Interest Rate Update

These are certainly challenging times for the Federal Reserve. The past few weeks brought new data confirming historically tight conditions in the labor market alongside soaring domestic price pressures. While the Fed’s recent aggressive rate hikes have yet to cool inflation, concerns are growing that the pace and scope of their activity will push the US economy into recession as early as next year.

Solid June Employment Report

Employers added 372,000 new nonfarm payrolls in June, easily beating the forecast for 265,000, while the unemployment rate was unchanged from May at 3.6%, the lowest point in almost 50 years. The job gains were led by increases in the education and health sector (+96,000), professional and business services (+74,000) and leisure and hospitality (+67,000) while the government sector (-9,000) was the only major category to shed jobs in June. Over the past three months, the US economy has added an average of 375,000 jobs to nonfarm payrolls. Average hourly earnings (5.1% yoy), average weekly hours (34.5%) and the labor force participation rate (62.2%) all edged down slightly.

Worrisome Consumer Price Index Data

The Federal Reserve has been hoping that its aggressive tightening of rates by 1.50% over the past three FOMC meetings would soon begin to subdue rampant US inflation, but worrisome data from June’s consumer price index revealed otherwise. Headline CPI jumped by 1.3% in the month of June, and year-over-year the index surged by 9.1%, the fastest pace since November of 1981. Stripping out food and energy costs, the core consumer index jumped by 0.7% last month, and year-over-year climbed by 5.9%.

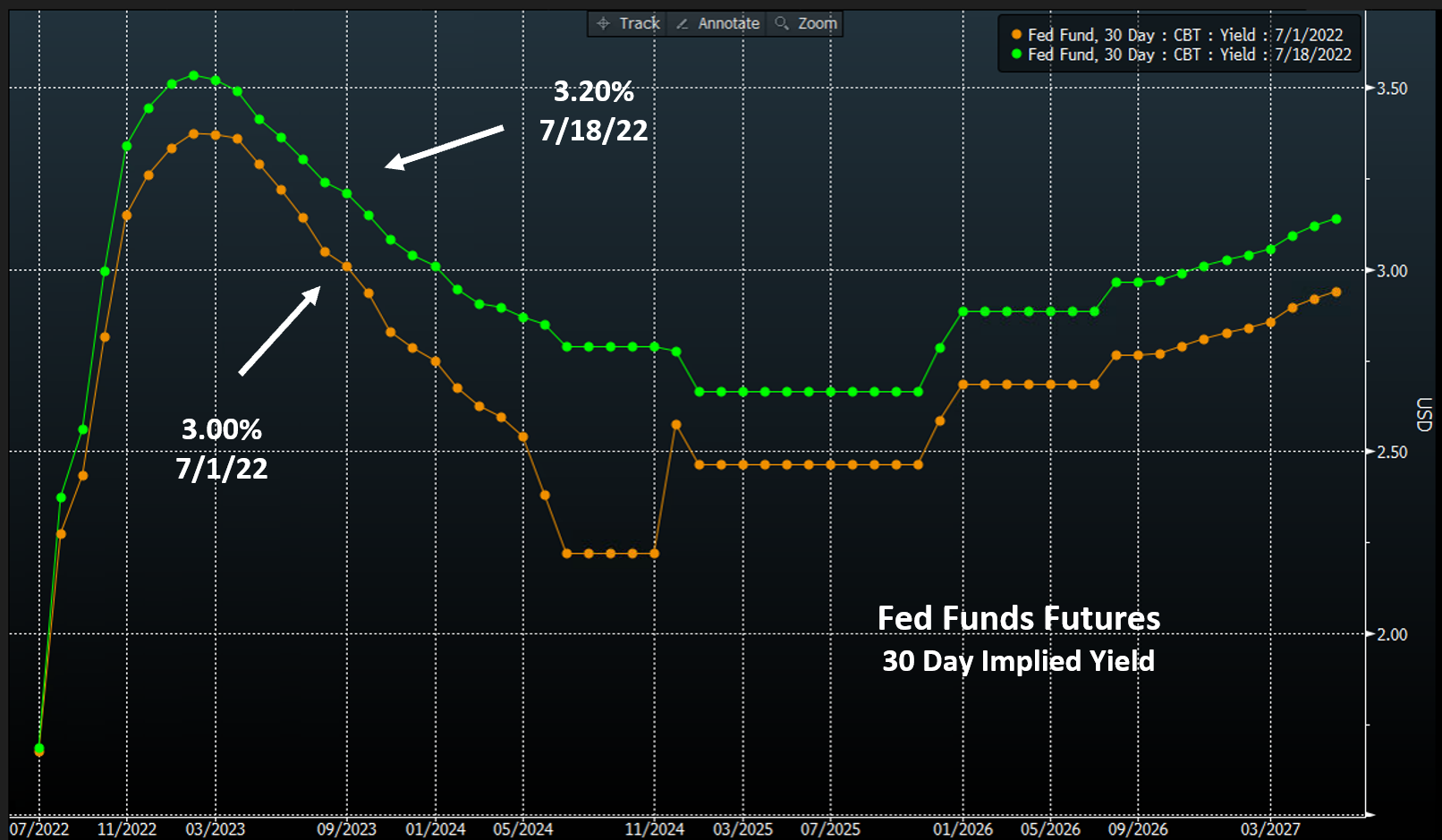

FOMC Meeting on July 26-27 and Fed Funds Futures Contracts

June’s stubbornly high consumer inflation reading prompted some speculation that the Fed may raise rates by a full percentage point at next week’s meeting and this in turn led to a sharp selloff in risk assets. However, in the days that followed the CPI release, Fed officials walked the market back to an expectation for a “smaller” July hike. Fed funds futures are currently pricing in a 100% probability of at least a 75 basis point hike next week with only minimal (20%) odds for a 100 basis point increase. Looking further down the road, the markets expect a total of 1.25% of hikes over the final three FOMC meetings in 2022, and a terminal fed funds rate between 3.50% and 3.75% by February of 2023.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.