June 2025 Mid-Month Market Update

Tariffs Not Yet Impacting Inflation; & Softening Labor Market

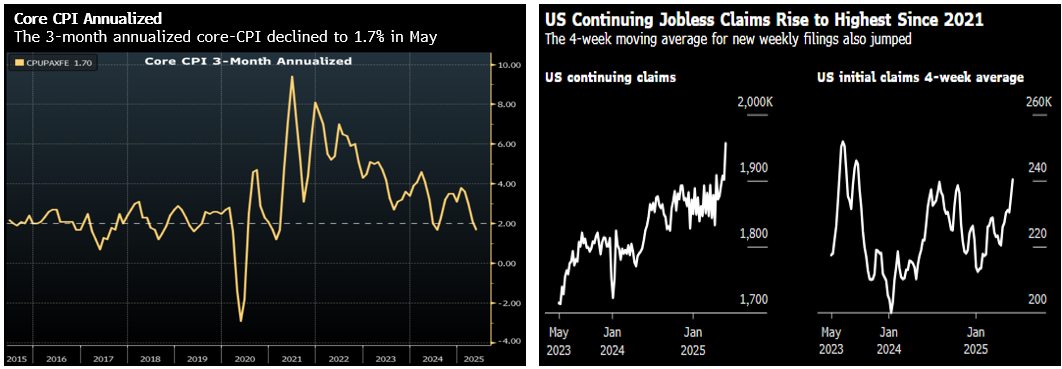

For the 4th month in a row, both headline and core CPI came in lower than expectations, suggesting companies have not yet passed tariff-driven price increases to consumers. For May, both readings came in at +0.1%; year-over-year CPI rose to 2.4%, while Core-CPI held at +2.8% for the 3rd consecutive month. The 3-month annualized rate of core inflation ending in May was +1.7%, the slowest pace since 2021 (see chart below). However, it is likely too early to declare victory on inflation as companies spent much of the first half of this year building inventories ahead of the new duties, potentially delaying tariff effects on their bottom lines.

On the labor market front, although the unemployment rate remained unchanged at 4.2% in May, this was primarily due to a large decline in the labor force participation rate, which prevented a large increase in the unemployment rate. In addition, last week continuing jobless claims rose to 1,956,000, the highest level since 2018 (excluding the Covid pandemic), signaling it is taking longer for unemployed Americans to find a new job. So, although headline labor market news has looked decent, there has been some softening in the underlying data.

Source: Bloomberg

FOMC Meeting: Focus Will Be On Updated SEP

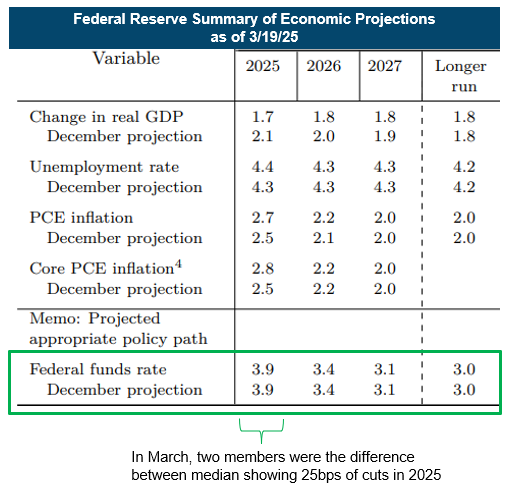

On Wednesday June 18th, market consensus calls for the FOMC to keep the federal funds target range unchanged for the 4th consecutive meeting at 4.25% to 4.50% and for Powell to reiterate the Committee’s wait-and-see narrative. Since we expect no major shift in tone from Powell, our attention will be on the updated fed funds target range estimates within the Summary of Economic Projections (SEP), better known as the “dot plot”.

At the March FOMC meeting, the Fed kept their average expectations for 50 basis points of rate cuts by the end of 2025, unchanged from their previous update in December. However, in March, the FOMC was only two Committee members away from an average of only 25-basis points of rate cuts in 2025.

With the Fed’s message likely to remain largely unchanged, there is a possibility that the dot plot could show only 25 basis points of rate cuts this year. If so, we could see an increase in 2026 rate cuts from 50 basis points to 75 basis points, as the second cut projected in 2025 is pushed to 2026.

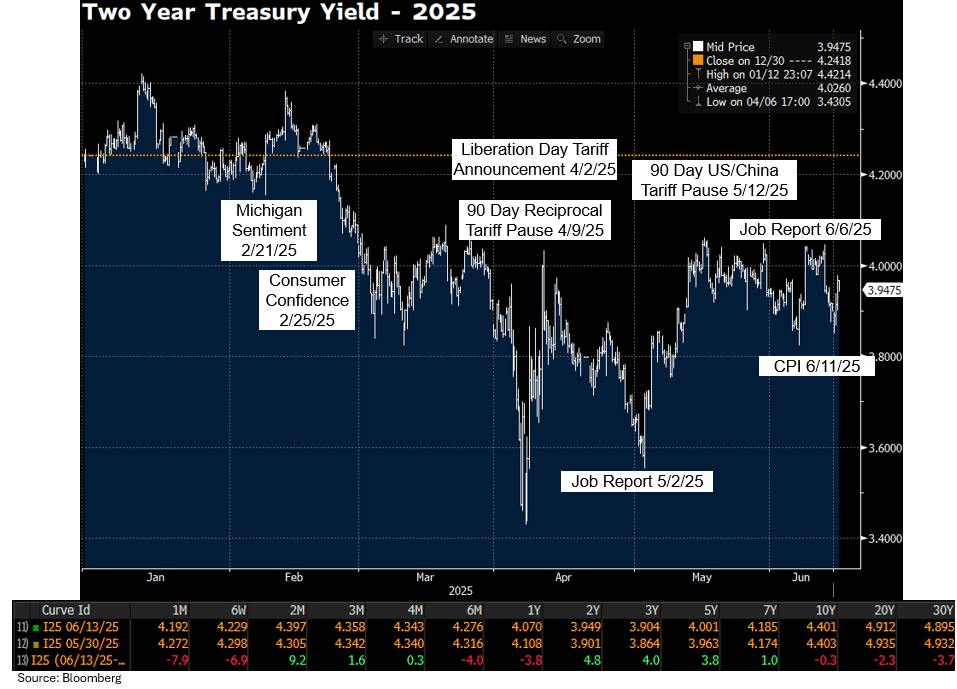

Geopolitical Risk Did Not Lead to a Major Flight-to-Quality

On Friday June 13th, Israel launched airstrikes against Iran’s nuclear program and military facilities. Despite fears of an escalation and wider conflict, it was noteworthy that U.S. Treasury yields were little changed and did not experience a flight-to-quality bid, with yields rising slightly on the day. Other markets were little changed as well with gold rising +1.37%, the S&P 500 declining -1.13%, and credit spreads little changed. The most notable move was oil, with WTI initially spiking over 14% but then declining back to finish the day approximately +7% higher on the session.

As of June 13th, yields are overall little changed across the curve. Front-end investment grade corporate bond spreads are also little changed on the month. Most attention was given to the high yield bond market, with $13 billion in new issuance priced in just the first 5 days of June, the busiest week for new issuance since May 2024. High yield funds have seen $3.5 billion of inflows through June 11th while the Bloomberg High Yield Index has seen spreads tighten 7 basis points so far this month.

Source: Bloomberg

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.