Worried About Declining Yields?

Laddered SMA Portfolios vs. MMFs and Deposits in a Rate-Cutting Environment

The Federal Reserve recently cut overnight interest rates at its September meeting – now what? As an institutional cash investor, you might feel like a kid watching the ice cream truck pulling away. But there may be a way to help keep yields from melting away: a separately managed account (SMA) built on fixed-income securities and laddered maturities. Compared to the old standbys of money market funds (MMFs) and bank deposits, a laddered SMA may help preserve income for a period of time by locking in current yields and thereby reducing the whiplash from policy moves. Our goal in publishing this report is to highlight how institutional cash management strategies that include fixed-income laddering may be beneficial when seeking higher yield and stability after Fed rate cuts.

Don’t Have Time to Read the Whole Article? Here Are Our 3 Key Takeaways:

- Evaluate short-term cash strategies: What worked yesterday, such as parking cash in money market funds (MMFs) and bank deposits during an inverted curve, may not work tomorrow. When the Fed cuts rates, those yields may reset downward quickly.

- Consider separately managed accounts (SMAs): Laddering high-quality fixed income securities out on the curve may provide the opportunity to lock in today’s yields for a period of time, help support more stable income, and potentially offer higher returns than MMFs and deposits, especially if cuts accelerate.

- Act while the Fed is easing: With the Fed back in easing mode, now may be the window to consider moving a portion of liquid balances up the yield curve.

Background: The “Overnight Trade” Worked – Until It Didn’t

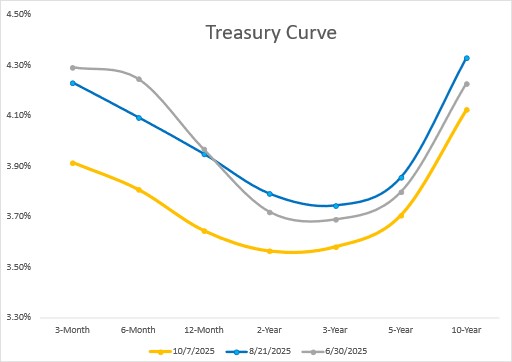

For context, let’s rewind. Over the past few years, an inverted yield curve – where short-term rates outpace long-term rates – tempted some institutional investors to park cash in MMFs or bank money market deposit accounts (MMDAs). While these instruments may be attractive due to their convenience, daily liquidity, and principal protection due to underlying government securities or FDIC deposit guarantees up to $250,000, they typically offer yields more closely tied to the federal funds rate (FFR), often surpassing individual securities like commercial paper (CP) or corporate bonds with maturities beyond overnight.

MMF and MMDA yields tend to dance to the Fed’s tune, set by the FOMC to balance inflation and employment goals. But longer-maturity fixed income securities? They may be less beholden to these whims and may be more influenced by market expectations and economic data. After the 2024 rate cuts and subsequent pause at 4.25%-4.50%, some managers extended maturities to shield against future declines, while others preferred the status quo.

Source: Bloomberg

But there’s a catch: MMFs and bank deposits are tethered to the federal funds rate. Typically, when the Fed cuts the FFR, other short rates quickly reset. In contrast, longer-maturity securities tend to reset more slowly — their coupons remain fixed until maturity. This difference is where a laddered SMA strategy may offer advantages.

What Changed: The Fed’s September Rate Decision, and Market Reset

On September 17, 2025, the Fed cut the FFR by 25 basis points (bps), lowering it to a 4.00%-4.25% target range. This marks the restart of easing after a nine-month pause, following an initial 100 bps reduction that began in September 2024. Fed Chair Jerome Powell called it a “risk management cut,” signaling caution amid a resilient economy but hinting at more to come – possibly two additional 25 bps cuts by the end of 2025, plus one each in 2026 and 2027.

Historically, once the Fed begins easing, it typically doesn’t hit the brakes until reaching a “terminal” rate – currently estimated at 2.6-3.9%. Yields on MMFs and MMDAs, which are pegged to the FFR, tend to adjust downward accordingly (minus fees or spreads). Investors who did not venture up the curve risk seeing their returns erode as the curve shifts downward – but there may still be an opportunity to act before yields reset more fully.

Historically, here is what typically happens when the Fed cuts rates:

- Front-end yields (MMDAs, repo, and MMFs) fall first and fastest.

- Intermediate front-end paper (6–24 months) starts to price in the new path in response to the Fed’s action more gradually, but the drop in yield is more moderate.

- Credit spreads on top-tier short credit instruments (e.g., A-1/P-1 CP) may add incremental income, even as the base rate still drifts lower.

A Quick Word on Politics and Policy Risk

Here is where politics enters the picture – and potentially turbocharges those rate cuts. The Fed governor nomination process has grown increasingly politicized, with President Trump’s ongoing court battle against Fed Governor Lisa Cook raising eyebrows. Although an appeals court has temporarily blocked efforts to remove Cook, if the administration prevails, it could lead to a more “dovish” stance where the Federal Reserve Board may be more willing to slash rates faster to align with administration goals. This uncertainty may heighten the risk of rapid FFR declines, making strategies that lock in yields even more appealing. In today’s unpredictable political environment, locking in longer-term yields for a period of time may be a strategic advantage – not a bug – for cash investors.

Why an SMA May Be Beneficial Now: Five Key Reasons

Despite the lengthier set up process associated with SMAs, which typically involves adopting an investment policy and engaging an account manager, they may provide the following potential benefits compared to MMFs and deposits:

- Lock it in while you can. MMF and deposit yields typically decline as soon as the FFR moves lower. Purchasing high-quality bonds and notes today may help to lock in those coupons for their full term, supporting the preservation of a portfolio’s yield potential for longer.

