January Month-End Market Update

Central Casting: You’re Hired — Fed Chair Edition

President Trump nominated Kevin Warsh as the 17th Chair of the Federal Reserve to succeed Jerome Powell, whose term ends on May 15, 2026. Although Warsh had been under consideration for several months, he only emerged as the front-runner after President Trump signaled on January 16th that he was reluctant to nominate Kevin Hassett, who was previously viewed as the leading candidate.

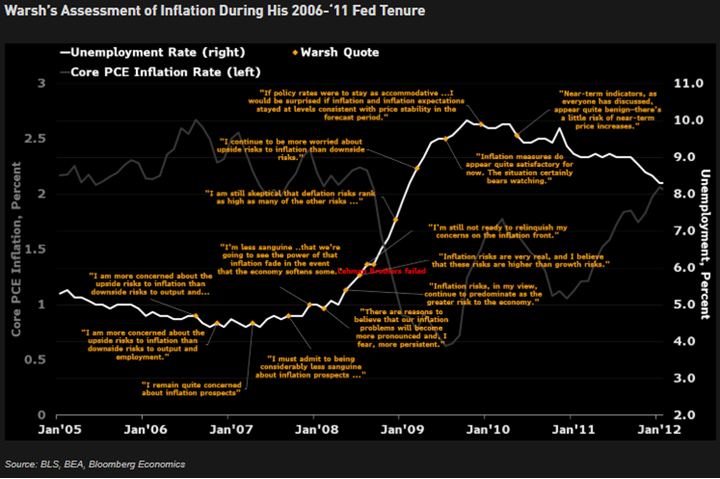

Warsh brings prior Fed experience, having served as a Governor from 2006 to 2011, but his nomination is notable given his long-standing reputation as an inflation hawk. He opposed the Fed’s 50-basis-point rate cut in September 2024 and has historically favored tighter monetary policy. More recently, however, Warsh has adopted a more dovish tone, citing artificial intelligence as a disinflationary force that could boost productivity. He has also criticized the Fed’s large balance sheet, prolonged bond purchases, excessive communication, and an overly data-dependent approach to policymaking.

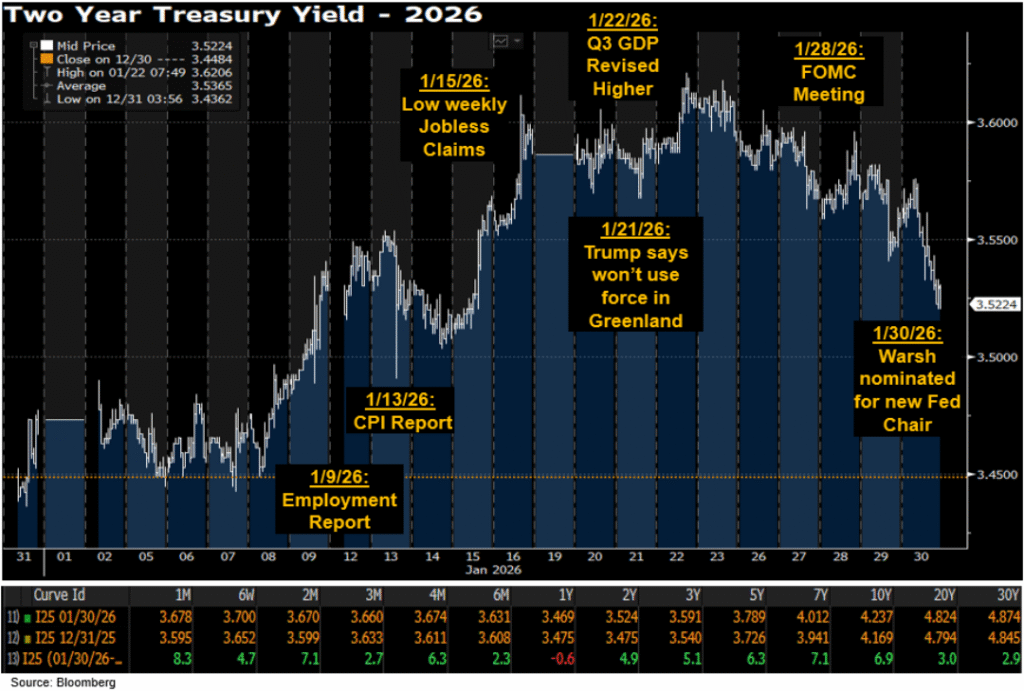

Markets appeared to interpret the nomination as hawkish, with long-end Treasury yields rising and equity markets declining. Gold prices fell sharply, signaling expectations of continued inflation discipline, while the U.S. dollar strengthened, suggesting markets anticipate a higher-rate environment under a Warsh-led Fed.

The key question going forward is whether Warsh governs as the historical inflation hawk or the recently more dovish advocate. While that element remains uncertain, a positive for markets is Warsh’s support for Federal Reserve independence.

