SLR Reform 2025: Unlocking Bank Balance Sheets and Navigating New Risks

Key takeaways:

- The Fed released its notice of proposal for reducing the enhanced Supplementary Leverage Ratio (eSLR) from a flat 2% rate for all GSIBs to an amount equivalent to 50% of the Method 1 GSIB surcharge.

- If enacted, we believe this change will reduce a constraint that has, over time, inhibited banks’ ability to intermediate in the U.S. Treasury market.

- Chair Powell’s Senate testimony signals immediate attention on Basel III Endgame and a shift toward baseline Basel requirements.

On June 26, 2025, the Federal Reserve proposed significant changes to the enhanced Supplementary Leverage Ratio (eSLR), loosening a key capital constraint that has long limited how large banks use their balance sheets. While this move could unlock billions of dollars in capital, improve treasury market liquidity, and reshape bank’s capital allocation strategies, it also reintroduces strategic challenges and potential risks to the banking sector in the months ahead.

Recent SLR Changes: What Banks and Investors Need to Know

The Supplementary Leverage Ratio (SLR) ensures banks hold sufficient Tier 1 capital against their total leverage exposure, covering both on- and off-balance sheet risks. Initially designed as a non-risk-based backstop to risk-weighted measures, the SLR has recently become binding for several Global Systemically Important Banks (GSIBs), particularly as balance sheets expanded during the COVID-era monetary response.

