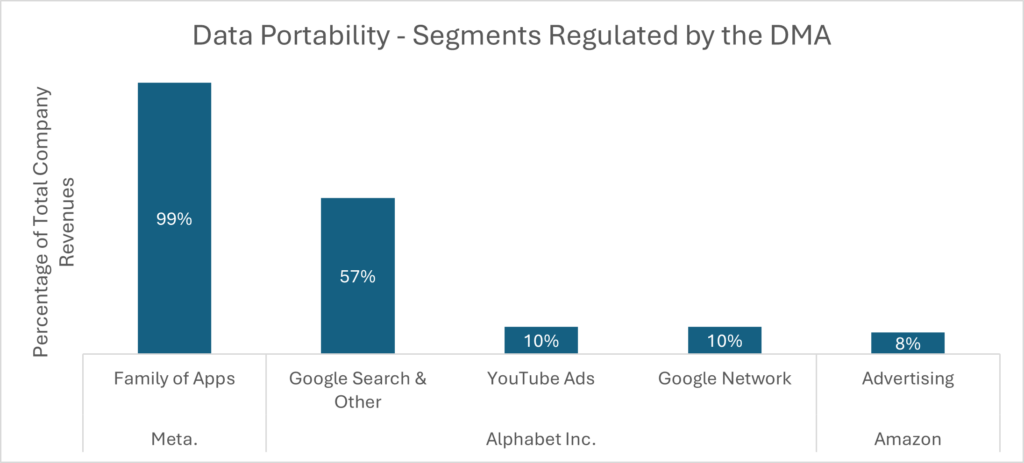

Data Portability: Gatekeepers must allow users access to the data they generate across platforms. They cannot track users outside of these platforms for targeted advertising purposes without the consent of the user. Additionally, third-party advertisers should be able to independently audit their ad practices.

Figures are as of 2023. Source: SEC, Company Filings

The DMA’s rules regarding data portability are most significant for digital advertising companies. For example, users must consent to have data collected on Instagram sent to Facebook, and data from Google sent to other Google services like YouTube. While this mainly applies to Alphabet and Meta, Meta faces a greater risk to their operational efficiency than Alphabet given how the two companies earn their revenue. While Google’s revenues are highly concentrated in digital, most of those revenues come from within Google Search, reducing Alphabet’s exposure to significant risks to revenue.

Meanwhile, Meta derives 98% of its revenues through advertising across their Family of Apps, which include Facebook, Instagram, WhatsApp, Messenger, and Threads. While user data was previously transferred across Meta’s product portfolio, users must now consent to sending data between these platforms. In response, Meta introduced a “pay or consent” model in 2023 which gave users the option to share their data across apps or pay a monthly fee for an ad-free experience on Facebook and Instagram. However, this proposal has proven unpopular with the European Commission, who suggested this model “may not provide a real alternative.” Should they reject Meta’s proposal and impede data portability across apps, this may potentially reduce the effectiveness of digital advertising on Meta’s platforms.

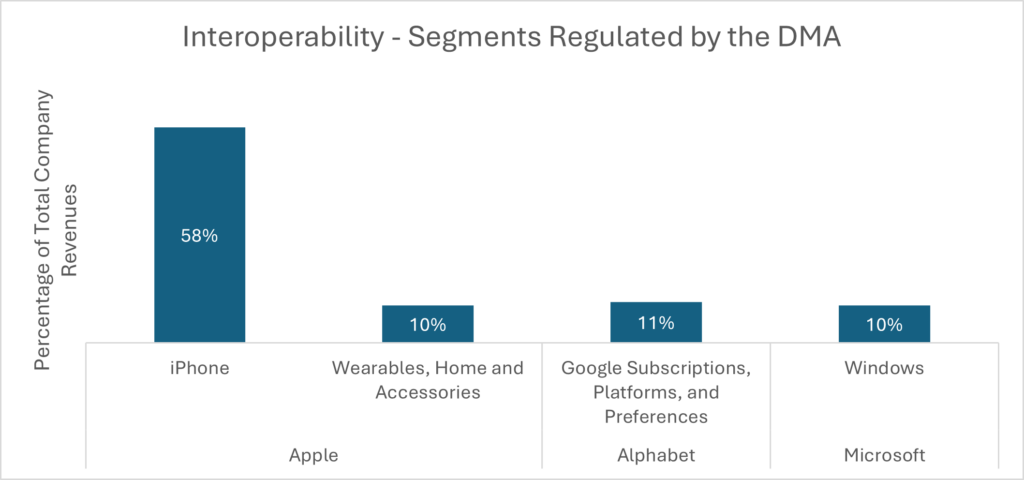

Interoperability

Interoperability: Gatekeepers should not degrade the functionality of third-party products and services such that cross-platform activity is unfairly affected. For example, third-party messaging systems should be able to send pictures just as well as iMessage.

Figures are as of 2023. Source: SEC, Company Filings

Interoperability requirements primarily threaten Apple’s walled garden, though Apple’s peers may benefit. Under the DMA, competitors’ products which interact with the iPhone will have new access or improved operations, including third-party tap-to-pay apps and wearables. Additionally, third-party messenger apps would have to work as well as iMessage, meaning group messages need no longer fear the “green bubbles”. Although this may increase competition for substitute products, Apple’s strong brand loyalty should help retain customers within their product ecosystem. On the other hand, interoperability may positively affect Google’s products like Android.

How is This Different?

Despite being the most comprehensive antitrust tech law recently passed, the DMA does not cover any new issues that haven’t been previously discussed, or in some cases resolved, in other legal matters. The main difference is timing: while overlapping lawsuits may take years to fully play out and proposed antitrust legislation in the US has stalled, the DMA’s impact to their Big Tech’s dominance, if any, will be felt much quicker. The implications will vary depending on a given company’s operating model and geographic exposure and should be considered individually, especially when considering potential spillover effects. Lastly, companies are subject to penalties for noncompliance of up to 10% of global turnover, but they are likely to cooperate with regulators in order to avoid major fines.

Bottom Line

The credit impact of the Digital Markets Act ultimately comes down to user retention in the face of lower barriers to entry and stricter regulation, and of course a company’s revenue exposure to Europe. In any scenario, these companies should likely keep most of their revenue streams. Likely, companies with strong products will continue to retain their customers due to performance and familiarity. Additionally, companies will likely cooperate with regulators to avoid substantial fines related to noncompliance, limiting the credit impact related to legal penalties.

However, people tend to be cautious of their data privacy, so there may be lower overall data portability if given the option, even if it may lead to a worse advertising experience. In areas with little to no differentiation, such as app stores, users may choose to opt for app stores with cheaper prices, but they will have to convince users that their data is secure.

How these new changes ultimately impact companies’ bottom lines will be of particular importance should the United States choose to follow suit. Investors should pay special attention to revenues associated with Europe for any major impacts resulting from the Digital Markets Act.

1 https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/europe-fit-digital-age/digital-markets-act-ensuring-fair-and-open-digital-markets_en

2 https://v2.creditsights.com/articles/574874

3 https://www.apple.com/newsroom/2024/01/apple-announces-changes-to-ios-safari-and-the-app-store-in-the-european-union/

4 https://ec.europa.eu/commission/presscorner/detail/en/ip_24_1689

5 https://www.wsj.com/articles/amazon-agrees-to-settle-eu-antitrust-cases-avoiding-fines-11671538014?mod=djemalertNEWS

6 https://www.wsj.com/articles/amazon-cuts-dozens-of-house-brands-as-it-battles-costs-regulators-3f6ad56d

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.