Interest Rate Update

Investors grew increasingly concerned about the risk of recession in late June. Stock markets were particularly volatile on Thursday with the S&P giving up 0.9% on the day and 21% over the first half of the year, marking the worst performance since the 1970s. The DJIA declined 0.8% and the Nasdaq retreated by 1.3% as the 10-yr Treasury yield fell to 2.97% from 3.01% over the last trading day. According to a Deutsche Bank survey released last Thursday, 90% of respondents expect to enter a recession by the end of 2023.

Fed Chair Powell testified before Congress on June 22nd and addressed recession concerns, saying “It’s certainly a possibility. We are not trying to provoke and do not think we will need to provoke a recession, but we do think it’s absolutely essential” to contain inflation. Powell acknowledged the risk that the Fed may overshoot in terms of raising rates but argued “the bigger mistake to make – let’s put it this way – would be to fail to restore price stability.” He went on to say that “the events of the last few months around the world have made it more difficult for us to achieve what we want” and “we’ve never said it was going to be easy or straightforward.” He signaled that “ongoing rate increases will be appropriate” and “over the coming months, we will be looking for compelling evidence that inflation is moving down,” noting that financial conditions “have now tightened significantly.”

Concurrent with Powell’s testimony, the Fed published a paper that predicts slightly more than a 50% chance of a recession over the next year and about a 67% chance over the next two years. Variables analyzed in the report included the unemployment and inflation rates, the spreads of investment-grade corporates over Treasuries and the difference in yields between medium and longer-dated Treasuries. Senior Fed economist, Michael Kiley noted that typically higher inflation rates and lower unemployment rates have preceded recessions, pointing out how “such developments signal imbalances (overheated product and labor markets) that may unwind through an economic contraction.” In his discussion at the ECB’s economic policy meeting in Portugal, Chair Powell went on to say that “The economy is being driven by very different forces. What we don’t know is whether we’ll be going back to something that looks like, or a little bit like, what we had before.”

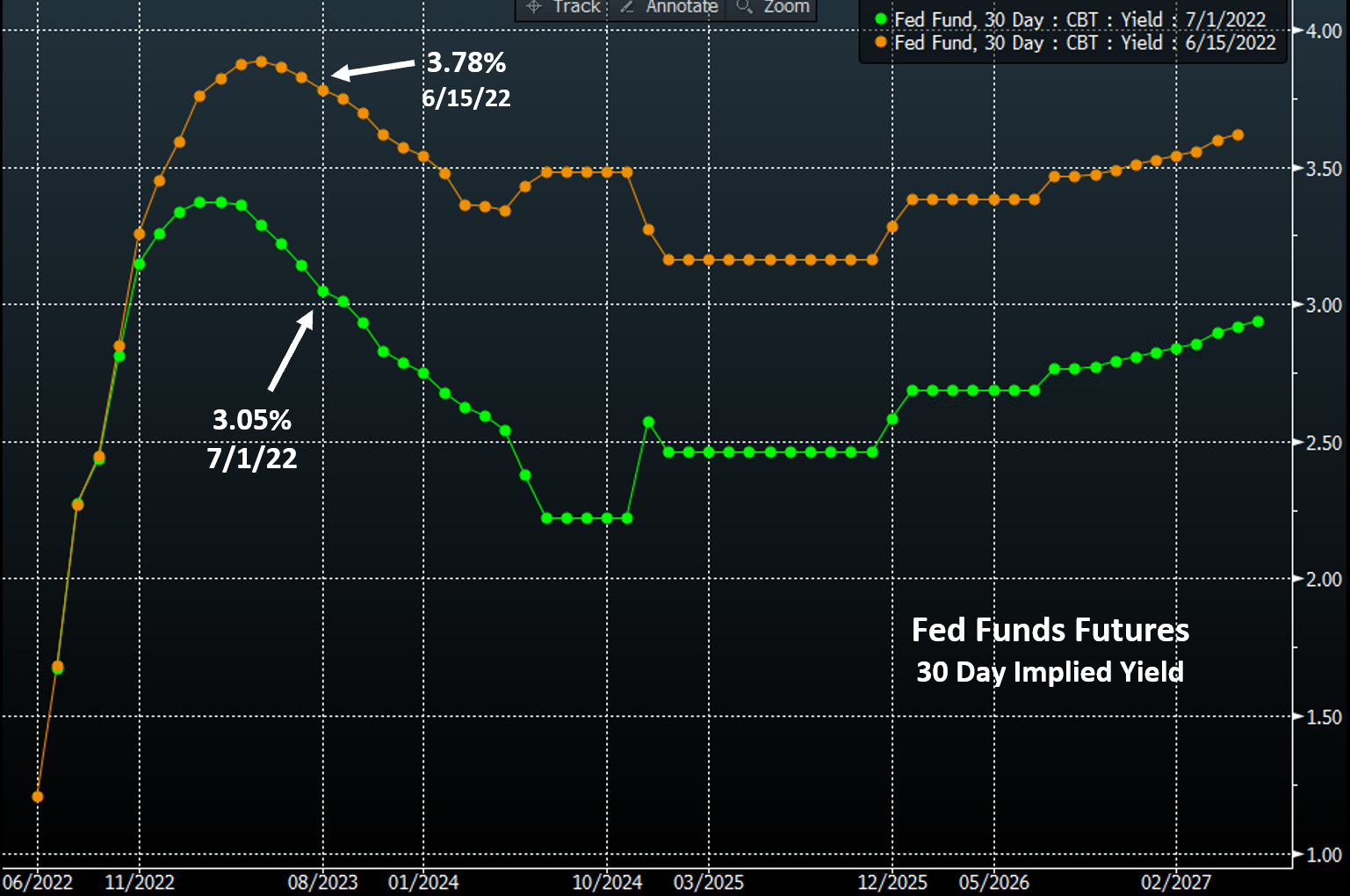

Fed Funds Futures Contracts

Fed futures markets continue to price in an 83% probability of a 75 basis point hike at the next meeting in late-July but have pulled back on where rates will top out, placing a 60% chance that fed funds will be between 3.00% and 3.50% by mid-2023, down from 3.75% in mid-June. Short-term Treasury yields declined in the second half of June on growth concerns – the 2-year note yield fell 28 basis points from 3.20% to 2.92% from June 15th to June 30th.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.