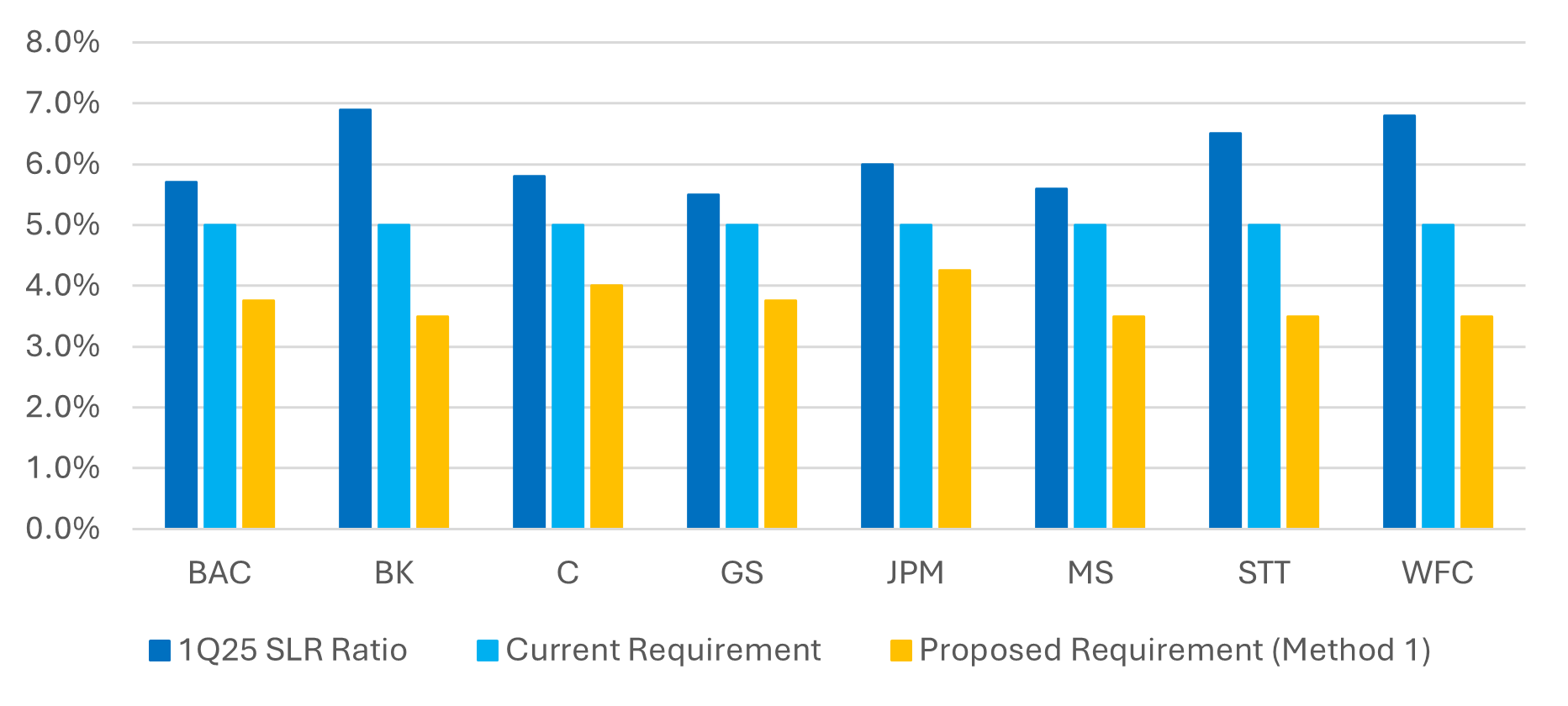

Previously, GSIBs had to meet a fixed 2% enhanced SLR (eSLR) buffer on top of a 3% base, totaling 5% at the holding company and 6% at the depository subsidiary level (3% floor plus a flat 3% eSLR buffer). The Fed’s June 2025 proposal replaces this fixed buffer with one tied directly to each bank’s systemic importance, set at 50% of the bank’s GSIB Method 1 surcharge (Exhibit 1)[1]. This adjustment significantly reduces required minimums across the eight U.S. GSIBs, now ranging from 3.5% to 4.25% (Exhibit 2).

Exhibit 1: For the 8 U.S. GSIBs, the Proposal would recalibrate the eSLR requirement to equal 50% of the organization’s Method 1 surcharge calculated under the Federal Reserve’s risk-based GSIB surcharge framework, rather than the current requirement of 2%

| Institution Category | Current eSLR Requirement | Proposed eSLR Requirement |

| US GSIBs | 3% + flat 2% eSLR buffer | 3% + 50% GSIB Method 1 Surcharge |

| Insured depository institutions that are owned by US GSIBs | 3% + flat 3% eSLR buffer | 3% + 50% parent’s GSIB Method 1 Surcharge |

| Category II and III banking organizations and advanced approaches banking organizations that are not US GSIBs | 3% (SLR) | 3% (unchanged) |

Exhibit 2: 1Q25 SLR Ratio (Hold Co) vs. Current and Proposed Minimums[2]

| BAC | BK | C | GS | JPM | MS | STT | WFC | Median | |

| 1Q25 SLR Ratio | 5.7% | 6.9% | 5.8% | 5.5% | 6.0% | 5.6% | 6.5% | 6.8% | 5.9% |

| Current Requirement | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% | 5.0% |

| Proposed Requirement | 3.75% | 3.50% | 4.00% | 3.75% | 4.25% | 3.50% | 3.50% | 3.50% | 3.63% |

| Change | -125 bps | -150bps | -100bps | -125bps | -75bps | -150bps | -150bps | -150bps | -137bps |

Source: Company Filings

The proposal also modifies related leverage-based rules, including external total loss-absorbing capacity (TLAC) and external long-term debt (LTD) requirements as below:

| Current Requirement | Proposed Requirement | |

| Minimum TLAC Ratio | 9.5% | 7.5% + 50% GSIB Method 1 Surcharge |

| Minimum LTD Ratio | 4.5% | 2.5%[3] + 50% parent’s GSIB Method 1 Surcharge |

These adjustments align TLAC and LTD standards with the revised SLR rules, easing issuance burdens and providing capital flexibility.

What Prompted the Fed’s Action on SLR Reform?

The previous framework discouraged banks from holding low-risk, low-return assets such as U.S. Treasuries. This limitation was especially problematic during market stress, when banks’ willingness to intermediate in Treasuries is critical for stability. Temporary COVID-era adjustments had provided some relief, but permanent recalibration was overdue.

