The Critical 5: Key Themes Investors Shouldn’t Ignore in 2026

Introduction: Turning the Page—Who’s at the Controls in 2026?

If 2024 was the year of the “soft landing,” 2025 became the year the U.S. economy decided to run a marathon in spikes. Fueled by an insatiable demand for Artificial Intelligence investment and adoption, real GDP growth defied gravity, accelerating to 3.8% in Q2 and 4.3% in Q3.

Yet, beneath the shiny veneer of tech-driven expansion, the foundation began to show hairline cracks. The labor market cooled noticeably, with unemployment rising to 4.6% by November. The Federal Reserve shifted its policy stance from “higher for longer” to “lower for safety”. Beginning in September, the Fed cut rates three consecutive times, shaving 75 basis points off the federal funds rate to land at 3.50%–3.75% by December. Meanwhile, the cryptocurrency and digital asset market received a harsh dose of reality. The passage of the GENIUS Act introduced regulatory clarity, banning interest on stablecoins and a more mature framework for digital cash.

Looking back at the three key macroeconomic questions we posed in January 2025, our crystal ball was mostly clear—though perhaps slightly cracked on the timing.

First: Is the “Goldilocks economy” here to stay? We posited that the “soft landing” may be too good to be true. As it turns out, Goldilocks did stick around—but she started charging rent. While U.S. GDP growth stayed strong, the labor market weakened just enough to force the Fed’s hand into “insurance rate cuts.” Essentially, we got the growth we wanted with the labor softening we feared—a “Goldilocks” scenario that feels less like a fairy tale and more like a delicate economic balancing act.

Second: Are bank reserves reaching a critical threshold? We fretted over the plumbing of the financial system, warning that Quantitative Tightening (QT) may drain liquidity too far. We’d love to say we were wrong to worry, but the Fed agreed with our anxiety. On December 1, the central bank officially ended its balance sheet reduction and began purchasing T-bills to maintain ample reserve levels.

Third: Will tariffs “seriously, but not literally” impact growth and inflation? We suspected trade rhetoric to evolve into economic reality. With core inflation remaining sticky and tariffs adding a new inflationary impulse, markets took the threat literally. The “last mile” of inflation reduction has proven treacherous, complicating the Fed’s policy path even as interest rates were cut to support employment.

As we turn the page to 2026, the economic narrative shifts from “will we land?” to “who is flying the plane?” For institutional investors, the dominant questions this year are structural, geopolitical, and potentially existential for the financial markets as we know them.

Our analysts have identified five defining investment themes for 2026:

- Why should one care about Fed Independence on trial?

- Will AI cause a labor market downturn?

- The $1.5 Trillion question: Why is the AI boom moving from tech to finance?

- What will a deflated Chinese economy mean to the rest of the world?

- Beyond the stablecoin hype: What to know about the strategic shift to tokenization?

Fed Independence at Stake: Supreme Court Ruling Could Reshape Financial Markets in 2026

A Defining Moment for Federal Reserve Independence

The Federal Reserve’s independence faces an unprecedented challenge in 2026, driven by simultaneous political and legal developments. President Donald Trump is preparing to nominate a successor to Jerome Powell as Chair of the Federal Reserve, while the U.S. Supreme Court is set to hear Governor Lisa Cook’s termination lawsuit as early as January 2026. This may be the most consequential legal decision in the history of the Fed. Both decisions carry the potential to materially alter the structure, authority, and independence of the Federal Reserve as constituted today.

Who Will Lead the Fed? Inside the Search for the Next Federal Reserve Chair

The President’s nominee will assume the role following the conclusion of Powell’s second term in May. The two presumed front runners, Kevin Hassett and Kevin Warsh, are both well-known establishment figures.

- Kevin Hassett is a PhD economist with experience at various universities, think tanks, and has prior service as an economic advisor to the President.

- Kevin Warsh is a former banker who served as a Fed Governor from 2006 to 2011.

Other reported candidates, including current Fed Governors Christopher Waller and Michelle Bowman, are of similar ilk. Taken as a whole, this suggests that the President desires someone who has a deep background in finance or economics for the position.

The Tension Between Political Pressure and Data-Driven Monetary Policy

Despite this emphasis on experience, tensions remain. The President has publicly stated that he believes he should have an input into monetary policy decisions. In a December interview, he answered “Yes” when asked whether a commitment to lowering rates immediately would serve as a litmus test for his Chair pick. While the Fed is currently amidst a cutting cycle, a blind pledge to follow through with this action would be in conflict with the Fed’s “data dependent” approach, raising concerns about political pressure influencing monetary decisions.

