January Mid-Month Portfolio Update

Labor Market Steady with Signs of Slowing

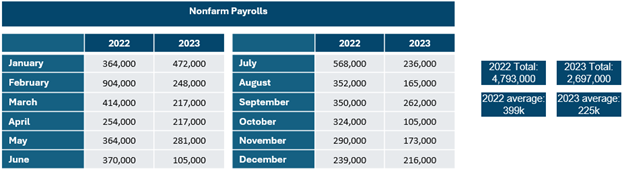

The December employment report was mixed: although non-farm payrolls came in higher than expectations at 216,000, there were 845,000 people who left the labor force, the largest drop in the labor force participation rate since January 2021. For 2023, there were a total of 2.697 million jobs created vs. the 4.793 million created in 2022. The 3-month moving average was 165,000 in the 4th quarter of 2023 vs. a 245,000 average in the first 9 months of 2023. Separately, the ISM Services report also showed some signs of slowing with the employment component dropping to its lowest level since the pandemic (to 43.3 from 50.7). While the pace of job growth has been slowing, this is a welcome sign for the Fed as it supports the soft-landing narrative.

Source: Bloomberg

Push Back For March Rate Cut

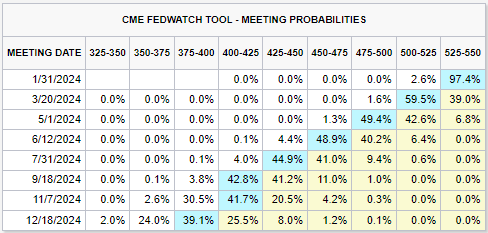

Fed members have continued their push back against the aggressive rate cuts that the Fed Funds futures market are currently signaling – 25 basis point rate cuts at every meeting starting in March through November.

- – Cleveland Fed President Loretta Mester said “I think March is probably too early in my estimate for a rate decline because I think we need to see more evidence.”

- New York Fed President John Williams said current rates are restrictive enough to reach the 2% inflation target and “I expect that we will need to maintain a restrictive stance of policy for some time.”

- – Richmond Fed President Thomas Barkin said the economy is on its way to a soft landing and that despite progress toward their inflation goal, he noted “the potential for additional rate hikes remains on the table.”

- – Atlanta Fed President Bostic repeated his expectations for two rate cuts in 2024 and told reporters he expects the first cut in the third quarter.

We should get more clarity at the January FOMC meeting – likely with either the Fed adjusting their view and hint to a March rate cut or with the market adjusting and pushing out the timing of the first rate cut.

Source: CME Group

Inflation Readings Mixed But Trending Lower

Last week, we received mixed inflationary readings but overall, these readings are unlikely to change the Fed’s message that inflation has eased over the past year but remains elevated.

- – CPI in December rose higher than expectations at +0.3% vs. expectations of a +0.2% increase while Core CPI came in line with expectations at +0.3%. Year-over-year headline CPI rose to 3.4% from 3.1%, while the core rate declined from 4% to 3.9%. Shelter costs continue to account for over half of the overall increase in the cost of living. Energy prices climbed, with both electricity and gasoline on the rise which contributed to the higher headline reading.

- – PPI for December came in lower than expectations with the headline declining -0.1% while Core PPI came in flat. This is the third consecutive negative monthly reading for headline PPI, the longest streak since 2020. Both headline and core PPI are now both below 2% at 1% and 1.8%, respectively.

- – The November reading for PCE, which is the Fed’s preferred inflation gauge, had the first negative headline print since 2020 at -0.1%. In fact, on a 6-month annualized basis, Core PCE rose 1.9%, the first time in more than 3 years that this measure is below the Fed’s target. Year-over-year PCE is at 2.6% while Core PCE is at 3.2%.

Looking ahead, market forecasts expect CPI and PCE to show a steady decline through 2024, ending the year very close to the Fed’s 2% target. Inflation continues to moderate but it appears that price normalization is likely going to be a prolonged journey.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.