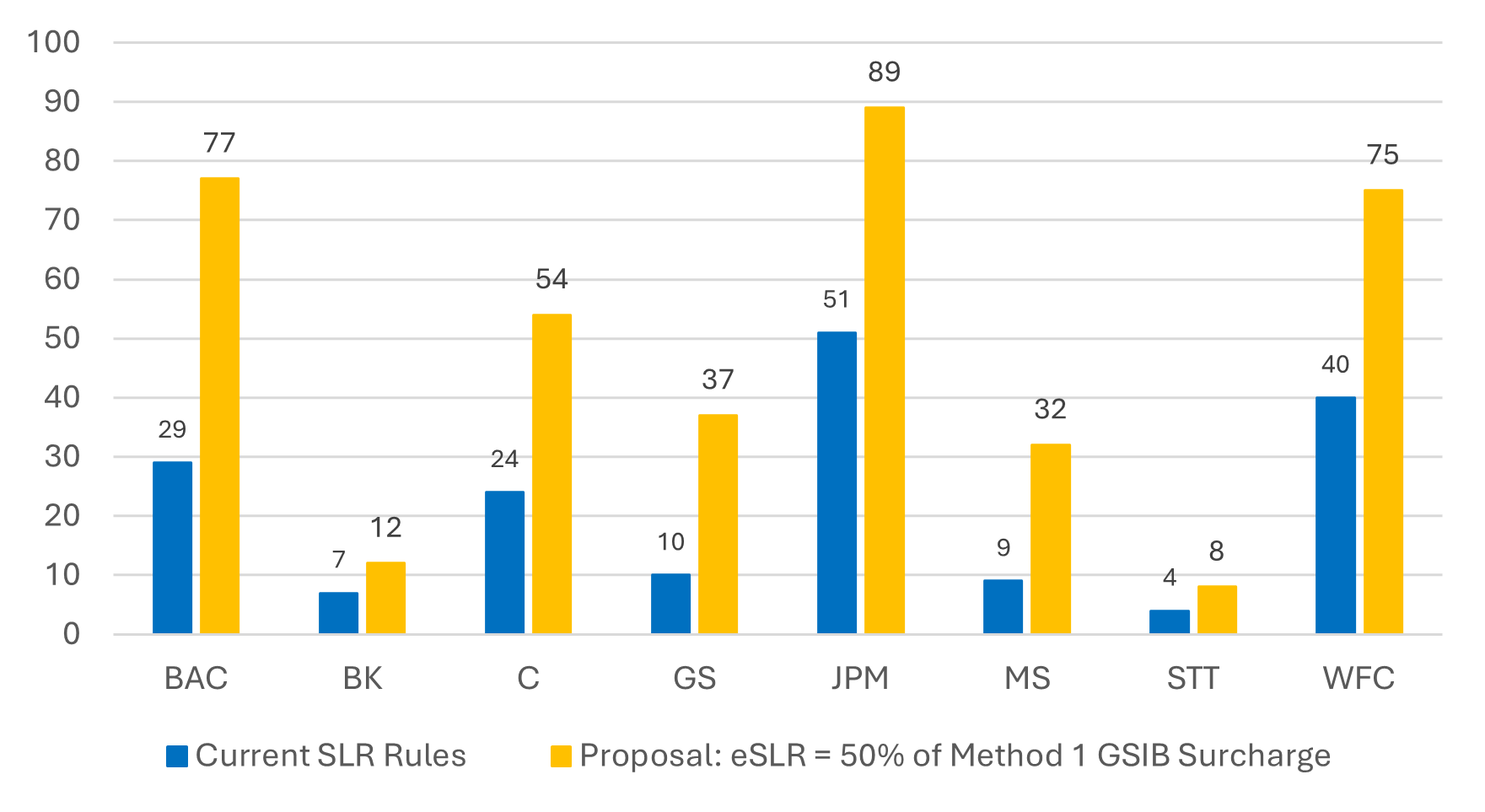

The 2025 SLR reform proposal, led by Federal Reserve Vice Chair Michelle Bowman, reflects renewed regulatory urgency and addresses market demands for increased Treasury market liquidity and greater bank balance sheet flexibility in response to elevated Treasury issuances. We estimate the proposed rule will result in $384 billion of excess tier 1 capital under leverage ratio requirements (an incremental $210 billion, or 121% from current levels) for the U.S. GSIBs (Exhibit 3).