Three Critical Uncertainties Facing the Federal Reserve in 2026

These dynamics leave us with the following questions:

- Will the next Fed Chair publicly commit to consulting—or not consulting—the President on interest rate decisions?

- Will the confirmation process go smoothly, or face Congressional pushback? Past nominations such as Judy Shelton and Stephen Moore failed to gain sufficient Congressional support.

- Will Fed Governors feel empowered to act more independently of the Chair, potentially through dissenting votes on policy decisions, public speeches, or policy disagreements?

Trump v. Cook: The Supreme Court Case That Could Redefine the Fed

The answers may hinge on the outcome of Trump v. Cook, a case with historic implications. In August, the President announced the termination of Governor Lisa Cook due to allegations of mortgage application fraud–marking the first attempted presidential firing of a Fed Governor in the institution’s history. Cook sued to block the action, claiming that the President lacks the legal standing to dismiss her. The case is now on the Supreme Court’s docket, with oral arguments set for January and a decision expected in the first half of 2026.

The Constitutional Stakes: What a Supreme Court Ruling Means for Fed Independence

Setting aside the legal merits, the stakes are profound. If the court upholds the President’s authority to dismiss Governor Cook, Fed governors may effectively become at-will employees of the executive branch. This would transform the Fed into a quasi-independent agency, subject to executive control, like the FTC or SEC. Conversely, a ruling in Cook’s favor would reinforce statutory protections designed to insulate Fed Governors from political removal, preserving the Fed’s role as an independent central bank.

Will AI Spark the Next U.S. Job Market Crisis?

GDP Surges While Jobs Stumble: What 2025 Really Tells Us

The U.S. labor market painted a different picture than the booming GDP growth driven by AI demand in 2025.

- Nonfarm payrolls steadily declined throughout the year, while the year-end unemployment rate was 0.4% higher than the start of 2025.

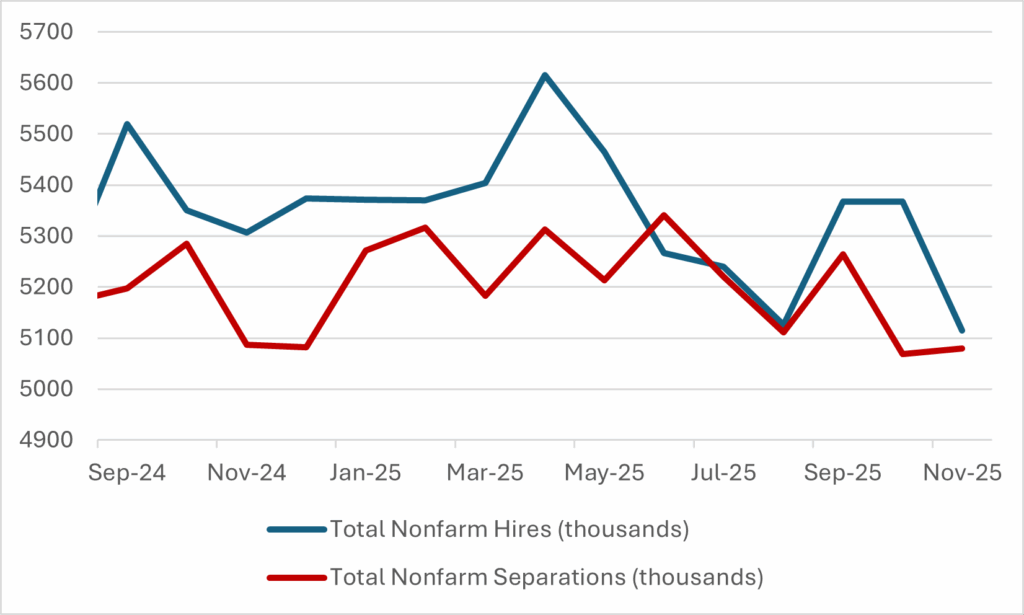

- Hiring activity trended modestly downward, and job separations remained flat, indicating a low-hire, low-fire environment.

Exhibit 1: Payroll Growth Slowed in 2025 While Unemployment Ticked Up

Exhibit 2: Hiring has Trended Downward since April; Separations Flat-to-Down

Weaker employment data garnered the attention of the Fed, who noted at the September meeting that “downside risks to employment have risen.” This was the primary reason for ending their extended pause, lowering rates by 0.75% since then. While inflation pressures from tariffs will likely persist in 2026, full employment remains central to Fed policy decisions in 2026.

