November Mid-Month Portfolio Update

Potential for a Fed Santa Pause

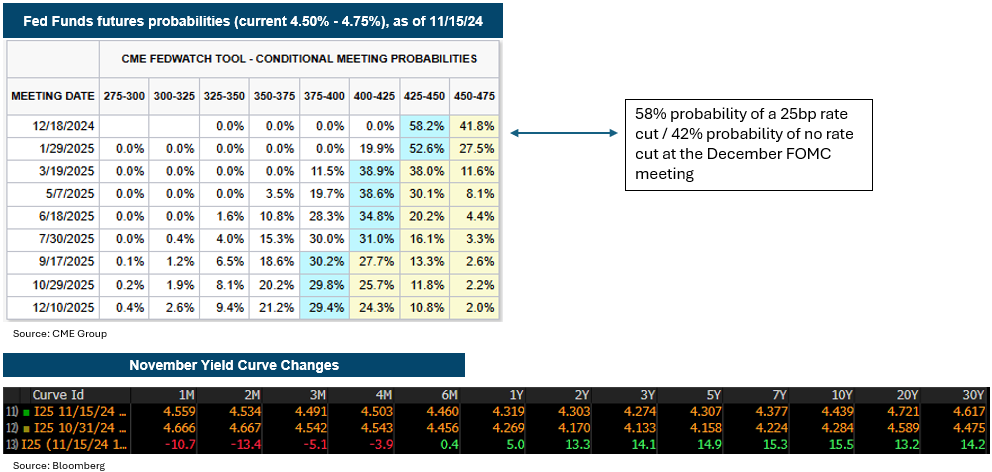

The Fed followed up their September 50 basis point rate cut with a unanimous 25 basis point cut on November 7th, bringing the federal funds target range to 4.50%-4.75%. With one remaining FOMC meeting this year on December 18th, the market has been flip-flopping between the potential for another 25 basis point cut or a pause in December.

As of 11/15/2024, the market is pricing only about a 50/50 probability of a cut in December (actually 58%/42%) primarily due to solid economic data and stickier inflation along with an expectation the Trump administration will pursue tariffs and tax cuts policies, pushing up inflation. Recent Fed speeches have supported this narrative:

- Fed Chair Powell: “The economy is not sending any signals that we need to be in a hurry to lower rates,”

- Boston Fed President Collins: “Another rate cut in December is “certainly on the table, but it’s not a done deal,”

Looking ahead to 2025, the market continues to price in fewer rate cuts for next year. Although a Santa Pause is still up for debate, one thing is clear: the Fed is expected to cut rates very slowly in 2025. Even though Fed Chair Powell said the presidential election outcome would not affect FOMC decisions in the near term, the market is signaling that it could lead to less easing in 2025, with just two 25 basis point rate cuts priced in next year (March and September).

This is also being reflected in the yield curve, with front-end yields pricing in additional rate cuts. 1-and 2-month T-bills saw yields decline 10 & 13 basis points, respectively, while the 2-year yield has risen 13 basis points this month

