June Mid-Month Portfolio Update

Labor Market Data is Mixed

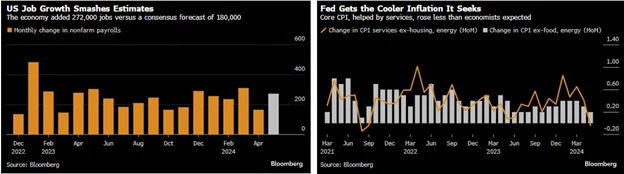

- May Nonfarm Payrolls rose 272,000, higher than the 180,000 expected, with most of the gains coming from 3 categories: health and education, leisure and hospitality, and government.

- The unemployment rate rose to 4%. The unemployment rate has now been at or below 4% for 30 consecutive months, the longest streak since the 1960s.

- Average hourly earnings climbed +0.4%, indicating wage induced inflation pressures remain.

- Weekly initial jobless claims for the week of June 8th spiked to 242,000, the highest reading since last August. The 4-week moving average increased to 227,000, the highest level since last September.

2024 Inflation Data May Finally be Moderating

- In a welcome sign, the May Consumer Price Index (CPI) came in flat versus expectations of +0.1%. The reading marked the first time in almost two years that the index did not climb.

- Core-CPI rose +0.2% and +0.163% on an un-rounded basis which was the lowest monthly Core-CPI gain since August 2021.

- Supercore CPI, which excludes food, energy, other goods, and housing rents, was unchanged, the lowest reading since September 2021. Supercore services fell -0.04%, the first negative reading over the same timeframe.

- The Producer Price Index (PPI) declined in May by -0.2%, the largest decline in 7 months.

- With both CPI and PPI moderating, estimates are pointing towards a soft May Core Personal Consumption Expenditures (PCE) reading (the Fed’s preferred inflation gauge).

Economic Data Leads to Ongoing Rate Volatility

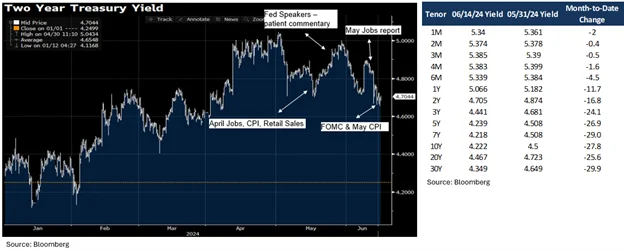

The first half of June brought a fresh roller coaster ride of volatile yields. The 2-year note is one of the tenors most impacted by future monetary policy, and June began with the 2-year yield declining on disappointing data releases: ISM Manufacturing, JOLTs Job Openings and ADP.

- Friday June 7th: The 2-year note yield rose 16 basis points to 4.88% on the heels of a solid employment report.

- Wednesday June 12th: First up was a soft CPI release, driving the 2-year yield down 16 basis points back to 4.66%. Later that day, the Fed’s hawkish tone, expressed through a reduction in the FOMC’s rate cut expectations in 2024 from 3 to 1 led the 2-year yield to rise 8 basis points.

- Overall, the 2-year yield has rallied this month by 16 basis points from 4.87% to 4.71%.

- With a data-dependent Fed, expect continued rate volatility following upcoming economic releases.

- Separately, political uncertainty in France led to a flight-to-quality bid, contributing to some of the recent declines in yields.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.