Entry-Level Jobs At Risk: Is AI Replacing the Workforce Faster Than We Think?

While fiscal policy, namely tariffs and immigration policy changes, has been cited as the primary contributor to labor shifts, AI adoption is increasingly reshaping employment. High-profile layoffs at firms like Amazon and Goldman Sachs directly cite AI as a factor.[1],[2]

Evidence includes:

- Entry-Level Replacement: The November Beige Book indicates firms using AI to replace entry-level positions, boosting productivity while maintaining or reducing headcount.[3]

- Sector-Specific Declines: A Stanford University paper found workers aged 22-25 in “AI-exposed occupations” (such as software engineers and customer service) experienced 16% relative employment declines, while experienced workers remained stable.[4]

The Hidden Truth About AI and Job Cuts: Hype vs. Reality

Despite the headlines, AI may be less impactful than broader fiscal and market catalysts:

- The November Challenger Report listed AI as the 6th-most cited reason for job cuts in 2025, significantly behind effects from DOGE actions (mostly impacting the public sector) and general market conditions.[5]

Exhibit 3: 2025 Job Cuts by Reason – December Challenger Report

Source: Gray, Challenger, & Christmas

- The October Beige Book also noted that “in some cases” AI contributed to lower layoffs and attrition, in contrast to the November report of “a few firms” using AI to replace entry-level positions or curb hiring.[6] This suggests that while AI may be a tangible factor in job losses, headlines may be masking broader economic weakness.

The 2026 Outlook: Key Risks for the Labor Market

Looking forward, the potential for an AI-driven labor market downturn in 2026 may stem from indirect economic impacts:

- GDP contribution: Barclays estimates that AI investment accounted for roughly half of GDP growth in 1H25,[7] while technology stocks contributed heavily to the S&P 500’s double-digit returns.

- Wealth effect risk: If AI fails to drive revenue growth required to justify lofty valuations, a correction in equities could reverse the wealth effect and trigger broader layoffs across the economy.

Exhibit 4: Contribution to Return of S&P 500 in 2025, by Sector

Source: Bloomberg

Bottom line: While tariffs and policy uncertainty appear to weigh heavily on the labor market, the “double-edged sword” of AI, as both a productivity booster and a cost-cutting alternative to human capital, could shift the balance of the economy in 2026.

The $1.5 Trillion Question: How the AI Boom Is Turning Tech Giants to Finance

By Keren Luo

When we talk about Artificial Intelligence, we usually focus on chatbots, apps. But behind the scenes, there is a massive construction project happening: thousands of high-powered data centers are being built to run these AI models.

This construction project is so expensive that it’s reshaping the world of finance. Later this year, AI is expected to extend beyond just technology to include private credit, a type of “non-bank” lending that is footing the bill for the AI revolution. In the “Are Regional Banks Sitting on a Private Credit Time Bomb?“, we argued that the real private-credit story wasn’t simply “more non-bank lending,” but who ultimately bears the risk when the cycle turns. The AI build-out has made that question unavoidable.

$2.9 Trillion on the Line: The Cost of Powering the AI Revolution

Building the “brain” of AI—the data centers, high-end chips, and supporting power infrastructure— is incredibly expensive. Experts estimate that from 2025 to 2028, companies will spend roughly $2.9 trillion on AI data centers.

Figure 1: Estimated financing breakdown for total capex CY25-28

Source: Morgan Stanley Research estimates; Global Fixed Income, Tech Diffusion, &Gen AI: Bridging a $1.5T Data Center Financing Gap

Even tech giants like Microsoft or Google are expected to only fund a portion of this cost themselves[8]. Estimates suggest this may leave a $1.5 trillion “financing gap”—a massive hole that would likely need to be filled by lenders.

Who’s Financing AI? The Private Credit Funds Betting Big on Data Centers

Because traditional banks are often heavily regulated and cautious, private credit funds (investment firms that act like private lenders) may step in to fill that gap.

According to Morgan Stanley Research, these funds are expected to lend as much as $800 billion to AI projects, highlighting private credit’s growing role in AI expansion. These lenders are financing everything from specialized buildings to high-end chips and the power grids that make AI possible.

The AI Hype Test: Can the Boom Survive If Growth Slows in 2026?