- Deposits generally pay less than market rates. Bank deposit yields are generally based on balance-sheet needs and loan demand, not strictly off of market yields. Historically, deposit rates tend to lag on the way up but can adjust downward quickly when cuts begin.

- MMF reforms cap yield potential. Recent SEC reforms increased daily and weekly liquidity requirements, shortened portfolio weighted average maturities (WAMs), and introduced liquidity fees for institutional prime/tax-exempt funds. These shifts pushed many institutional investors towards government funds, resulting oftentimes in more liquidity but less credit spread, lower WAMs, and in many cases lower yield potential than a customized SMA that can have longer WAMs and hold credit instruments.

- Budget stability matters. Even in a comparable yield situation over an investment horizon, a laddered portfolio may offer steadier and more predictable income potential than MMFs or deposits, which tend to drop in step with each Fed cut – an advantage for budgetary spending.

- If cuts accelerate, SMAs have the potential to shine. In a faster-easing scenario, MMF and deposit yields may drop quickly. A prudently laddered SMA may help preserve higher coupons over the next 12–24 months while maintaining staggered liquidity.

An Illustration: Crunching the Numbers with Five Simple Investment Scenarios

For illustrative purposes only. Not a recommendation. The following scenarios are intended solely as an indication of potential yields. Unless noted, yields presented are not reflective of any fees or expenses, and therefore are not representative of actual results under a managed account or if purchased directly.

To illustrate the point, let’s look at a two-year horizon across five strategies under two scenarios:

Scenario 1: Market consensus: Two additional rate cuts in 2025 and three in 2026.

Scenario 2: Accelerated cuts: Two cuts 2025 and eight across 2026-2027.

Expected Two-year Horizon Returns (excess returns vs. MMF are in parentheses)[1]

| Strategy | Description | Consensus 2-Year Yield | Excess Over MMF | Accelerated Cuts 2-Year Yield | Excess Over MMF |

| A. Government MMF | Yield = FFR – 15 bps fees | 3.14% | – | 2.31% | – |

| B. Rolling 6-month T-bills | Reinvest every 6 months | 3.37% | +0.23% | 2.87% | +0.56% |

| C. Single 2-year T-note | Buy and hold | 3.56% | +0.42% | 3.56% | +1.25% |

| D. Rolling 3-month CPs | Reinvest every 3 months | 3.49% | +0.35% | 2.77% | +0.46% |

| E. Rolling 6-month CPs | Reinvest every 6 months | 3.53% | +0.39% | 3.03% | +0.72% |

In the consensus scenario, laddered or longer-term options (scenarios B to E) outperform MMFs by 23-42 bps. Under the accelerated cuts scenario – the political wildcard – the gap widens dramatically, with the 2-year note beating the MMF scenario by 125 bps. Even short-term rolling instruments (3/6-month CP or T-bills) outpace MMFs in this example, especially if cuts accelerate. This illustrates the potential reset penalty, or the opportunity cost of doing nothing, of MMFs and deposits at work.

Additionally, a laddered SMA strategy that blends short-maturity paper may be able to capture some of the 2-year note’s stability while helping to preserve ongoing liquidity as securities mature and are reinvested. This case study underscores how extending maturities may help preserve yield for a period of time when rates fall.

Potential Advantages of SMAs Over “Pooled” Short Vehicles

We wrote about some of the potential advantages of SMAs over pooled cash in our whitepaper Six Advantages of Separately Managed Accounts. Here is a quick recap.

- Customization: MMFs are managed to satisfy the investment objectives of a broad shareholder base and tight regulatory liquidity/tenor constraints which may provide investors with daily liquidity. SMAs, however, may offer investors more control over the duration, sectors, and liquidity of their portfolios to reflect their business profile, risk tolerance and cash-flow needs.

- Transparency: An SMA’s safety profile maturity, and individual credit exposures are typically more visible to the investor, which may be important to a firm’s auditors and boards. MMF portfolio disclosures may be less frequent with fewer details.

- Yield and stability: Longer WAMs and credit exposures than MMFs may result in higher and potentially steadier income in a declining rate cycle.

Consider Laddering Your Portfolio to Help Enhance Stability

In a falling-rate cycle, it may not be prudent to let cash sit in MMFs or deposits while yields compress. A laddered SMA may allow cash investors to lock in more of today’s yield, help produce a more stable future earnings stream, and maintain appropriate liquidity without playing the “what-did-the-Fed-do-today” game every six weeks.

It may be wise to consider reallocating a portion of liquid balances from MMFs and deposits into a laddered SMA of high-quality fixed income securities spread across the yield curve. Investors may want to consider maintaining an average maturity of one year or longer, while shortening WAM as the Fed approaches the “terminal” target rate.

[1] All yield information sourced from publicly available Bloomberg data as of October 9, 2025. Additional information regarding yield information is available upon request. A. A generic Government MMF, represented by the effective fed funds rate in the futures market minus a management fee of 15 bps as a proxy. B. A 6-month T-bill, reinvested in a new 6-month T-bill at each maturity date using indicated forward rates derived from the current Treasury yield curve. C. A bullet 2-year U.S. Treasury note (buy-and-hold). D. A 3-month A-1/P-1 rated CP note, reinvested at future 3-month rates derived from the SOFR futures curve. E. A 6-month A-1/P-1 rated CP note, reinvested at future 6-month rates derived from the SOFR futures curve.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.