April 2025 Month-End Market Update

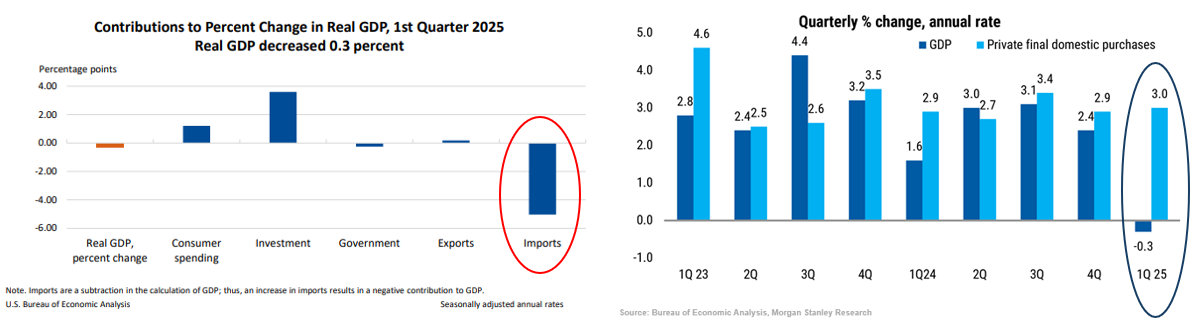

Decent Underlying GDP Data Despite A Negative Headline

Q1 2025 GDP contracted for the first time since 2022 on a pre-tariff import surge of 41.3%, the 2nd largest quarterly jump in the past 50 years. Since these goods and services are not produced here in the United States, they are subtracted from the GDP calculation, contributing to a decline of nearly 5% to GDP in Q1, though imports were largely offset by other factors. Due to the distortion that imports have on GDP, economists prefer to look at a subset of GDP called private final domestic purchases which is sometimes referred to as Core-GDP. This measure increased 3%, very similar to the 2.9% increase seen in Q4. Personal consumption was strong, rising 1.8%, similar to Q1 2024’s reading of 1.9%, and in line with the March retail sales report, which rose 1.4%, the largest increase in more than two years.