The big worry for 2026 is a classic scenario: What happens if we build it and the money doesn’t come?

- Think of it like the 19th-century railroads: companies spent a fortune laying tracks across the country, but it took years for them to make a profit. If the debt payments were due before the trains started making money, the companies went bankrupt.

- In the AI world, if “value creation” (profits from AI applications) arrives slower than the “debt schedule” (when the loans need to be paid back), it could increase financial risk.

The Hidden Risk: How AI Could Hit the Banks

The corporate treasurer may think, “I don’t invest in private credit, so why should I care?” The problem is that the financial system is more connected than it looks.

- Banks lend to the lenders: Major banks have increased their lending to private credit funds, from 1% to 14% of their business over the past decade.[9]

- The Ripple Effect: If AI growth slows down in 2026, the companies building data centers may struggle to pay back the private credit funds.

- The Result: If those funds can’t pay back the big banks, a “tech problem” suddenly becomes a “banking problem.”

2026 Watchlist: The AI Risks Every Investor Should Watch For

We don’t expect the AI industry to collapse, but we do expect it to “cool down” from a sprint to a jog. When that happens:

- Borrowing will likely get harder: Lenders may get pickier about who they give money to.

- The “weakest” will struggle: Startups and AI-cloud companies that rely on constant new cash may be the first to feel the squeeze.

- Hidden links: We may finally see how much risk is hidden in the links between tech startups, private lenders, and your traditional bank.

- The takeaway: In 2026, the most important thing to watch isn’t how smart AI is—it’s who is holding the bill for the buildings it lives in.

What Will a Deflated Chinese Economy Mean to the Rest of the World?

China’s “Strong Economy” façade is Cracking—Here’s Why

As we wrap up 2025, China has done its best to project a strong self-sufficient, robust economy to the rest of the world. But the reality is an interesting dynamic where deflationary pressures have stagnated growth, driven by China’s internal crisis of “involution” and industrial overcapacity, as state-subsidized companies cannibalize profit margins to maintain employment while its decades-old growth model collapses.

The “Involution” Trap and the Rise of Zombie Firms: Why China Can’t Let Profitable Businesses Fail

Involution, in the context of the Chinese economy, describes a process of intense, self- destructive competition where increased effort yields diminishing returns. Faced with a saturated market, slower growth, and a government directive to keep citizens employed, Chinese firms engage in destructive price wars to steal market share from one another.

This phenomenon is made worse by the state’s refusal to allow large-scale corporate failures or massive unemployment. Local governments, desperate to preserve tax revenue and social stability, continue to subsidize “zombie firms” that would have failed in a market economy.

- Data from the first half of 2025 indicates that 25%[10] of listed Chinese companies reported losses the highest level in 25 years.

- Despite negative profitability, the Chinese production engine continues to churn out solar panels, electric vehicles, steel, and rare earth metals, often lowering prices abroad so long as China is allowed access to those markets.

“Lying Flat”: How China’s Youth Are Abandoning the China Dream

Beyond financial metrics, a profound psychological shift is occurring, especially among the youth. The “China Dream,” a social contract promising that hard work would lead to better living standards and national pride, has been broken.

- Young workers have adopted “lying flat”, rejecting economic pressure in favor of minimal efforts and low consumption, further exacerbating economic stagnation.

- A 2024 central bank survey found consumer confidence in future income and employment at record lows, with over 60% of respondents preferring to save rather than consume, the highest rate since the pandemic[11].

Entrenched Deflation and the Global Price Ripple

The combination of industrial overcapacity and a disaffected populace have produced a broad-based deflationary environment.

- Bloomberg’s 2025 analysis of pricing data paints a picture of an economy in which domestic goods prices are declining across sectors.

- From EVs to household appliances to food, prices have fallen 15-27% over the past two years[12].

Could China Use Taiwan to Distract from Economic Trouble?

While a full-scale invasion of Taiwan remains unlikely, poor economic conditions in China could lead to higher geopolitical risk:

- Poor domestic conditions may give President Xi reasons to drum up “rally to the flag” propaganda and divert sentiment towards an outside enemy to its One China agenda.

- A blockade of key areas near Taiwan, which houses critical semiconductor infrastructure, may create a black swan risk event, affecting global technology and industrial supply chains.

- China may aim to maximum pressure while minimizing direct conflict with the West, a risk that one should not view lightly.

The Tokenization Takeover: Why Stablecoins Are Already Outdated

Move over, stablecoins. Hello, tokenized cash assets.

