March FOMC Update

Stable Guidance Amid Inflation’s Bumpy Road

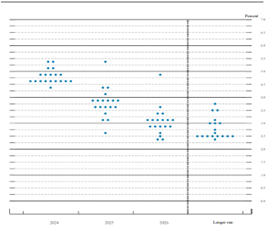

Yesterday, the Federal Reserve left the Fed Funds Target Range unchanged at 5.25% – 5.50%. The Committee’s statement was largely unchanged from January, noting solid economic expansion, strong job gains, and low unemployment. The Fed published their updated Summary of Economic (SEP), which did not significantly change, except for projected real GDP in 2024, which was revised to 2.1% from 1.4%. Projected Core PCE inflation was revised slightly upward to 2.6% in 2024 from 2.4%, but both headline and core PCE inflation projections were virtually the same. Regarding the projected Fed Funds Rate, the median estimate for year-end 2024 was unchanged at 4.6%, although the dot plot showed upward movement in projections that were centered at or above the median estimate. FOMC participants also expect one less cut in 2025 compared to the December projection. During the press conference, Powell noted that it would be appropriate to slow the pace of the Fed’s balance sheet runoff “fairly soon” to avoid undue stress in money markets, but the decision to do so would be independent of their decision to begin lowering the Fed Funds Target Range.

Overall, the FOMC’s expectations for inflation and the labor market appear to be largely unchanged from the previous two meetings. Recent data suggests greater balance in the labor market with slowing wage growth and a slight uptick in unemployment. PCE inflation has slowed to 2.6% year-over-year as of February-24, although CPI has been slightly more stubborn due to persistently strong housing inflation. The upward revision to growth without other major changes suggests economic conditions are evolving largely as expected by the Committee, though they will continue to rely on the totality of data before cutting rates.

Takeaways for Cash Investors

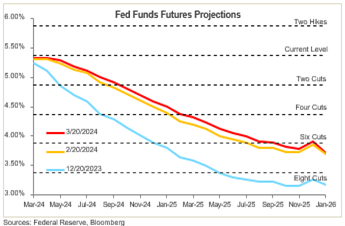

Fed- While the Fed Funds Rate implied by markets at year-end 2024 has moved slightly lower, the Futures market is broadly in line with the Fed’s projection for three cuts through December 2024. Markets are implying that the first cut will occur in June and that cuts will proceed from there at every other meeting. The probability of a cut in June is now 69%, compared to 57% on Tuesday, and a May cut remains unlikely.

Rates- Although the Fed projected one less cut in 2025, yields sold off the most between the 2- and 5-year Treasuries with smaller moves on the front- and back-end. Following yesterday’s meeting, both the 2-year and 3-year Treasury yields fell 0.08% to 4.60% and 4.39% respectively, and the yield on 5-year Treasury bonds fell 0.05% to 4.24%.

Credit- The FOMC’s projections and Powell’s comments were largely credit positive. Upward growth revisions without changes in the median Fed Funds rate this year reflect the Fed’s optimism in a “goldilocks” scenario where growth moderates from 2023, but without a surge in inflation or unemployment. Moreover, a reduction in the Fed’s balance sheet runoff may increase liquidity in financial markets. Nonetheless, the Fed will rely on the totality of economic data, and unexpected changes in inflation or unemployment may alter the Fed’s trajectory.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.