July 2025 Mid-Month Market Update

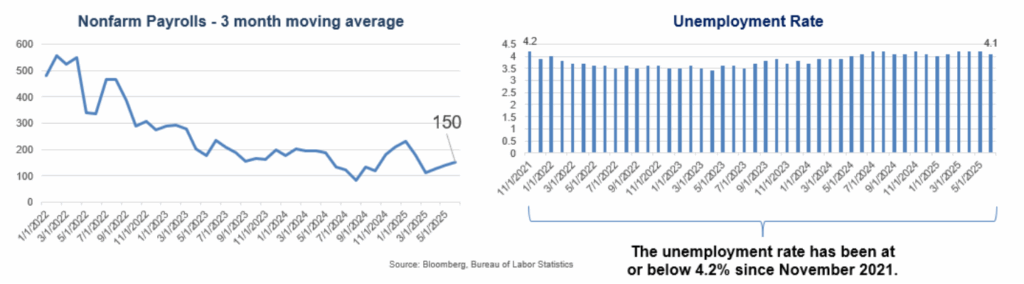

The Labor Market is Holding Up

For the fourth consecutive month, nonfarm payrolls exceeded expectations with June adding 147,000 jobs versus the projected 106,000. The trend of job growth remains solid and strong with average gains of 150,000 over the past 3 months, 130,000 over the past 6 months, and 151,000 over the past year. Notably, one of the largest contributors to job growth in June was the government sector, which added 73,000 jobs.

The unemployment rate (based on a separate household survey) declined to 4.1% in June, however, this drop was driven by a decrease in the labor force participation rate. Of particular concern, the number of discouraged workers (those who believe no jobs are available for them) increased by 256,000, reaching the highest level since December 2020. Additionally, the size of the immigrant workforce continued to contract, falling by 1.1 million to 32.6 million foreign-born workers. This marks the third consecutive monthly decline in this sector, and the trend may reflect both a slowdown in border crossings and stepped-up immigration enforcement actions under the Trump administration.

Outside of the June employment report, there was encouraging news on the layoff front, as weekly initial jobless claims declined for the fourth straight week, falling to 227,000, the lowest level in two months.

Source: Bloomberg, Bureau of Labor Statistics

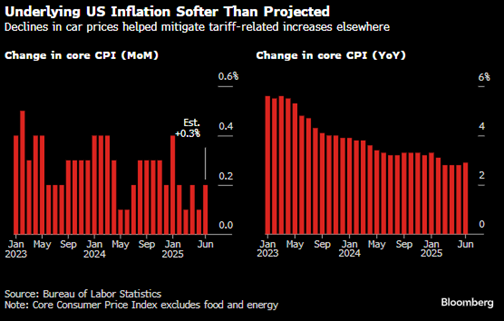

Early Signs of Tariff Impact in June Consumer Prices

At first glance, the June Consumer Price Index (CPI) report suggests tame inflation, but a deeper look reveals emerging pricing pressures. Core CPI came in below expectations for the fifth straight month, rising just +0.2%, while headline CPI increased by +0.3%, its highest reading since January. Year-over-year, CPI rose for the third consecutive month, reaching +2.7%, while Core CPI edged up to +2.9%. The impact of tariffs was evident in several categories: household furnishings rose +1.0% in June, the largest increase since January 2022, and toy prices jumped +1.8%, the biggest gain since April 2021. Excluding autos, core goods prices rose +0.6%, marking the strongest monthly increase since November 2021. With these early signs of underlying tariff-related inflation and continued upward pressure on annual readings, the Fed is likely to maintain its wait-and-see stance for the next few months.

Source: Bureau of Labor Statistics

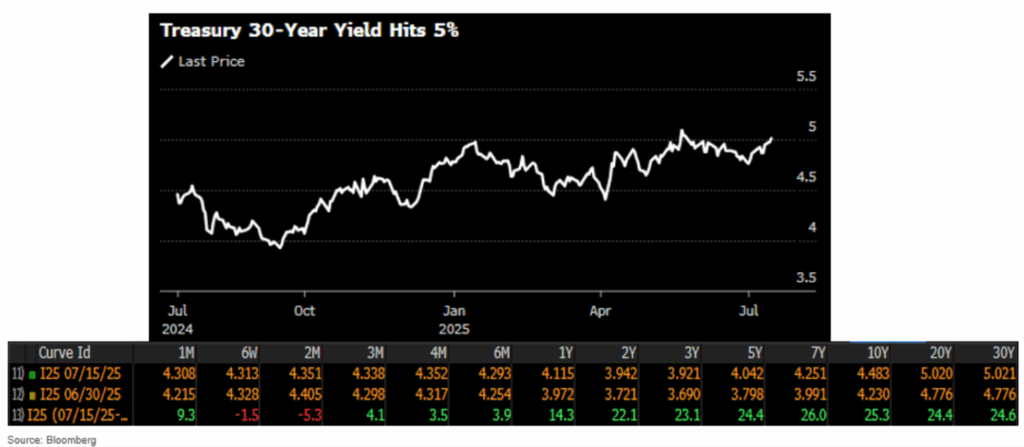

Markets Take Tariff Announcements In Stride

Tariff developments have returned to the headlines this month as the Trump administration announced a series of updates that potentially impact more than two dozen trading partners. The silver lining is that the implementation date was delayed from July 9 to August 1, providing additional time for negotiations before the measures take effect. Equity markets have largely taken the news in stride, with both the S&P 500 and Nasdaq reaching all-time highs in July, and investment grade and high yield credit spreads tightening on the month. However, rising tariff risks have pushed Treasury yields higher across the curve, with the 30-year yield closing on July 15th above 5% for the first time since May.

Source: Bloomberg

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.