November Mid-Month Portfolio Update

Data Supports a Fed on Hold

At a recent speech, Fed Chair Powell pushed back on the narrative that the Fed is done raising rates. He continues to reiterate the Fed will be reviewing monetary policy decisions “meeting by meeting” and that more data is needed to show inflation is coming down sustainably. Since the meeting, data has shown both lower inflation and softer economic data readings, which supports a Fed that is likely to remain on hold:

- The October employment report showed 150,000 jobs were created, which was below expectations of 180,000, and followed a decrease of 101,000 jobs from the prior two months. In addition, the unemployment rate rose to 3.9%, the highest since January 2022, while the labor force participation rate decreased.

- A positive takeaway from the employment report regarding inflation was that average hourly earnings only rose 0.2%, the slowest pace in 22 months.

- The October CPI report came in at the lowest monthly reading since July 2022 with the year-over-year readings continuing to decline. The Supercore measure – which the Fed closely tracks – had the biggest monthly deceleration since October of last year and on an annual basis, the slowest increase since December 2021.

- ISM Services came in lower than expectations at 51.8 vs. an expected 53 reading, marking the second month in a row of decelerating growth.

- Headline Retail Sales posted the first negative print in seven months with seven of the 13 categories declining, confirming the slowdown that had been expected. However, overall readings were better than expectations and prior months were revised higher, suggesting some resiliency heading into the holiday season.

- West Texas Intermediate (WTI) oil has posted three weekly declines and is down over 17% from the 2023 highs reached in September.

- Continuing jobless claims rose to the highest level in almost two years, jumping to 1.87 million, which is the eighth straight week of increases.

Moody’s Changes Outlook on United States

On November 10th, credit rating agency Moody’s changed its United States outlook to negative from stable, saying the downside risks to the country’s fiscal strength have increased. Moody’s remains the only rating agency that still assigns the United States with a AAA rating, following a downgrade from Fitch Ratings on August 3, 2023. Moody’s said “without effective fiscal policy measures to reduce government spending or increase revenues, Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.” Both Fitch and S&P have the United States rating at AA+ with a stable outlook.

Government Shutdown Averted

The Senate approved the temporary funding measure that the House passed earlier in the week, just ahead of the November 17th deadline. The bill funds some parts of the government through January 19th and others through February 2nd, setting up the possibility of yet another shutdown in early 2024. President Biden signed the bill on Thursday from San Francisco while hosting the Asia-Pacific Economic summit, where he met with Chinese President Xi Jinping and other Asian world leaders.

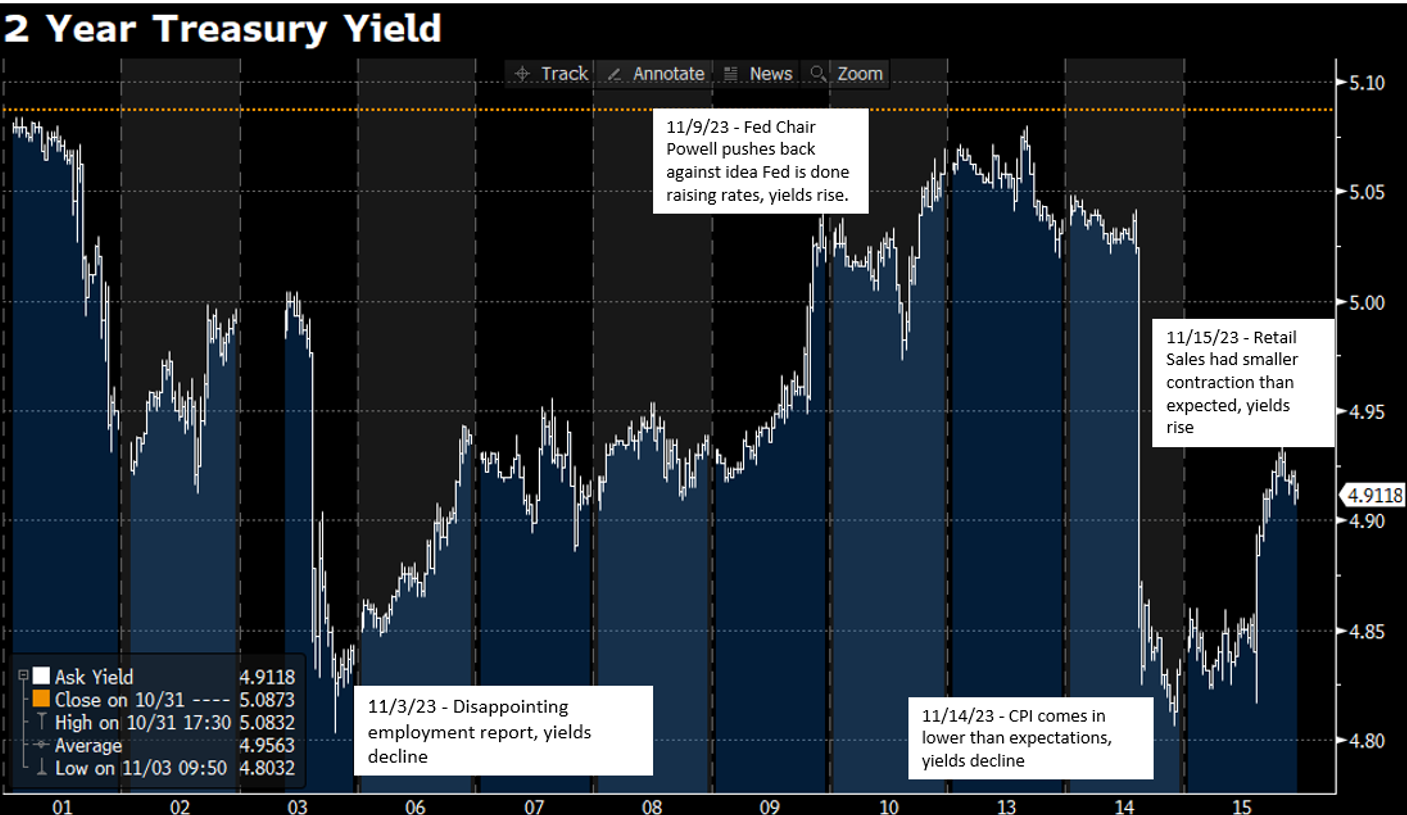

Roller-Coaster Yield Ride

Yields have seen a roller coast ride in November, highlighted below with the 2-year Treasury yield. We saw the 2-year yield rally around 24 basis points to 4.84% after the disappointing employment report. After Fed Chair Powell’s speech on November 9th in which he pushed back against the narrative that the Fed is done raising rates, the 2-year yield rose back above 5%. After the CPI report, the yield rallied 20 basis points to fall back below 5% to 4.84%. Although the retail sales report contracted in October, it was less of a contraction than expected. Additionally, the New York Fed’s Empire State manufacturing survey hit a seven-month high of 9.1 vs. -3.0 expected, which saw yields rise on the day. With short-term Treasury yields driven largely by the Fed’s overnight rate policy, the potential for continued yield volatility remains as markets react to incoming inflation data in the months ahead.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.