May Mid-Month Portfolio Update

Moderating Economic Data – Rate Cut Timing Pushed Up

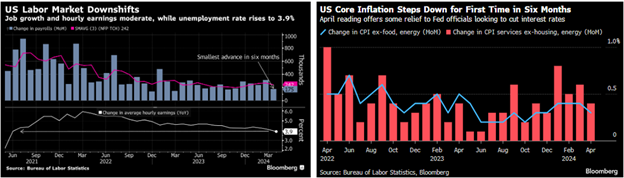

Key economic data released in the beginning of this May have come in below expectations, including a downward surprise on the employment report for the first time since October 2023. Although these data points only cover one month, they reveal an economy that appears to be moderating. The data have contributed to a May rally in Treasury yields and the estimated timing of the first Fed rate cut moving up from the end of this year to as early as September. One release the Fed has likely welcomed the most is the April CPI inflation report, which marked the first time this year that CPI did not surprise to the upside.

Here’s a summary of the key indicators:

- 5/1/24: The ISM Manufacturing Index fell back below 50 to 49.2, reflecting contraction in the manufacturing sector.

- 5/3/24: The ISM Services Index also fell back below 50 to 49.4, the first contractionary reading since December 2022. However, the Prices Paid component jumped to a 3-month high, marking a potential concern about inflation.

- 5/3/24: The April Employment report showed that headline Nonfarm Payrolls came in lower than expectations at 175,000 vs. 240,000, marking the smallest gain in six months.

- 5/9/24: Weekly initial jobless claims jumped 22,000 to 231,000, the highest reading since last August.

- 5/15/24: CPI came in lower than expectations at +0.3% vs. +0.4% anticipated, while Core-CPI cooled for the first time this year. The annual Core-CPI gain declined to +3.6%, the lowest in three years.

- 5/15/24: Retail Sales came in flat for April vs. expectations of a +0.4% increase. The Control Group, which feeds into the consumption component of GDP, declined -0.3% vs. expectations of a +0.1% rise.

Source: Bloomberg

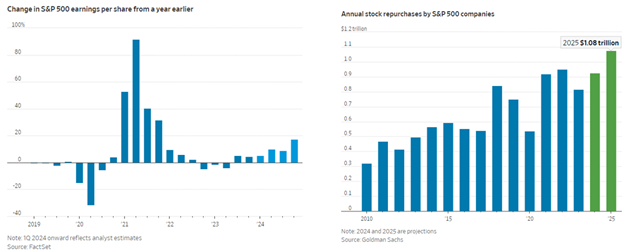

Earnings Season: Solid First Quarter

A good portion of U.S. based companies have reported their first quarter earnings, with the majority coming in better than analyst expectations. According to FactSet, companies in the S&P 500 have reported earnings per share at +5.4% from a year earlier, compared to analyst expectations of +3.4%. On the heels of strong earnings, companies have announced increases in share buybacks. Buyback announcements so far have totaled over $181 billion of S&P 500 company shares, which are up +16% from the same quarter a year ago, a significant show of confidence from companies that the economy will continue to remain strong. Some Wall Street analysts are projecting buybacks totaling $925 billion in 2024 and $1.075 trillion in 2025.

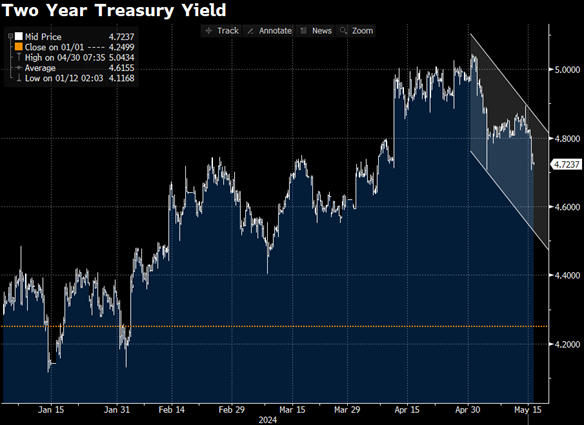

Yields Lower & Record High Equity Indexes in May

Treasury yields have rallied across the curve, led by the 2-year and 3-year notes which fell by 31 and 37 basis points, respectively, through the middle of May. Both tenors are the most sensitive to changes in monetary policy expectations and the decline in yields reflects softer May economic data. In addition, all three major equity indexes closed at record highs as of May 15th, while front-end credit spreads tightened.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.