January Mid-Month Market Update

Fed Voting Rotation Adds Hawkish Tilt in 2026

The annual rotation of regional Federal Reserve Bank presidents with a vote on monetary policy introduces a more hawkish tilt in 2026. All four presidents rotating into voting positions this year are generally inclined toward a patient approach on rate cuts, while the Board of Governors remains relatively more dovish. This dynamic suggests a continued split within the Fed’s policy-setting body this year. While President Trump has not yet announced his nominee for the next Federal Reserve Chair, it’s expected that the incoming chair will take a more dovish stance than current Chair Jerome Powell.

Mixed Economic Data Supports Fed Patience

Economic data released this month has been mixed and it spans multiple time periods, reflecting the continued impact of delayed reporting caused by the recent government shutdown. Overall, the data has done little to alter expectations for monetary policy. Markets are currently pricing a roughly 95% probability that the Federal Reserve will remain on hold at their January 28 FOMC meeting, with expectations that policy will remain unchanged for the remainder of Powell’s term as Chair, which ends in May.

- Employment Report: The December nonfarm payrolls report offered both hawkish and dovish signals. Payroll growth came in below expectations at 50,000, though this remains a respectable level of job creation. In contrast, the household survey showed a solid increase of 232,000 jobs. The unemployment rate declined to 4.4% (4.375% unrounded). However, this improvement was accompanied by a decline in the labor force participation rate, as the number of job seekers fell—an underwhelming underlying signal. Weekly initial jobless claims for the week ending January 10, 2026 fell to 198,000, marking only the second sub-200,000 reading since early 2024. The four-week moving average is at its lowest level in two years.

- Inflation: December inflation data was mixed. Headline CPI rose in line with expectations at 0.3%, while Core CPI came in slightly below expectations at 0.2%. On a year-over-year basis, headline CPI held steady at 2.7% and Core CPI remained at 2.6%. In contrast, Producer Price Index data showed some reacceleration in price pressures, with both headline and core PPI rising back up to 3% in November.

- Consumer Spending: Retail sales for November exceeded expectations, signaling continued consumer resilience. Headline sales increased 0.6%, the strongest monthly gain since July, while the control group rose 0.4%. Ten of the thirteen retail categories posted gains, with motor vehicle sales and spending at eating and drinking establishments rebounding after declines in October.

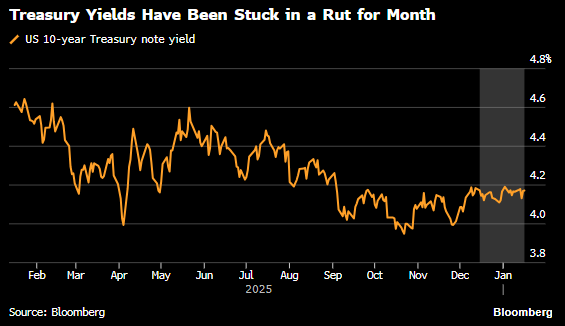

Treasury Curve Mostly Unchanged Despite Elevated Headlines

Treasury yields across most of the curve have been little changed at the start of the year, with the notable exception of the front end. 2- and 3-year yields, the portions of the curve most sensitive to expectations for future monetary policy, have risen by 9 and 8 basis points, respectively. This move reflects market expectations that the timing of the next rate cut by the Federal Reserve has shifted to the second half of the year.

In contrast, the 10-year Treasury yield has remained surprisingly rangebound, rising just 0.2 basis points and trading within a narrow 4.1%–4.2% range since mid-December. This stability has persisted despite a series of significant headlines from the Trump administration, including:

- Jan 3: US captured Venezuela President Maduro.

- Jan 7: President Trump called for restricting institutional investors from purchasing single-family homes.

- Jan 8: President Trump directed Fannie Mae and Freddie Mac to purchase $200 billion of mortgage-backed securities to help lower housing costs.

- Jan 9: President Trump proposed capping credit card interest rates at 10% for one year.

- Jan 9: The Department of Justice issued a grand jury subpoena to Fed Chair Jerome Powell related to his congressional testimony on renovations to the Fed’s headquarters.

- Jan 12: President Trump announced a 25% tariff on goods from countries doing business with Iran.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.