Exhibit 3: GSIBs Excess Tier 1 Capital ($ billion) – we estimate $174 billion of excess Tier 1 capital under current SLR rules, $384 billion under the proposal.

Source: Company Filings

Anticipated Bank Responses to the SLR Rule Changes

With SLR becoming less restrictive, banks will likely:

- Reduce Capital Buffers: With SLR less of a constraint, banks may feel more comfortable running leaner on capital. This could support higher shareholder payouts, but also reduce the cushion available in times of stress. For credit investors, thinner buffers call for closer attention to liquidity and capital management trends.

- Shift Toward Securities Over Loans: Lower leverage constraints may encourage banks to grow their securities portfolios, especially Treasuries and agency mortgage-backed securities (MBS), instead of expanding loan books aggressively. While beneficial for liquidity, this raises their exposure to interest-rate volatility, especially if banks pursue higher yields through longer-duration securities.

- Rebuild Trading and Treasury Intermediation: The proposal explicitly targets improved dealer capacity in Treasury intermediation. Banks with robust trading operations may significantly expand repo financing, U.S. Treasury trading, and client market-making activities, which could enhance market liquidity while also increasing market risk exposure[4].

- Monitor for potential SVB-Type Risks: As securities portfolios grow, banks face heightened risks from interest rate fluctuations. An SVB-type scenario, where long-duration assets are mismatched with shorter-duration liabilities, remains a risk, particularly if banks do not adequately hedge their interest rate exposure.

Understanding Credit Risks and Their Impact on Financial Markets

While the reform may encourage banks to add Treasuries and High-Quality Liquid Assets (HQLA) securities, Fitch highlights that the most significant capital relief will likely occur at the operating bank level, with Tier 1 requirements expected to fall by 27% (or $210 billion)[5]. This could prompt banks to reallocate capital toward higher-return nonbank or foreign subsidiaries, increasing loss severity for senior creditors at the depository level[6]. For credit investors, monitoring where capital flows, not just total amounts, is essential.

Looking Ahead: Deregulation Tailwinds

Federal Reserve Vice Chair Michelle Bowman described the SLR reform as “a first step toward what I view as long overdue follow-up to review and reform what have become distorted capital requirements.”[7] Indeed, this proposal likely marks only the beginning of broader regulatory recalibration.

Future changes, including revisions to the Stress Capital Buffer (with less severe scenarios), adjustments to the GSIB surcharge, and a capital-neutral Basel III Endgame re-proposal, could unlock further bank capital and liquidity. Federal Reserve Chair Jerome Powell reaffirmed this momentum, stating before the Senate Banking Committee, “We’re looking at basically two big pieces now: Basel III and the leverage ratio. I’m pretty confident we’ll move on both of those in the relatively near future.”[8]

Markets now eagerly await further details at the Fed’s July 22 conference on the U.S. bank capital framework. The discussions are expected to focus on leverage requirements, stress-testing scenarios, and GSIB surcharge adjustments, providing key insights into future regulatory changes.

[1] The Federal Reserve -Regulatory Capital Rule: Modifications to the Enhanced Supplementary Leverage Ratio Standards for U.S. Global Systemically Important Bank Holding Companies and Their Subsidiary Depository Institutions

[2] Note: Data is based on 1Q25, GSIB score used for proposed SLR requirement is based on YE 2024 Method 1 calculation

[3] The minimum SLR of 3% minus 0.5% to allow for balance sheet depletion.

[4] The Federal Reserve – Statement on Enhanced Supplementary Leverage Ratio Proposal by Vice Chair for Supervision Michelle W. Bowman

[5] The Federal Reserve -Regulatory Capital Rule: Modifications to the Enhanced Supplementary Leverage Ratio Standards for U.S. Global Systemically Important Bank Holding Companies and Their Subsidiary Depository Institutions

[6] Fitch Ratings – Lower Supplementary Leverage Standards for US Banks Neutral to Ratings

[7] The Federal Reserve – Unintended Policy Shifts and Unexpected Consequences Speech by Michelle Bowman

[8] U.S. Senate Committee on Banking, Housing, and Urban Affairs – The Semiannual Monetary Policy Report to the Congress

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.