The digital finance dialog is undergoing a structural pivot. While 2025 was defined by fascination with payment stablecoins, 2026 is shaping up to be the year of tokenization of real-world assets (RWAs).

For corporate treasurers, this shift is not merely technological—it is reshaping how liquidity is managed, yield is generated, and collateral is mobilized.

From Payments to Profits: How Tokenized Assets Unlock Real Yield

Throughout 2025, stablecoins dominated headlines. These digital tokens, typically pegged to the U.S. dollar, promised to revolutionize payments by enabling instant, borderless transfers. However, the regulatory landscape has evolved. The GENIUS Act, signed into law in mid-2025, prohibits interest on stablecoins to protect traditional bank deposits.[13] This “yield gap” has pushed institutional capital toward tokenized RWAs—digital representations of:

- Money market fund (MMF) shares

- Treasury bills

- Commercial paper

- Repurchase agreements (repos)

These instruments can legally earn interest for investors while offering digital efficiencies.

The transition of RWA tokenization from pilot experiments to institutional-grade infrastructure is well underway.[14] Major players are no longer just dabbling in the field; they are embedding blockchain into their core market-making and asset-management strategies:

- JPMorgan’s tokenized MONY fund[15] and BlackRock’s offshore BUIDL fund[16] are prime examples of this “institutionalization,” offering regulated, on-chain fund options with interest while maintaining near-instant liquidity.

- Other innovative products, from on-chain Treasury bills to tokenized deposits, repos, and commercial paper are moving rapidly from labs to trials before mass adoption.

Liquidity That Never Sleeps: The 24/7 Cash Revolution

For the corporate treasurer, tokenization may offer tangible operational efficiencies that legacy finance cannot match:

- 24/7 Liquidity & Programmability: Traditional banking hours may soon become a thing of the past. JPMorgan’s Kinexys platform exemplifies this, enabling clients like BMW AG to automate cross-border FX settlements instantly regardless of time zones.[17] The 24/7 liquidity promise may eventually reduce idle “cash buffers,” allowing treasurers to deploy cash more efficiently.

- Collateral Mobility: Tokenized assets such as MMF shares are increasingly accepted as collateral for derivative contracts, keeping income-yielding assets as collateral longer instead of liquidating them into non-interest-bearing cash days in advance.

- Operational Precision: Smart contracts help simplify funds transactions, automate back-office functions, and reduce friction and settlement risk.

Navigating Tokenization’s Legal Minefields: The Regulatory Challenges to Know

Despite potential benefits, the legal and regulatory landscape for tokenization remains foggy and fragmented:

- Deposit Flight Risk: While the GENIUS Act prohibits stablecoins from paying any interest, it allows “loopholes” for crypto exchanges to offer yield through high-risk “rehypothecation” strategies, raising concerns about deposit flight from regulated banks.

- Forced Treasury Sales: Regulators including the Bank for International Settlements (BIS) have warned of “liquidity cliffs.”[18] If tokenized Treasury holders rush to redeem in a 24/7 framework, but the underlying securities can only be sold during market hours, the bond market may see a forced fire sale when it opens, potentially destabilizing the broader financial system.

- Global Disparity: Multinational corporations are facing a patchwork of rules, from the EU’s Markets in Crypto-Assets Regulation (MiCA) framework offering greater financial stability for consumers to the U.S. GENIUS Act, focusing on flexibility and legal rights for corporations.[19]

Wall Street’s New Play: Embracing the “Enemy” Before It’s Too Late

In 2026, we expect more banks to adopt and control tokenized assets rather than ignore them. Large institutions like Goldman Sachs and State Street are building proprietary platforms, on which tokenized assets live, to capture custody and issuance fees, preventing disintermediation by fintechs.[20] Tokenizing deposits and funds may support liquidity management within the financial system, potentially redefining their role as the backbone of the digital economy.

2026 Vision: The Future of On-Chain Treasury Management

The year ahead will be an exciting one for tokenized cash products.

While steering clear of illiquid products spawned by the tokenization craze, corporate treasurers and institutional cash investors should consider focusing on regulated instruments like tokenized MMF shares, deposits, and commercial paper that are rooted in plain vanilla traditional cash assets with defined liquidity terms.

The future of capital markets is on-chain, programmable, and interoperable. Those integrating their treasury functions with these digital rails may enhance capital efficiency, while those who ignore them may risk being trapped in a T+n world while the market moves at T+0.

