May 2025 Mid-Month Market Update

Risk-on Tone In Markets After US/China Tariff Reprieve

On May 12th, the United States and China issued a joint statement announcing a 90 day tariff reprieve. The U.S. reduced its levies from 145% to 30%, while China dropped theirs from 125% to 10%. This was seen as a significant de-escalation between the two countries, creating optimism about a future bilateral trade agreement. The news led to a risk-on tone in markets; here are some of the highlights for the month of May through 5/15/25:

- Equity indexes rallied, with the S&P 500 gaining over 4.5% since the announcement, helping to bring the S&P back into positive territory for the year (+0.60% as of 5/15).

- Credit index spreads rallied in May and are now at pre-Liberation day levels.

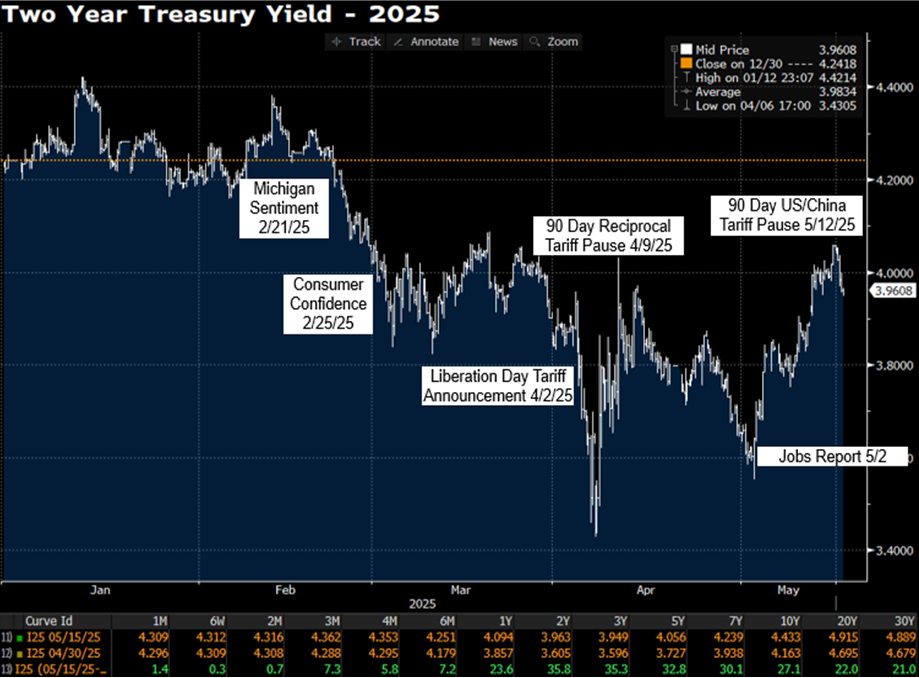

- Treasury yields increased across the curve since the announcement and are up during the month, led by the 2-year yield which has risen 35 basis points to 3.96%.

- Fed fund futures moved to price in significantly fewer rate cuts. Just last week they were predicting approximately 100 basis points of cuts in 2025, but are now only pricing in 50 basis points of cuts as of 5/15/25. The futures market has also pushed the timing of the first rate cut from June to September/October.