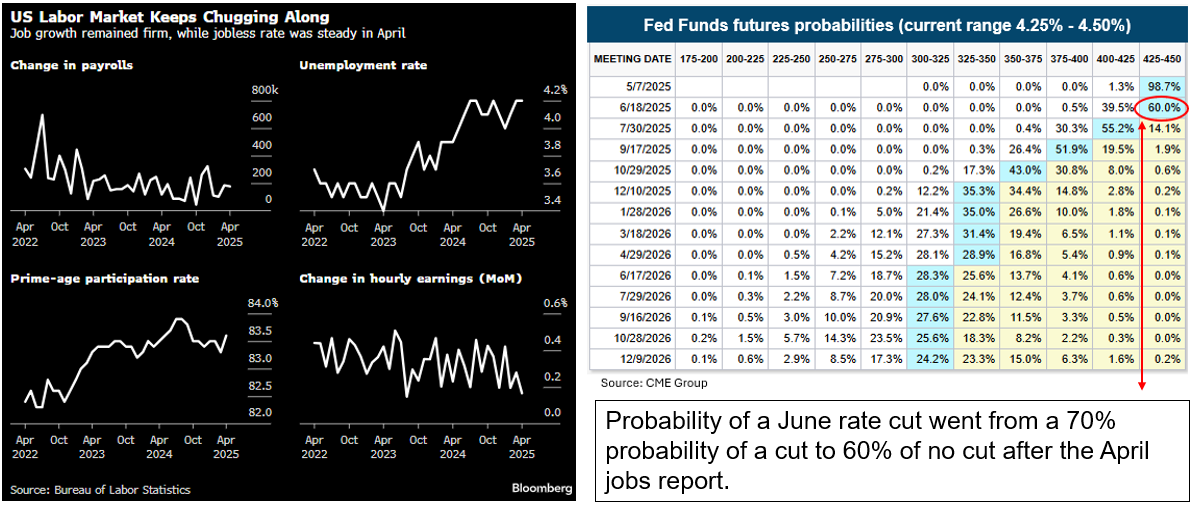

April Employment Report – No Tariff Impact Yet

The April labor market report was very solid overall, but most economists will be looking through this report as it does not yet incorporate the full impact of tariffs. This report will not alter anything for next week’s FOMC meeting, and the Fed is expected to remain on hold until there is clear and convincing data that indicates “a significant drop in the labor market”, according to Fed Governor Waller. After today’s report, the federal funds futures market has pushed out the probability of the first rate cut to July 2025. Here are the main highlights from the jobs report:

- Nonfarm Payrolls rose 177,000 vs. expectations of 138,000.

- The labor force participation rate rose to 62.6% as 518,000 Americans entered the labor force.

- The unemployment rate remained unchanged at 4.2%, despite new entrants into the labor force. A steady unemployment rate with a rising labor force participation rate indicates job seekers are finding employment relatively quickly.

- Average weekly hours increased, a sign of still-strong labor demand as employers typically reduce hours at the onset of a contraction. This will be something to monitor in the months ahead.

- Average hourly earnings came in lower than expected at +0.2%, which should place downward pressure on inflation.

- There were some DOGE effects as federal government jobs declined by 9,000 and are now down by 26,000 since January.

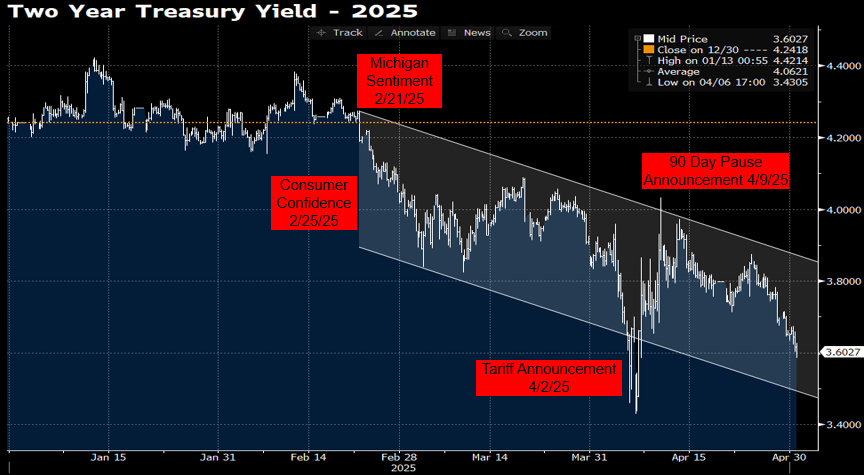

April Volatility Improved Heading into Month-End

If you were on a deserted island for the month of April and saw that the S&P 500 ended the month down 0.68%, you would have thought that maybe April was a quiet month. However, we all know there was a spike in market volatility following the “reciprocal” tariff announcement on April 2nd. Market sentiment improved after President Trump announced a 90-day pause a few days later and continued to change his tone on tariffs throughout the month. He also backed off comments suggesting that he is interested in removing Fed Chair Powell, saying he had “no intention” of firing Powell. These shifts saw markets improve through month-end with the S&P 500 having its best 6-day advance since March of 2022. Here are some of the highlights:

- 2-Year Treasury yield had an intra-month range of 60 basis points (high of 4.03%/low of 3.43%), ending the month at 3.605%. The 10-year yield had a 73 basis point range (high of 4.59%/low of 3.86%), ending the month at 4.163%.

- The S&P 500 posted its 5th worst 2-day decline since World War II.

- The VIX rose above 50 for the first time since Covid-19 and the global financial crisis.

- Investment grade corporate bond issuance was solid with over $100 billion pricing which was met with solid demand.

- Gold rose over 5% and is up 25% for the year, gold’s best start since 2006.

- The US dollar fell over 4% and has seen the largest 2-month decline (-7.6%) since 2002.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.