Conclusion: Stay Flexible and Defensive in 2026

The year ahead promises a collision of unstoppable forces—AI expansion, political reconfiguration, and financial innovation—against immovable objects like stubborn core inflation and a fragmented global economy.

For the corporate treasurer and institutional cash investor, defensive agility is the 2026 playbook. Credit risks are migrating from the visible public markets into the opaque private sector, making vigilance more important than ever.

We recommend:

- Maintain high liquidity to navigate sudden shocks.

- Scrutinize collateral behind “enhanced” cash products.

- Stay wary of yields that look too good to be true.

In a year where the rules of the game—from the definition of money to Fed independence—are being rewritten, protecting your capital must take precedence over chasing returns. Flexibility and caution remain critical considerations as market conditions continue to evolve.

[1] Amazon Workforce Reduction

[2] WSJ – More Big Companies Bet They Can Still Grow Without Hiring

[3] Beige Book – November 2025

[4] Canaries in the Coal Mine? Six Facts about the Recent Employment Effects of Artificial Intelligence

[5] Challenger Report – November 2025

[7] WSJ – How the Economy Became Hooked on AI Spending

[8] https://www.bloomberg.com/news/articles/2025-11-24/why-ai-bubble-concerns-loom-as-openai-microsoft-meta-ramp-up-spending

[9] https://www.bostonfed.org/publications/supervisory-research-and-analysis-notes/2025/bank-lending-to-private-equity-and-private-credit-funds.aspx

[10] “The True Cost of China’s Falling Prices” – Bloomberg

[11] “Why aren’t Chinese consumers spending enough money?” – CNBC.com

[12] “The True Cost of China’s Falling Prices” – Bloomberg

[13] “Fact Sheet: President Donald J. Trump Signs GENIUS Act into Law,” The White House, July 18, 2025, https://www.whitehouse.gov/fact-sheets/2025/07/fact-sheet-president-donald-j-trump-signs-genius-act-into-law/.

[14] The Irish Funds Industry Association, Fund Tokenization: Mind the Gap, December 3, 2025, https://www.irishfunds.ie/news-knowledge/news/irish-funds-publishes-new-paper-mind-the-gap-operational-considerations-for-the-tokenisation-of-irish-domiciled-funds/.

[15] “J.P. Morgan Asset Management Launches Its First Tokenized Money Market Fund,” J.P. Morgan Asset Management, December 15, 2025, https://am.jpmorgan.com/us/en/asset-management/adv/about-us/media/press-releases/jp-morgan-asset-management-launches-its-first-tokenized-money-market-fund/.

[16] “BlackRock USD Institutional Digital Liquidity Fund (BUIDL), Tokenized by Securitize, Surpasses $1B in AUM, PR Newswire, March 13, 2025, https://www.prnewswire.com/news-releases/blackrock-usd-institutional-digital-liquidity-fund-buidl-tokenized-by-securitize-surpasses-1b-in-aum-302401480.html.

[17] Anna Irrera, BMW uses JPMorgan Blockchain System for Automated FX Transfers, Bloomberg, December 9, 2025, https://www.bloomberg.com/news/articles/2025-12-09/bmw-uses-jpmorgan-blockchain-system-for-automated-fx-transfers.

[18] Matteo Aquilina, Ulf Lewrick, Federico Ravenna and Lorenzo Schonleber, The Risk of Tokenized Money Market Funds, BIS Bulletin, November 26, 2025, https://www.bis.org/publ/bisbull115.pdf.

[19] Tanishka V. Chougule, Cryptocurrency Regulation: MiCA vs.. USA Framework, American Journal of Student Research, November 2025, https://ajosr.org/wp-content/uploads/journal/published_paper/volume-3/issue-6/ajsr2025_aWlgcNAe.pdf.

[20] “Goldman Sachs Digital Assets to Spin-Out Technology Platform, GS DAP(R),” Goldman Sachs, November 18, 2024; https://www.goldmansachs.com/pressroom/press-releases/2024/announcement-18-nov-2024; “State Street Investment Management and Galaxy Digital Partner to Tokenize Private Liquidity Fund, With Planned Seed Investment from Ondo,” Businesswire, December 10, 2025, https://www.businesswire.com/news/home/20251210046330/en/State-Street-Investment-Management-and-Galaxy-Digital-Partner-to-Tokenize-Private-Liquidity-Fund-With-Planned-Seed-Investment-from-Ondo.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.