June 2025 Month-End Market Update

Stagflation Headlines Close Out Q2

Economic data released at the end of June showed signs of stagflation, which is likely prompting the Fed to maintain its current policy stance in the near term:

- Q1 2025 GDP (final) contracted by 0.5%, with personal consumption contributing to the weakness. The +0.5% consumption reading was the slowest since the onset of the COVID-19 pandemic.

- Continuing jobless claims rose to 1.97 million, the highest level since November 2021, suggesting it’s taking longer for unemployed individuals to find work.

- The Fed’s preferred inflation gauge, Core PCE, came in above expectations at +0.2% in May, with the year-over-year rate rising to 2.7%.

Looking ahead, GDP growth is projected to rebound in the second quarter, with estimates currently at +2.1%. However, inflationary pressures tied to tariffs are anticipated to persist through year-end, with both CPI and Core PCE expected to rise above 3% by December. In the labor market, job creation is forecasted to continue slowing, with monthly gains projected to fall below 100,000. Signs of further softening—such as the unemployment rate exceeding 4.5% or a negative non-farm payroll report—could accelerate the Federal Reserve’s timeline for rate cuts.

Source: Bloomberg

Divergence Grows Within the Fed

At the June FOMC meeting, Fed Chair Powell reaffirmed the Fed’s wait-and-see stance, stating, “For the time being, we are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.” While several Fed officials continued to echo this cautious approach, a few have recently adopted a more dovish tone:

- Fed Governor Waller: “I think we’re in the position that we could do this as early as July,…That would be my view, whether the committee would go along with it or not.”

- Fed Governor Bowman: “Should inflation pressures remain contained, I would support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market.”

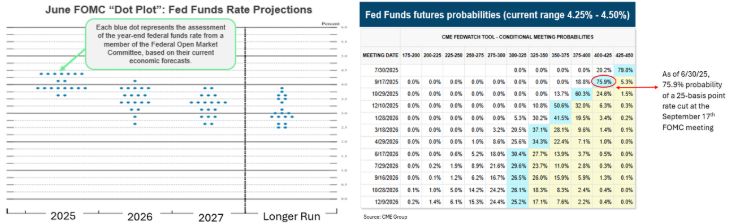

Diverging views among Fed officials were also reflected in the updated Summary of Economic Projections (SEP) released at the June FOMC meeting. While the median forecast for rate cuts in 2025 remained unchanged at 50 basis points, the distribution of individual projections revealed growing division. Seven of the 19 officials now anticipate no cuts this year—up from four in March—while eight project two cuts. Additionally, two members see just one cut, and another two expect three cuts in 2025.

Source: Federal Reserve and CME Group As of 6/25/2025

Markets Rally Across the Board in June

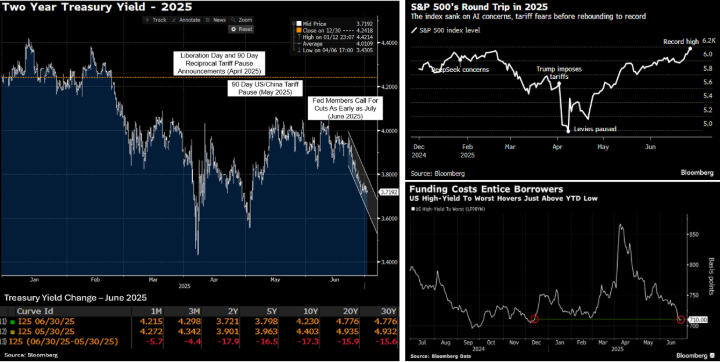

Despite ongoing geopolitical tensions and trade war uncertainty, there has been progress on both fronts. A ceasefire between Iran and Israel, along with an agreement between the U.S. and China on a trade framework, helped to boost market sentiment. Equity indexes rallied, while investment-grade and high-yield corporate bond spreads tightened in June. Treasuries also gained, with yields declining as some Fed officials signaled openness to earlier-than-expected rate cuts (see Divergence Grows Within the Fed above). Additionally, speculation that Trump could announce a successor to Chair Powell—well ahead of his term ending in May 2026—added to market dynamics. While a “shadow chair” would hold no formal influence over FOMC decisions, such a move could undermine Fed messaging and heighten market volatility.

Here are some key market highlights from June:

- Stocks: The S&P 500 and Nasdaq both ended June at record highs. The S&P posted its strongest quarterly gain since 2023, rising 10.9% in Q2.

- Credit: High yield spreads, as measured by the Bloomberg High Yield Index, tightened by more than 22 basis points, with yields approaching year-to-date lows (see chart below). Investment grade spreads also narrowed, including those on short-dated (0–3 year) indexes.

- Treasuries: Yields rallied across the curve, with the 2-year yield declining 18 basis points to close June at 3.721%. Year-to-date, the 2-year yield has dropped over 52 basis points.

- Oil: WTI crude rose 7.1% in June, while Brent crude gained 5.8%. The quarter was marked by volatility, with prices initially plunging after Liberation Day before rebounding sharply following Israeli strikes on Iran.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.