Source: Bloomberg

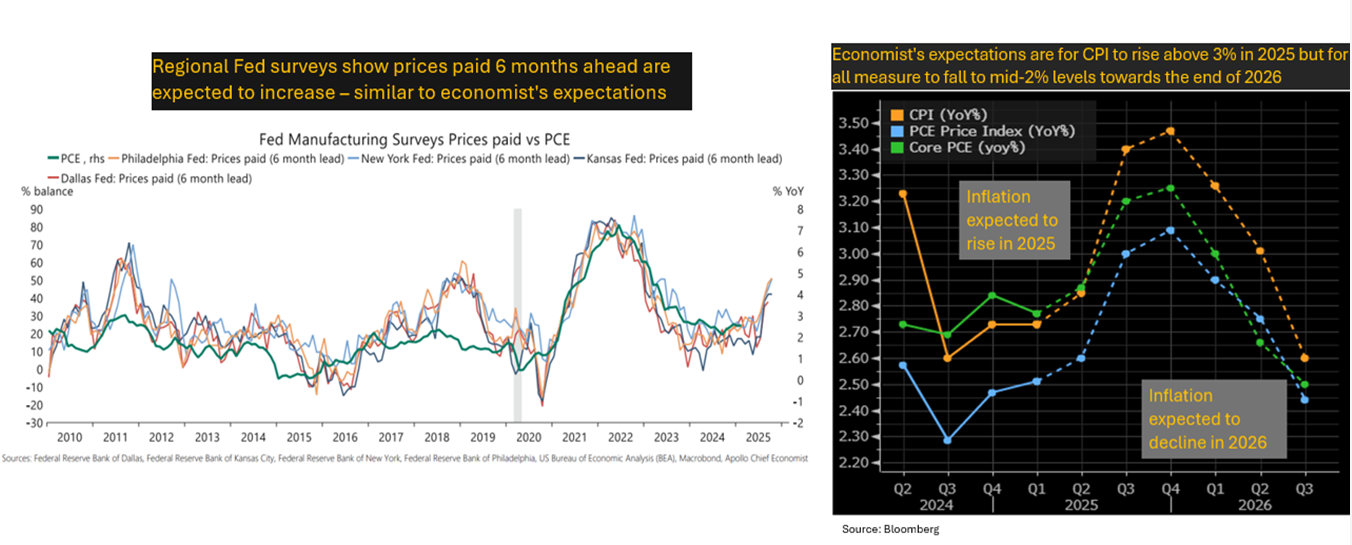

Below Consensus CPI Continues

For the third month in a row, both headline and core-CPI came in lower than expected with the April reading coming in at +0.2% vs. +0.3% expected. The headline year-over-year reading declined to +2.3%, the lowest since the spring of 2021. Although core-CPI was unchanged at +2.8% on an annual basis, the 3-month annualized run rate declined to a 9-month low of +2.1%. Grocery prices declined 0.4% with egg prices falling 12.7%, the largest drop since 1984. Despite April including 10% universal baseline tariffs, there was no major impact from tariffs in this report. Looking ahead, recent regional Fed survey data, along with updated economists’ outlooks show a likelihood of increased inflation in the coming months. However, most economists expect the increase in prices to be short lived and for inflation to head back towards the Fed’s 2% target in 2026.

Source: Federal Reserve Bank of Dallas, Federal Reserve Bank of Kansas City, Federal Reserve Bank of New York, Federal Reserve Bank of Philadelphia, US Bureau of Economic Analysis, Macrobond, Apollo Chief Economist, Bloomberg

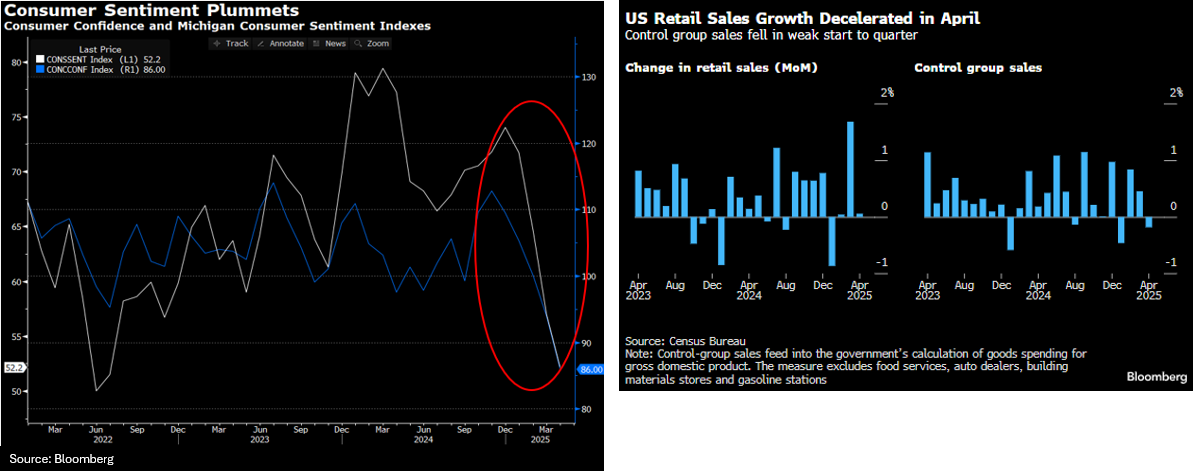

Consumer Retail Sales – Mixed

Recent consumer survey data continues to plummet: the Consumer Confidence Index is at a 14-year low, and the University of Michigan Consumer Sentiment Index in April reported its 4th lowest reading going back to 1970s (see chart below). The concern for economists and the Fed is that these negative consumer outlooks could become self-fulfilling, leading to a pullback in consumer spending, but so far the data has been mixed. For example, the April Retail Sales report showed decelerating, but still robust consumer spending. The headline reading rose +0.1% vs. expectations for a flat reading by economists and the previous month’s reading was revised up from +1.4% to +1.7% (the 20-year monthly average is +0.4%). However, the Control Group, which feeds into GDP, came in much lower at -0.2% vs +0.3% expected (see chart below). Although 7 of the 13 categories reported decreases, spending at restaurants and bars, which is the only service sector category included and typically the first area where consumers pull back, rose 1.2%, its 2nd consecutive positive reading.

Source: Bloomberg, Census Bureau

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.