A November to Remember for The Markets

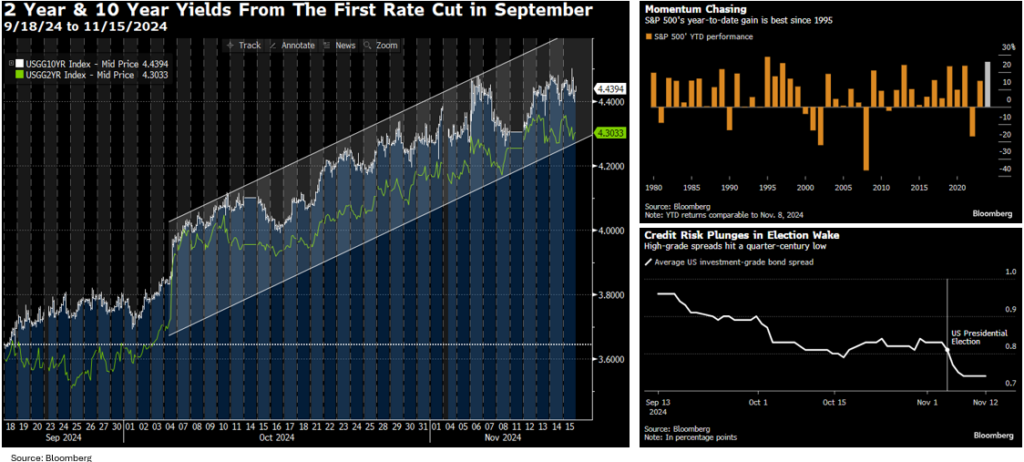

Although we are only halfway through November, so far it has been a rollercoaster ride. Prior to the election, part of the recent increase in yields was attributed to the market pricing in a Donald Trump victory over Kamala Harris and the possibility of a red sweep with a Republican majority in Congress. Now with the election over and a Republican controlled Congress confirmed, the focus is on a Trump administration that will be focused on tariffs, tax cuts, and deregulation – and with it, the market is factoring in higher growth and inflation expectations.

Although the 10-year Treasury yield spiked 20 basis points the day after the election, we saw larger moves going back to the Fed’s first rate cut on September 18th, with the yield on the 2-year Treasury rising 68 basis points to 4.303% through the middle of November while the 10-year yield spiked 73 basis points to 4.439% (see chart below). Away from Treasuries, here are some of the notable moves so far this month:

- The S&P 500 closed over 6,000 for the first time ever on potential cuts to the corporate tax rate along with the likelihood of deregulation.

- Investment grade spreads tightened to levels not seen since 1998, high yield spreads were the tightest since 2007, and ABS spreads reached their tightest of the year.

- Bitcoin jumped to a record high of $75,000 right after the election as Trump embraced digital assets during his campaign and recently reached $90,000 with expectations for it to reach $100,000 by year-end.

- Despite Trump advocating a weak dollar, the dollar rose to the strongest level in a year with the anticipation of faster inflation and higher interest rates.

- Emerging market currencies fell the most since February 2023, led by the Mexican peso, on concerns that Trump administration policies will curb emerging market exports and hurt foreign economies.

Mixed Economic Data

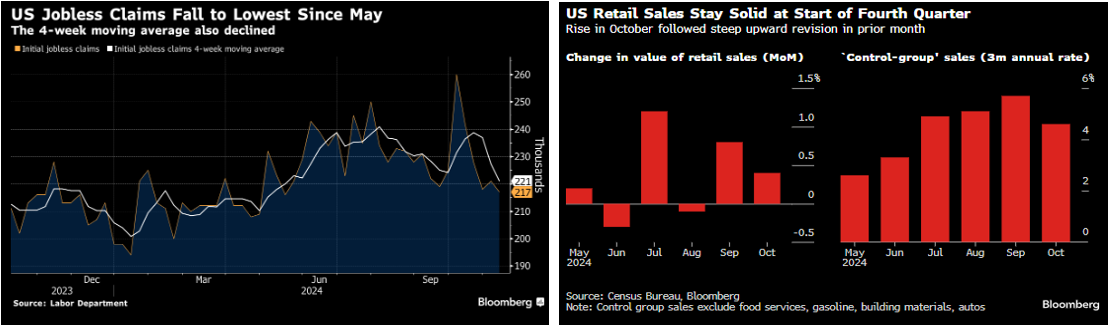

Economic data so far released in November has been mixed, starting with a disappointing employment report which was heavily impacted by hurricanes Helene and Milton as well as the Boeing strike. Here is a summary of the data released through mid-month:

- The October CPI report came in line with expectations with the headline reading rising +0.2% for the 4th consecutive month while Core-CPI rose +0.3% for the third consecutive month. However, for the first time in 6-months, the Core-CPI year-over-year reading rose from 2.4% to 2.6%. For the Fed, there was some good news via the supercore-CPI which rose the least in 3-months at +0.31%.

- Weekly initial jobless claims fell to 217,000 in the latest release, which is the lowest level since May and shows there is still a healthy demand for workers. The 4-week moving average declined 221,000 which is also the lowest level since May.

- The October Retail Sales report was mixed: the headline reading beat expectations, rising +0.4% and the prior months’ readings were all revised upward. The most notable upward revision was within the Control Group (which is a direct feed into GDP), which rose from +0.7% to +1.2%. Although the headline reading for October beat consensus, all other readings came in lower than expected. The October Control Group declined -0.1% vs expectations of an increase of +0.3%.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.