January FOMC Recap: Fed Signals Confidence in the Economy

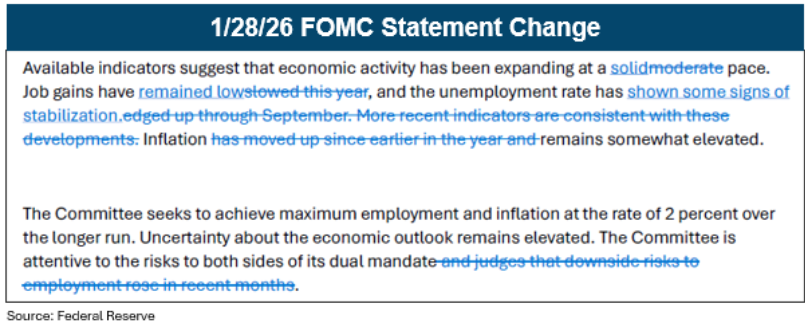

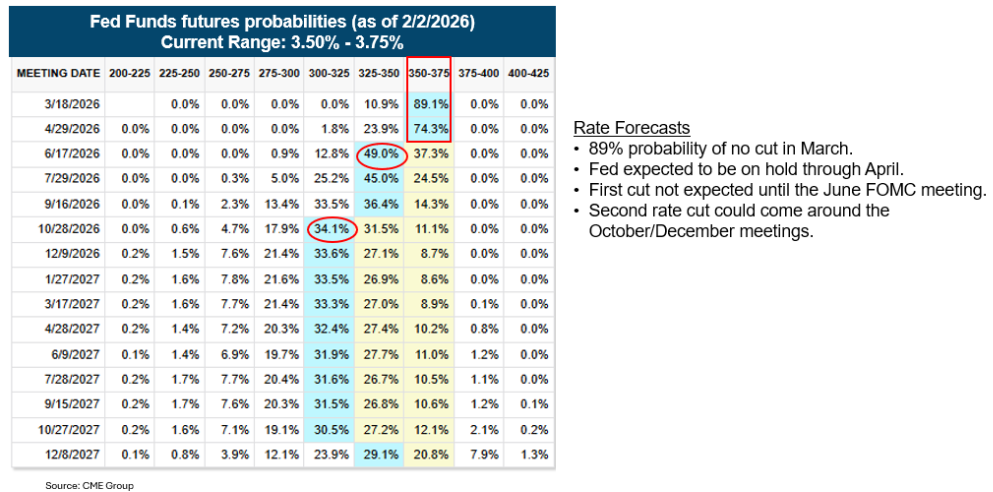

As expected, the Fed kept the federal funds target range unchanged at 3.50%–3.75%. Both the official statement (see chart below) and Chair Powell’s press conference conveyed a distinctly hawkish tone.

FOMC Statement:

The Committee struck an upbeat tone regarding both the economy and the labor market. It noted that “economic activity has been expanding at a solid pace,” an upgrade from the prior description of a “moderate pace.” Regarding the labor market, the Committee said that “the unemployment rate has shown some signs of stabilization,” an improvement from the previous characterization that it “has edged up.”

Powell Press Conference:

Chair Powell said the U.S. economy is “coming into 2026 on a firm footing” and that the “outlook for economic activity has clearly improved.” He added that interest rates are now “within a range of plausible estimates of neutral” and emphasized that there was “broad support on the Committee for holding policy steady” at this meeting.

Overall, both the Committee and Chair Powell signaled little urgency to begin cutting rates, despite two dissenting votes in favor of a 25 bp cut from Governors Miran and Waller. Markets continue to put the chance of at least one cut by June at 63%, and they expect that at least a second cut before year end is more likely than not.

January Market Recap: Strong Performance Amid Uncertainty

January was an eventful month, dominated by geopolitical headlines and political uncertainty. Key developments included a criminal investigation involving Fed Chair Powell, an FOMC meeting, the announcement of a new Fed Chair, and a partial government shutdown. Speaker of the House Mike Johnson indicated he hopes the shutdown can end by Tuesday; however, the Bureau of Labor Statistics has already announced that it will not release the January employment report as scheduled for this Friday due to the shutdown.

Despite the heightened volatility throughout the month, risk assets posted solid gains:

- Risk Assets: Both credit and equity markets rallied. Investment-grade and high-yield spreads tightened, and all three major equity indices finished higher, led by gains of over 1% in both the Dow and the S&P 500. Investment-grade corporate bond issuance was particularly strong, marking the largest January on record and the fifth-largest issuance month ever.

- Treasuries: Treasury yields rose across the curve as markets pared back expectations for near-term rate cuts, supported by resilient economic data and hawkish commentary from Federal Reserve officials.

- Metals: Precious metals saw exceptional performance. Gold rose more than 13%, its largest monthly gain since September 1999, and surpassed $5,000 per ounce for the first time ever. Silver climbed over 18%, reaching an all-time high of $121.60 per ounce. Volatility in the metals complex spiked amid the DOJ investigation into Chair Powell, which raised concerns over Fed independence, along with rising geopolitical tensions and government shutdown fears, before moderating toward month-end.

- Oil: Brent crude advanced more than 16%, driven primarily by escalating geopolitical concerns involving Iran.

- U.S. Dollar: The dollar index declined 1.4%, pressured by political uncertainty and comments from President Trump expressing support for a weaker dollar.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.